What is the role of the Greek Foreign Investors Council in the field of renewable energy?

The Foreign Investors Council in Greece (FIC) was established in 2024 to promote best practices and attract foreign direct investment. Its core mission is to support and facilitate collaboration among all stakeholders, including the Greek Government. Currently, the Council has 20 members and companies, most of which are active in renewable energy investment. FIC aims to accelerate Greece’s energy transition through advocacy and information exchange, such as sharing successful co-location project examples from other countries to raise awareness. FIC works closely with the PV industry association Helapco and is seeking to expand cooperation with wind energy associations in the future.

Which countries are the main investors in PV and storage projects in Greece?

Companies from Germany, France and Spain are major investors in photovoltaic technology and have driven solar adoption across Greece. The United States, Israel and the UAE, as non-EU members, are also significant contributors across all RES technologies, with substantial investments in recent years. Greek companies are increasingly investing in PV and energy storage as part of their own energy transition strategies, leveraging the country’s abundant sunshine to make solar a practical choice. China is also a major global investor in Greek EPCs, PV and energy storage, both in manufacturing and deployment of solar and storage technologies.

Helapco – “We’re boosting the self-consumption sector”

What role does co-financing by the European Union play?

EU co-financing has a significant impact, accelerating photovoltaic and energy storage projects in Greece. By providing grants and loans, the EU helps reduce initial investment costs and shares financial risk, incentivising private investment in projects that might otherwise be seen as too risky. This funding also attracts additional private sector investment. With specialised technical assistance, project developers receive the expertise needed for smooth implementation. Moreover, EU co-financing ensures compliance with key EU policies such as the Green Deal. Overall, it is essential for advancing renewable energy projects and building a sustainable energy future.

What obstacles remain for renewable investments in Greece?

Administrative and regulatory hurdles persist, with lengthy permitting processes that can slow progress. However, with patience and persistence, investors can overcome these challenges. Community engagement is crucial, so let’s embrace local involvement to ensure everyone is on board. Strengthening energy communities with a more local focus can help anchor projects. A clear legal framework is essential to inspire investor confidence and build trust.

Subscribe to our special monthly newsletter for investors

Infrastructure must be enhanced to fully realise the potential of PV and storage technologies. While high upfront costs remain a challenge, various financing options are available. Developing a skilled workforce is also vital to overcome competition from fossil fuels.By streamlining processes and supporting collaboration, Greece can foster a robust investment culture for renewables and move confidently towards a greener future.

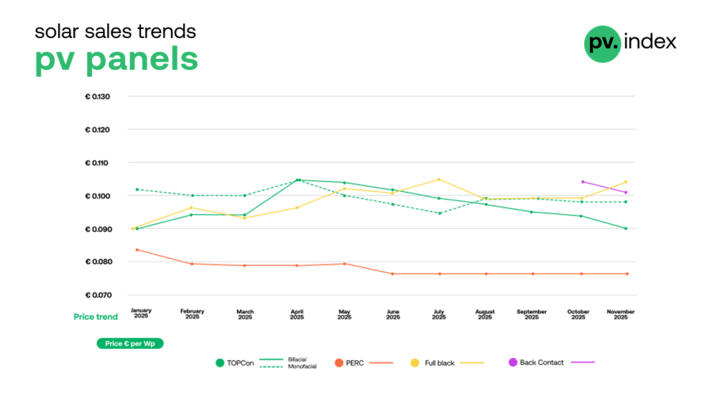

What are the trends in the market at the moment?

The trends shaping Greece’s energy market highlight the need for greater clarity regarding storage, grid networks and curtailment of energy production. There are delays in project licensing. This issue must be addressed, and we see cooperation between the involved bodies—which is currently lacking—as particularly important. We call for a positive response, along with more substantial planning and transparency. It is important to underline that electrification of the economy is a key priority and requires a dedicated plan.The cycle of project withdrawals should be a concern for the government.

Greece – Metlen and Karatzis partner on 790 MWh storage

There is significant unease in the market, and the State should restore a sense of security for companies. As foreign investors, we have a significant portfolio of projects and have invested heavily. We want to continue investing, but there is considerable concern. Let me emphasise that modernising infrastructure is essential. New financing tools are needed, licensing procedures must be streamlined, there must be cooperation with local communities and the issue of energy production curtailment must be addressed. We consider the need for a transparent environment for investors, the strengthening of grid networks and increased consumption to be the most important challenges facing the renewable energy sector.

Interview by Hans-Christoph Neidlein

About the interviewee: Efstathios Sideris has extensive experience managing large-scale renewable energy projects in Greece, Cyprus and the Balkans. In addition to serving as Founder and President of the Foreign Investors Council Greece, he is Country Manager for Econergy Renewable Energy and a Board Member in the Econergy-TERNA Energy joint venture.