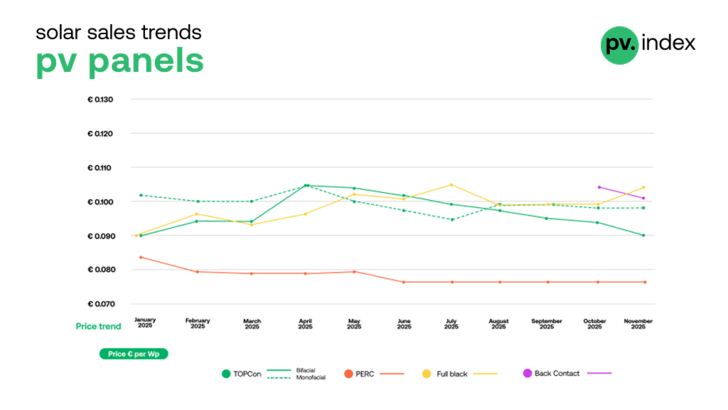

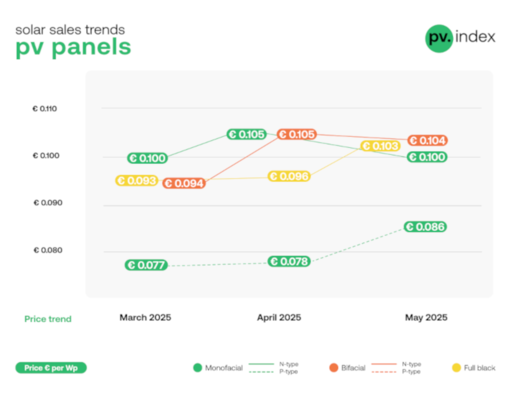

November brought another month of low volatility in the European PV module segment, with price movements reinforcing the sense of equilibrium observed in the fourth quarter. TOPCon bifacial modules edged down by 4% to €0.090/W, while TOPCon monofacial modules held steady at €0.098/W. The slight dip in bifacial pricing reflects competitive positioning among major manufacturers heading into winter, whereas monofacial pricing remains solidly anchored. Full Black modules rose by 4%, reaching €0.104/Wp, supported by controlled inventories and consistently stable demand within the residential segment.

This month marks an important methodological upgrade, as pv.index now lists Back Contact modules as a separate category. While Back Contact (BC) modules are still emerging, their presence in the European market is growing, reflected in the expanding portfolios of leading manufacturers and a rising number of BC-related transactions on sun.store. The price for Back Contact modules fell 3%, from €0.104/Wp in October to €0.101/Wp in November. Meanwhile, PERC modules again held steady at €0.077/Wp, marking six months of uninterrupted stability. This sustained plateau suggests a well-balanced relationship between supply and demand and a mature pricing environment with little pressure in either direction.

November saw a notable reshuffle in the module rankings:

1. LONGi

2. Jinko

3. Canadian Solar

4. JA Solar

5. Trina

LONGi’s return to the No. 1 position reflects strengthened distribution activity and renewed demand for its high-efficiency product families, particularly in markets preparing for 2026 framework programmes. Jinko moves to second as competition tightens across mainstream TOPCon portfolios.

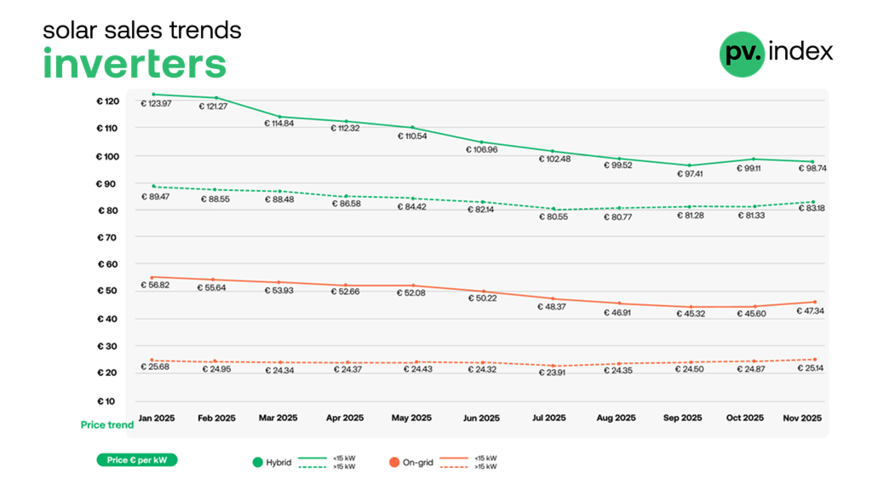

Inverter market: modest increases signal steady winter demand

Inverter prices posted another month of steady or upward movement, suggesting the correction phase seen earlier this year has concluded, with the segment now benefiting from consistent end-of-year procurement.

sun.store

Hybrid inverters: 1–15 kW: nearly flat at €98.74/kW, >15 kW: up 2% to €83.18/kW. The larger commercial hybrid category continues to see solid order flow as developers finalise installations before winter.

