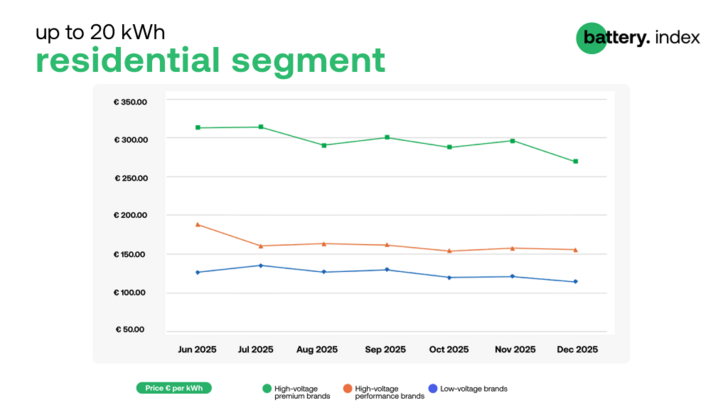

In December 2025, residential storage showed renewed softness, with the steepest declines seen in high-voltage premium systems (up to 20 kWh):

● High-voltage premium brands: €269.5/kWh (–9% vs Nov)

● High-voltage performance brands: €155.7/kWh (–1% vs Nov)

● Low-voltage brands: €114.6/kWh (–5% vs Nov)

After November’s unexpected spike in premium HV prices, December appears to mark a return to normal: installers and distributors are closing out the year with more cautious procurement, while the market recalibrates following pre-year-end stock-building. This matches the broader narrative of the Battery Index: the storage market remains structurally divided, with significant gaps between premium and value segments.

Top 5 battery brands December 2025

Huawei retains its lead for another month, underscoring its consistent channel strength in Europe’s residential market. Deye and Dyness remain close competitors as installers weigh performance against brand confidence.

Stay informed – subscribe to our newsletters

“December’s drop in premium high-voltage pricing looks less like a structural shift and more like a year-end reset after November’s reversal. What stands out is the continued resilience of the performance segment. While premium moves more sharply month-to-month, value-oriented systems remain anchored, suggesting installers are still prioritizing bankable cost-per-kWh as they plan early-2026 projects,” says Grzegorz Furman, Senior International PV Trader at sun.store.

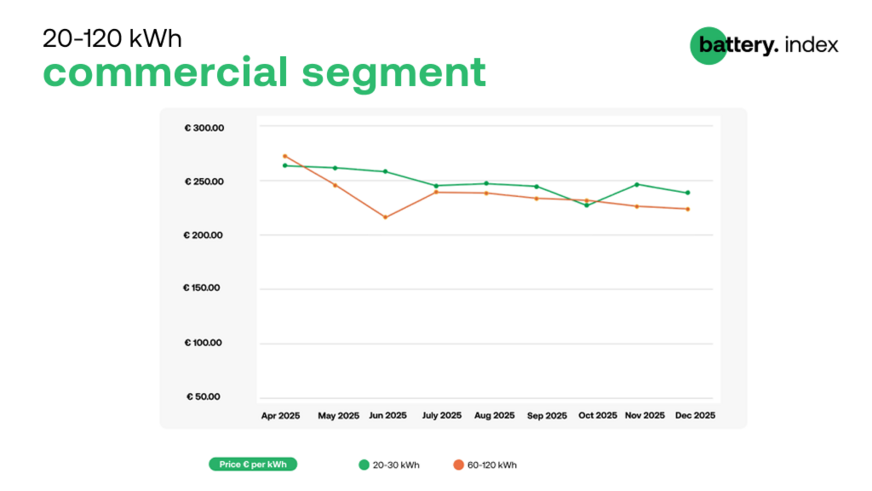

Commercial segment (20–120 kWh): modest declines

Commercial storage also softened in December, although price movements remained more measured than in the residential sector – a pattern that aligns with the longer project planning cycles highlighted in previous Battery Index reports.

sun.store

● 20–30 kWh systems: €238.46/kWh (–3%)

● 60–120 kWh systems: €223.52/kWh (–1%)

