The regulatory landscape for BESS in Europe is influenced by EU directives aimed at accelerating the shift to cleaner energy sources. Notable policies include the Clean Energy for All Europeans Package and the European Green Deal, which emphasise the uptake of energy storage technologies. However, each country adopts its own set of regulations at a different pace, which can significantly impact the attractiveness of BESS investments. These regulations influence areas such as:

- Market access and participation rules

- Tariffs and fees related to electricity consumption and storage

- Incentives and support mechanisms for renewable energy and storage solutions

- Safety and environmental standards for energy storage technologies

Different revenue models & market maturity

Revenue generation for BESS is derived from various sources, including energy arbitrage, capacity markets, frequency regulation services and ancillary services. The availability of these revenue streams varies by region based on market structures and regulations. Market maturity reflects the level of development of the energy market, the deployment of technology and the investment climate for BESS projects. Mature markets tend to offer more robust regulatory support and established business models.

Large battery storage systems as new champions

BESS business cases:

Germany

Germany is the most developed market for CCE in continental Europe. It offers a dynamic environment, with one project currently under construction and three more in preparation, totalling approximately 50 MW. Our target is to grow our operational portfolio to around 250 MW, complemented by further assets at the medium-voltage and high-voltage levels, by the end of 2026. The market is developing rapidly: CAPEX has fallen by around 30 percent since the beginning of the year, while commercialisation and financing strategies are maturing, offering investors an ecosystem that supports growth.

Irrespective of our individual developments at CCE, we see increasing capacities in Germany. The major bottleneck remains the availability of grid connections, with local grid operators becoming increasingly defensive regarding the operational mode of storage facilities. These limitations will impact the business case of future projects and may even call the investment itself into question. Action at the regulatory level is crucial to provide guidance to the many decentralised local grid operators on how BESS can positively contribute to grid efficiency. Further clarifications on the (in)famous BKZ (Baukostenzuschuss) and procedures for grid connection acceptance must be implemented to provide the necessary certainty for BESS investors.

Italy

Italy’s energy regulations adequately support the integration of renewable sources and energy storage. The country has been implementing policy measures to enhance energy efficiency and promote decarbonization through the national energy strategy. The capacity market introduced by the Italian government and future programs such as MACSE provide opportunities for flexible power generation technologies, including BESS. The market is expanding, but the potential for revenue generation is somewhat limited compared to Germany due to the less developed ancillary services market. Italy's BESS market is in a transitional phase, with recent regulatory changes attracting increased investment and installation, particularly in the commercial and industrial sectors.

Solar Investors Guide #4: Long-term storage with iron flow technlogy

In Italy, we find a very competitive market; however, a clear business case for BESS still needs to be defined. Following the recent tenders for the capacity market, in which three BESS projects were awarded contracts, it will be important to continue adapting business models. This will likely involve a combination of merchant, capacity market, and MACSE models, which will need to strike a balance with investors' return expectations. CCE is developing a portfolio of over 1.3 GW of BESS projects across Italy. As in Germany, grid connection remains the main limiting factor. Thanks to years of experience in the country and many secured PV sites, we can also convert these existing sites into BESS sites or add BESS to the PV sites.

France

In France, we are at a relatively early stage and are focused on developing the business case; CCE France’s project pipeline currently comprises three projects. Due to the high base load capacity in the country, there is somewhat less volatility, but green energy projects will continue to be added, impacting grid stability. France’s regulatory framework encourages the use of storage through various programmes. The Multiannual Energy Program (PPE) outlines the government’s objectives for renewable energy and storage integration.

France has also set targets for energy storage capacity by 2028, fostering investments in BESS. While the revenue potential has been positively impacted by recent policies, the overall market for energy storage remains less developed and mature compared to other EU countries. However, it is progressing, particularly in large-scale BESS.

The Netherlands

The Netherlands has implemented a progressive regulatory regime supporting energy storage systems. The country fosters investments through subsidy programmes for innovative storage technologies and adjustments to grid fees for storage facilities. Revenue generation in a market with high volatility and limited liquidity holds significant promise, particularly as more renewable energy sources come online. The Netherlands boasts a mature market, characterised by many projects in the commercial sector. The integration of battery storage into existing energy infrastructures is highly favourable.

