September was initially set as the policy’s expiration date, but manufacturers acted quickly. As soon as rumours of the repeal spread, factories ramped up production, filled their warehouses and moved to capitalise before the tax break ended. Scheper notes, “They squeezed every last drop from the old regime. With full trucks, they rushed to the exit.”

The scale of that surge took Chinese authorities by surprise, prompting a postponement. Although the changes are now being implemented in phases, the transition is still underway. Insiders report that the nine percent incentive will be withdrawn in two separate 4.5 percent steps between late November and early December. While the policy shift may be gradual, Scheper says it sends a clear message: the era of unregulated dumping is drawing to a close.

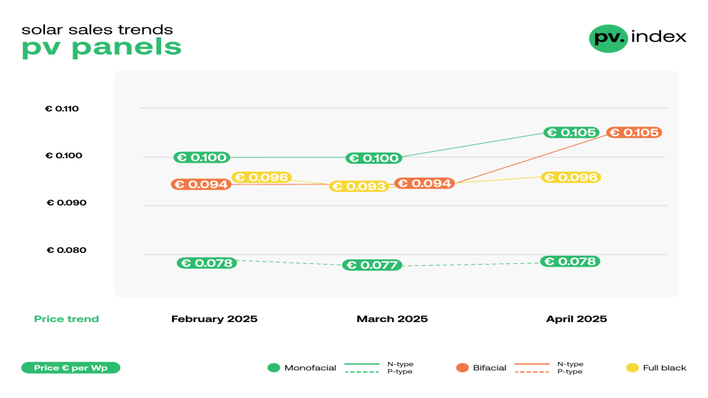

PV index September – stability returns to module prices

Global buyers are likely to see a flood of low-cost panels hitting the market just before the deadline, as excess inventory needs an outlet. After that, prices may begin to rise gradually. With incentives reduced and margins under pressure, the drive to maintain high production volumes will wane. “When the math changes, so does the behaviour – you can’t burn money indefinitely.”

The industry is entering a new phase

In the battery sector, the pattern is different. Despite widespread predictions of sharp price increases, the market has remained unexpectedly stable. Recent production slowdowns have been offset by large reserves of nickel, cobalt and lithium. Scheper believes this calm won’t last. Prices are unlikely to move until those reserves run low, as inventories remain high. “The supply cushion is still thick, so we haven’t seen any impact yet. But that’s temporary,” he adds.

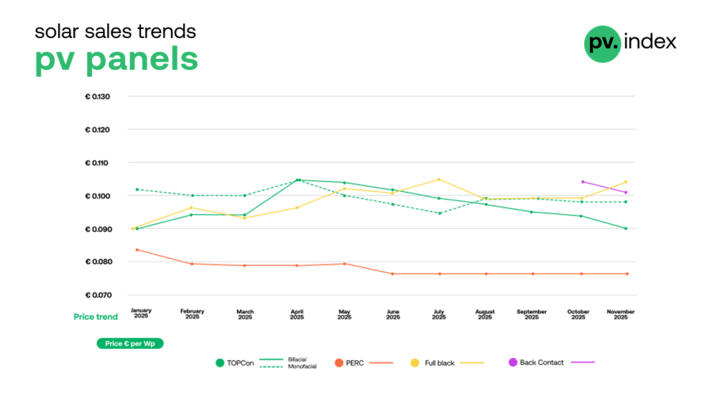

Market index – premium battery prices hold steady as gap widens

Anyone sourcing for custom-built solar or storage projects is walking a tightrope at the moment. Waiting too long risks getting caught by a price swing, while rushing in could mean overpaying in a panic. “If you’re building anything that doesn’t come off the shelf,” Scheper advises, “lock in wherever you can.”

The industry is entering a new phase after a decade of rapid growth and razor-thin margins. Sustainability and foresight are now taking precedence over speed and scale. “This isn’t a crash,” Scheper says. “It’s a correction. And in that correction, the winners will be those who prepared for the turn.” (GS/hcn)