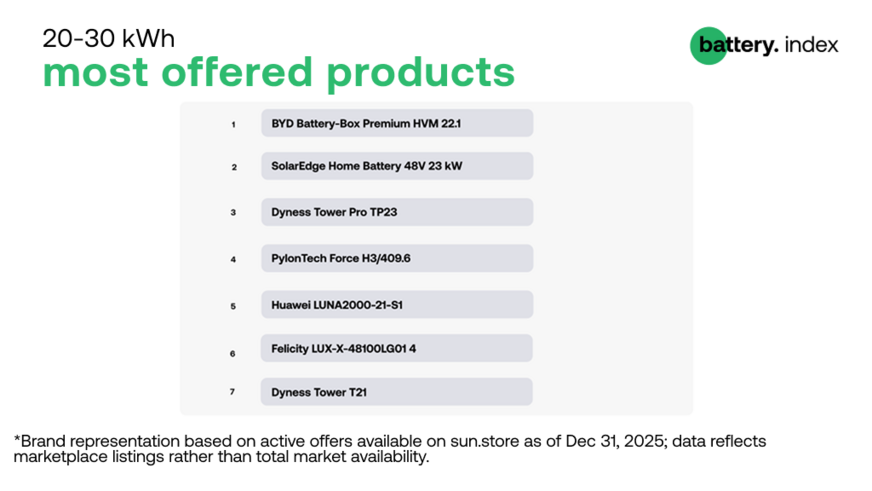

Most offered products – December 2025

sun.store

This segment continues to combine established premium ecosystems (such as BYD, Huawei, and SolarEdge) with scalable tower systems, which remain popular among installers standardising residential-to-light-commercial deployments.

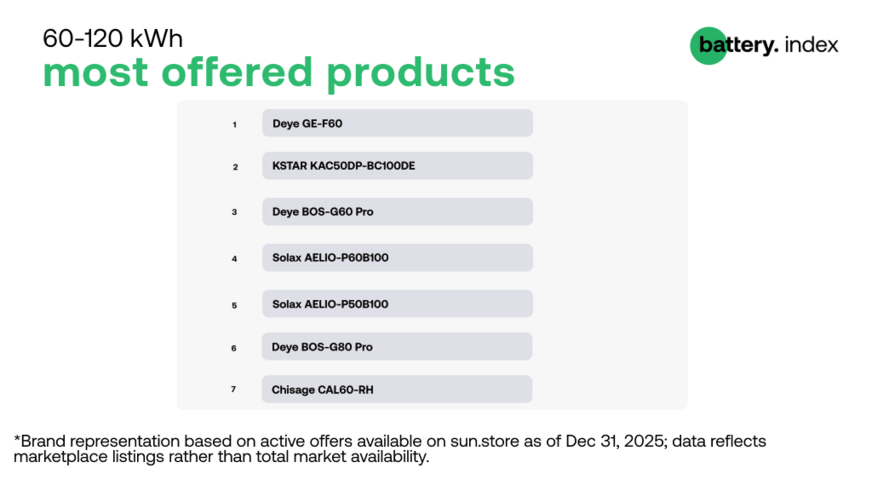

60–120 kWh segment

The upper commercial range is still dominated by a small group of recurring players – a trend seen in previous months, with Deye and KSTAR consistently among the most frequently offered C&I solutions.

sun.store

2025 yearly review

sun.store introduced the Battery Index in August 2025 to provide transaction-based transparency in a storage market characterised by persistent price gaps between premium and value tiers.

The 2025 storyline in three acts:

1. Late-summer segmentation becomes visible:

Early editions revealed a clear structural divide between premium and performance pricing, with the gap often at or above 100 percent, highlighting that battery price convergence behaves differently than in PV modules.

2. Autumn correction and brand reshuffling:

October brought renewed downward pressure on prices and significant changes at the top of the brand rankings, reflecting a market where installers continually optimise for value, availability and channel support.

3. Q4 volatility in premium, stability in performance:

November interrupted the downward trend in premium HV prices, only for December to see a sharp correction. Performance HV prices, by contrast, remained comparatively stable from month to month, pointing to a more established “value benchmark” for installer purchasing.

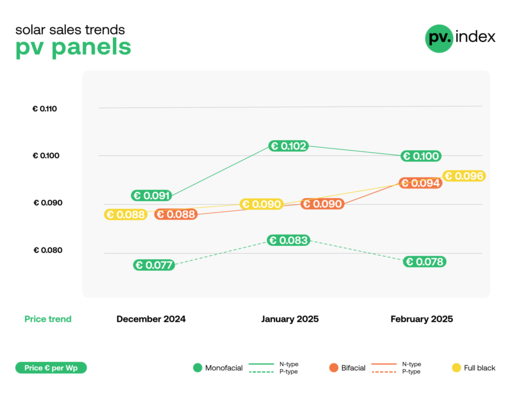

PV Index – prices ease as sentiment hits cyclical December low

Looking ahead to early 2026

● Premium price volatility is set to remain higher than in the performance segment. Premium products respond more quickly to fluctuations in demand, promotions, and channel dynamics.

● Commercial pricing is likely to move in smaller increments, shaped primarily by quarterly project pipelines rather than monthly spot buying.

● Brand leadership will continue to rotate as availability and promotional cycles change, although Huawei, Deye, and Dyness are clearly positioned as the core reference set going into 2026. (hcn)