String inverters: 1–15 kW: up 4% to €47.34/kW, >15 kW: up 1% to €25.14/kW. Residential string inverters are benefiting from resilient fourth-quarter demand, underpinning modest upward price adjustments.

Hybrid inverter brand ranking

1. Huawei

2. Deye

3. GoodWe

4. Sungrow

5. Fronius

String inverter brand ranking

1. Huawei

2. Sungrow

3. SMA

4. SolarEdge

5. Fronius

The stability in string inverter rankings contrasts with the slight movement in the hybrid category, where Huawei regains the top spot, backed by a strong product portfolio and widespread channel adoption.

China’s solar rebate rollback signals squeeze on margins

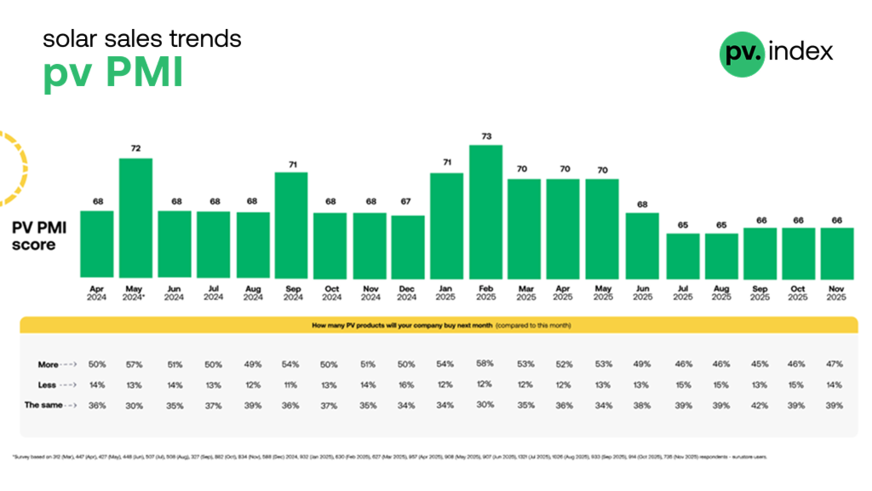

PV PMI: sentiment stable as Q4 progresses

The PV PMI remained unchanged at 66 points, mirroring October’s reading and underscoring a balanced, confident market.

sun.store

Survey results from sun.store users show:

● 47 percent expect to buy more next month

● 39 percent expect no change

● 14 percent expect to buy less

These results point to a mid-quarter environment characterised by steady demand and prudent stock management – neither overheated nor cautious, but well aligned with installation schedules and winter planning.

Expert commentary

“November reinforces the narrative of a market that has matured after a turbulent correction cycle. Prices remain stable and buyer behaviour is disciplined as we approach year-end. At the same time, we observe a build-up of module inventories on the manufacturer side, which typically leads to year-end sell-outs and targeted promotions – some of which are already appearing on sun.store,”

says Filip Kierzkowski, Head of Partnerships & Trading at sun.store.

“The introduction of Back Contact modules into pv.index is timely – the technology is scaling quickly and gaining industry momentum. While TOPCon still dominates today, BC is becoming a serious contender for the next standard in high-efficiency solar. As we move towards 2026, the competitive landscape will increasingly favour brands capable of combining innovation with reliability and strategic channel management.”

Stay informed – subscribe to our newsletters

Summary

● Module prices: stable with selective increases (inverters) and a new BC category, which shows a slight decline; TOPCon mixed; Full Black up; PERC steady for six months.

● Inverter prices: second consecutive month of upward movement.

● Rankings: LONGi leads modules; Huawei leads both inverter categories.

● PMI: unchanged at 66, indicating consistent caution.

As 2025 draws to a close, the European PV market stands on solid ground – stable, predictable, and increasingly shaped by technological differentiation.

About – PV Index & The PV Purchasing Managers' Index

PV Index tracks monthly trading prices for solar components on sun.store, Europe’s largest B2B marketplace for PV equipment. Our pricing data is weighted by transaction volume, offering a true reflection of the market.

Brand rankings are determined by total sales value on sun.store between January and October 2025, highlighting the most in-demand brands in each category. These rankings are updated monthly to reflect current buyer preferences and market conditions.

The PV PMI gauges purchasing sentiment among verified sun.store users. It is calculated using the formula: PMI = (P1 × 1) + (P2 × 0.5) + (P3 × 0), where P1 = percentage expecting improvement, P2 = percentage expecting no change, and P3 = percentage expecting decline. A score above 50 signals a positive market outlook. (hcn)