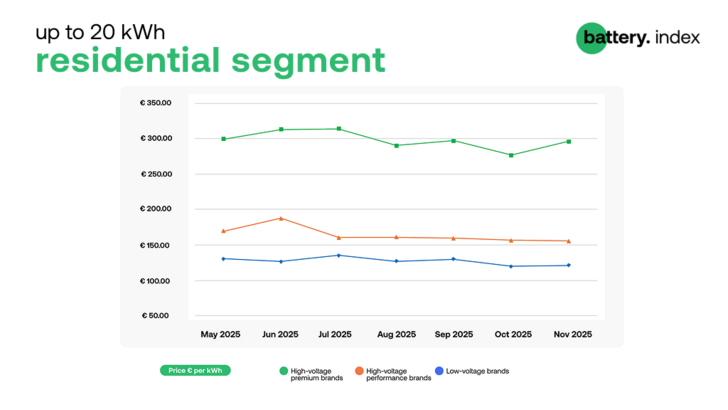

This edition sees sun.store introduce a three-tier classification for the residential battery market, giving a clearer breakdown of pricing trends across voltage categories.

● High-voltage premium brands: €296.1/kWh (+7% versus October)

● High-voltage performance brands: €155.7/kWh (–0.5% versus October)

● Low-voltage brands: €121.3/kWh (+1.3% versus October)

November marked the first notable price rise in the high-voltage premium segment since summer, ending a five-month decline. The 7 percent increase suggests tightening supply or renewed demand as installers stock up before year-end. High-voltage performance brands held steady, slipping just 0.5 percent, while low-voltage systems edged up 1.3 percent.

Brand rankings shifted in November. Huawei reclaimed the top spot after dropping to second in October, driven by renewed momentum in LUNA series sales. Dyness fell to second despite a strong performance the previous month. Deye, Sungrow and Pylontech rounded out the top five, holding firm in an increasingly competitive market.

PV Index: module prices steady, inverters up in November

“November’s price reversal in the premium segment is noteworthy,” says Grzegorz Furman, Senior International PV Trader at sun.store. “After sustained downward pressure throughout the autumn, we are now seeing signs of stabilisation or even tightening, especially among high-voltage premium systems. This could be due to a combination of year-end procurement cycles, shifts in component costs, and strategic positioning by leading brands in the run-up to 2026.”

The price gap between high-voltage premium and low-voltage brands has now reached around 144 percent, underscoring the persistent divide between reputation-focused buyers and cost-driven installers.

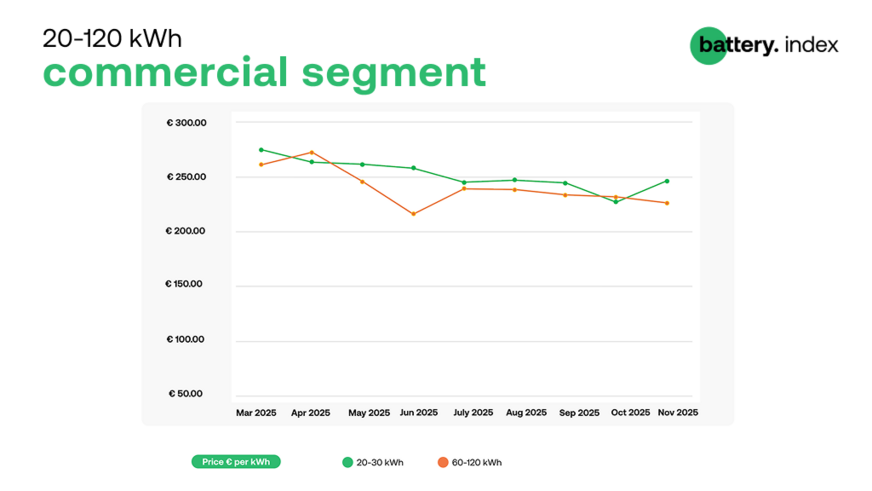

Commercial segment (20–120 kWh): diverging trends by system size

The commercial storage market saw contrasting movements in November, with small and large systems moving in opposite directions. Systems in the 20–30 kWh range averaged €246/kWh, up 8 percent from October's €227/kWh. This is the sharpest month-on-month rise since early 2025 and follows several months of falling prices. The increase likely reflects renewed demand for small commercial systems and possible supply constraints in this popular size category.

Larger systems in the 60–120 kWh range continued their gradual slide, averaging €226/kWh, down 2 percent from October's €231/kWh. This segment remains relatively stable, supported by longer procurement cycles and established C&I project pipelines that cushion short-term market fluctuations.

sun.store

Most offered products – November 2025

20–30 kWh segment

1. BYD Battery-Box Premium HVM 22.1

2. Dyness Tower T21

3. SolarEdge Home Battery 48V 23 kWh

4. PylonTech Force H3/409.6

5. Huawei LUNA2000-21-S1

6. Dyness Tower Pro TP23

The small commercial segment remains a mix of established premium suppliers and newer challengers. BYD holds its lead, while Dyness and Huawei are strengthening their positions with competitive mid-range products. SolarEdge and PylonTech round out the top five, reflecting installers’ continued trust in proven brands.

60–120 kWh segment

1. Deye GE-F60

2. Solax AELIO-P60B100

3. Solax AELIO-P50B100

4. KSTAR KAC50DP-BC100DE

5. Deye BOS-G80 Pro

6. Deye BOS-G60 Pro

Deye continues to dominate the larger commercial sector, securing two slots in the top five. SolaX has improved its standing with two ranked models, while KSTAR maintains a visible presence in the 60–80 kWh range. This segment remains defined by technical complexity and longer sales cycles tied to bespoke project requirements. (hcn)