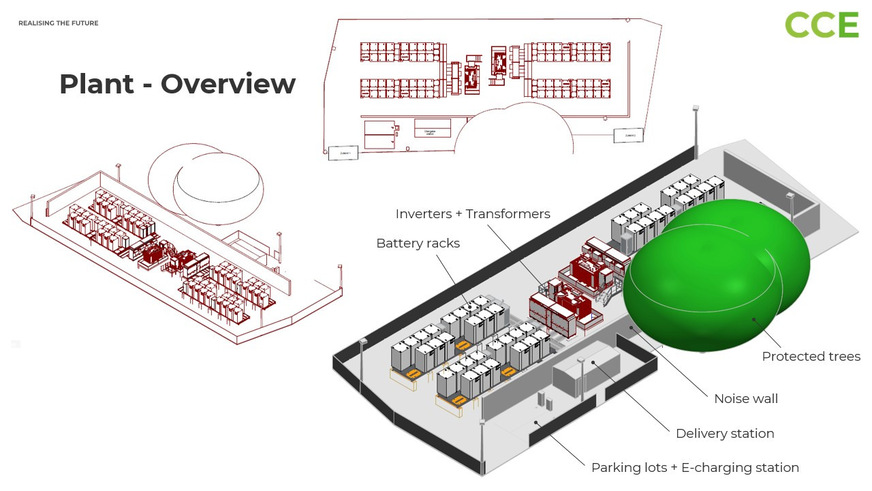

In the Netherlands, we are in the process of realising the first medium-voltage storage system, which will be installed alongside an existing PV system. With 80 GW of connection enquiries at grid operator TenneT for large-scale storage systems, there are considerable delays in grid commitments, and the market appears to be fully booked. We also anticipate further regulatory developments concerning grid fees and are currently focusing our strategic approach on utilising the existing grid connection capacity of PV systems to expand our BESS capacity.

Austria

In Austria, we anticipate improved regulatory frameworks for storage facilities with the establishment of the new government. This should provide greater certainty for the business case, including streamlined grid fees. Despite this time lag, the trend for BESS is expected to mirror that in Germany, and we are currently securing promising sites for these projects. In general, Austria has actively supported renewable energy through subsidies and feed-in tariffs in the past, and today the role of BESS is increasingly recognised. However, Austria’s BESS market is still developing, and the number of stand-alone installations remains relatively limited.

Romania

In Romania, the market is developing rapidly and is steadily catching up, although the installed BESS capacities to date remain modest. An interesting aspect of this market is that financing banks recommend adding a storage system to PV projects to provide grid-supporting services and reduce project costs, granting better conditions despite the overall profitability potentially being lower than that of a stand-alone PV system. An increase in stand-alone projects is also noticeable, and I anticipate a considerable capacity increase in the coming years, particularly given that authorisation phases in Romania are shorter than in other EU countries.

Central & Eastern Europe: Utility-scale storage market set to increase fivefold by 2030

In Romania, the market is developing rapidly and steadily catching up, although installed BESS capacities to date remain modest. An interesting aspect of this market is that financing banks recommend adding storage systems to PV projects to provide grid-supporting services and reduce project costs, offering better conditions despite the overall profitability potentially being lower than that of stand-alone PV systems. An increase in stand-alone projects is also noticeable, and I anticipate considerable capacity growth in the coming years, particularly as authorisation phases in Romania are shorter than in other EU countries.

CCE

Status Quo and Perspectives

The strategic value of grid connections is universally high and remains a key bottleneck in the energy transition. European coordination, particularly among grid operators, would be highly beneficial. Sharing experiences on regulatory initiatives and defining the role of flexibility in grid resilience could drive broader acceptance of storage systems as critical to achieving grid neutrality and efficiency. While challenges are often local, the importance of storage for expanding the energy system must be widely recognised.

Optimising energy storage - cost functions and strategies for long-term gains

Another key challenge is the transition of stand-alone BESS projects into co-located systems with PV or wind. Beyond regulatory issues, this combination of technologies is structurally and commercially complex. Business cases must be evaluated individually, as depending on local parameters discussed in this article, stand-alone projects are often more attractive than co-located ones.

In conclusion, the comparative analysis highlights varying levels of regulatory support, revenue potential, and market maturity. Germany and the Netherlands stand out as leaders, Italy and France show growing interest and opportunities, while Austria and Romania are still developing their infrastructures and regulatory frameworks. (Philipp Kraemer/hcn)

More on CCE