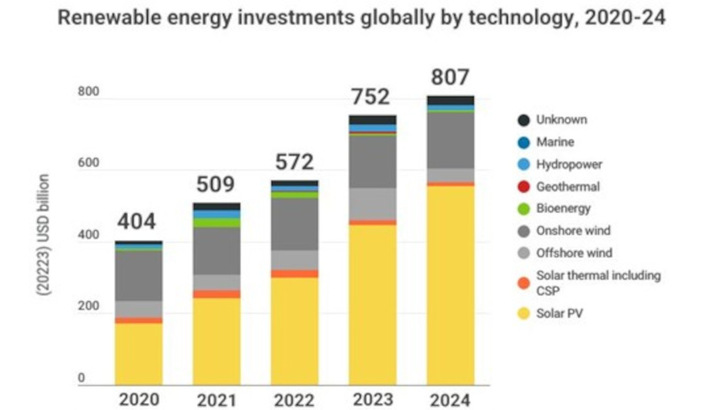

Despite the milestone, investment growth slowed markedly. Total spending on renewables rose to USD 807 billion in 2024, up 7.3 percent year‑on‑year compared with 32 percent the previous year, according to a report by the International Renewable Energy Agency (IRENA) and the Climate Policy Initiative (CPI).

The Global Landscape of Energy Transition Finance 2025 was launched at the UN Climate Conference COP30 in Belém, Brazil. The report aims to inform global finance discussions and assist government delegations by tracking investment in renewable energy technologies and supply chains, and by analysing regional trends, capital sources and financial instruments.

Key findings

• Ninety‑six percent of renewable energy investment went into the power sector, continuing a long‑term trend.

• Global investment in solar PV reached a record USD 554 billion in 2024, a 49 percent increase.

• Spending on renewable power, grids and battery storage surpassed fossil‑fuel investment, although fossil spending is rising again.

• Ninety percent of global energy‑transition investment remained concentrated in advanced economies and China, leaving emerging and developing markets behind.

Francesco La Camera, Director‑General of IRENA: “Investments in the energy transition continue to grow, but not at the pace needed to meet the global goal of tripling renewable capacity by 2030. Funding for renewables is increasing rapidly but remains highly concentrated in the most advanced economies.”

Record levels for renewables as deployment falls behind

The report notes that advanced and major economies can draw on domestic financial resources to fund their energy transitions, whereas lower‑income countries remain heavily dependent on external support. This reliance is linked to underdeveloped financial markets, limited fiscal capacity, high capital costs and rising debt vulnerabilities.

Debt burdens for developing countries

Globally, almost half of total investment in 2023 came in the form of debt, mostly at market‑rate terms, with most of the remainder provided as equity. Grants represented less than one percent. The need to scale up investment, combined with the limited availability of low‑cost or impact‑driven capital such as concessional loans and grants, risks increasing debt pressures on developing economies.

Nairobi to host expanded Intersolar Africa 2026

La Camera added: “IRENA has long called for more strategic use of public funds to unlock private investment through risk‑mitigation tools. Yet the heavy reliance on profit‑driven capital is leaving developing countries behind. Where private finance will not flow, the public sector must step up, supported by stronger multilateral and bilateral cooperation and increased climate finance.”

Battery-factory investment doubled

The report also notes that investment in clean‑energy supply chains and manufacturing remains essential but highly concentrated. Between 2018 and 2024, China accounted for 80 percent of global spending on manufacturing facilities for solar, wind, battery and hydrogen technologies. Encouragingly, new factories are now being established outside advanced economies and China, strengthening energy security and spreading the socio‑economic benefits of the transition more widely.

HoloSolis raises over €220 million for major module plant

Overall, global investment in factories producing solar, wind, battery and hydrogen technologies declined 21 percent to USD 102 billion in 2024, mainly because of a sharp drop in solar‑PV manufacturing investment. In contrast, investment in battery factories nearly doubled to USD 74 billion, driven by rising demand for energy storage in grids, electric vehicles and data centres.

Foreign direct investment, supported by joint ventures, technology partnerships and knowledge sharing, will be central to expanding energy‑transition manufacturing in emerging and developing economies, including through South‑South cooperation.

Subscribe to our monthly newsletter for investors

In parallel, dedicated policies are needed to ensure these activities are implemented in a socially and environmentally sustainable way, with benefits shared equitably. (hcn)