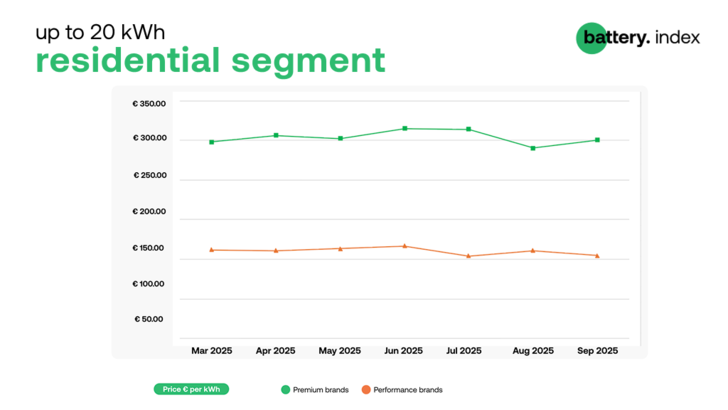

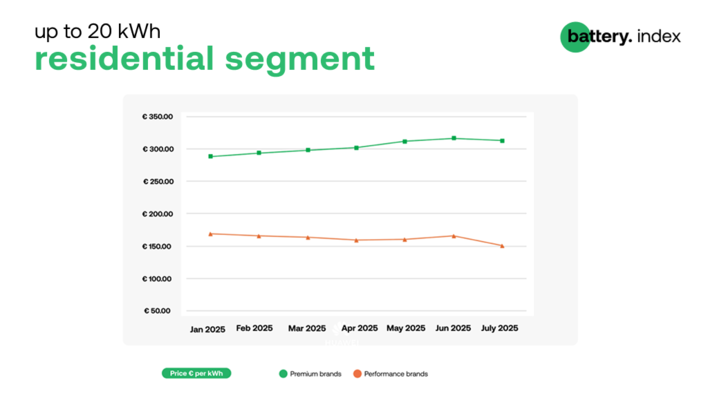

The residential battery market stabilised in September, with average prices for premium brands holding steady at just under €300 per kilowatt-hour. This marks a pause in the earlier downward trend, as inventories return to normal and supply chains reach equilibrium.

Performance-focused batteries saw a modest decrease, dropping from around €159 per kilowatt-hour in August to approximately €150 per kilowatt-hour in September. This decline reflects lower component costs and heightened competition among mid-range suppliers, as distributors clear inventory ahead of fourth-quarter procurement cycles.

As a result, the price gap between premium and performance segments has widened slightly, reversing the narrowing trend seen in August. The gap remains close to the 100 percent mark, underscoring the persistent structural divide between the two market tiers.

PV index September – stability returns to module prices

“In September, premium battery prices held steady while performance models saw a modest decline. The widening price gap between both segments suggests that installers remain willing to pay a substantial premium for recognised brands, reflecting sustained demand in the upper tier rather than an overall market correction,” comments Grzegorz Furman, International Senior PV Trader at sun.store.

Top 5 battery brands in September 2025

There were few notable changes in the residential Top 5 in September. Huawei held its lead for the fourth consecutive month, while Deye strengthened its position as the main challenger. Dyness continued to lose ground, falling further behind the top two due to softening demand and reduced availability. Sungrow and Pylontech traded places, with Pylontech returning to the Top 5 after a brief dip in August.

Overall, Huawei and Deye continue to dominate the premium and performance categories respectively, shaping installer preferences across Europe’s residential sector.

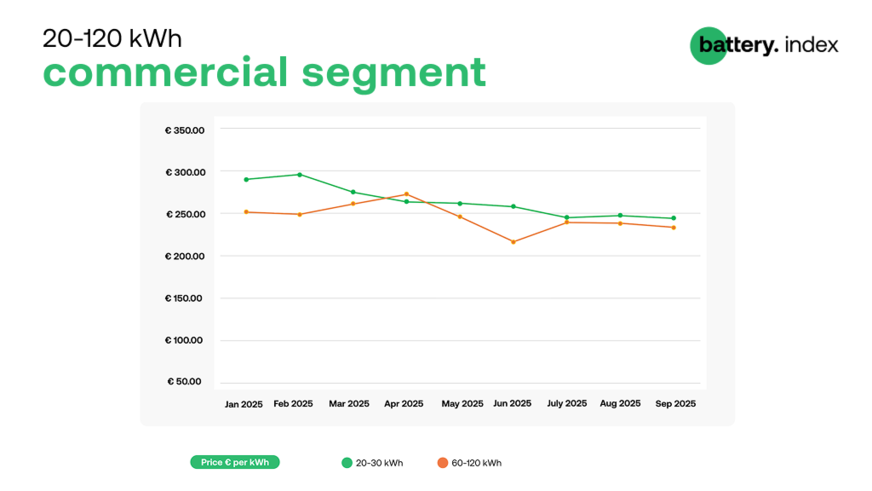

Commercial segment (20–120 kWh): steady trajectory

Price movements in the commercial segment remained moderate throughout September. Systems in the 20 to 30 kilowatt-hour range averaged around €245 per kilowatt-hour, virtually unchanged from August. The 60 to 120 kilowatt-hour segment saw a slight dip, falling from approximately €238 to €232 per kilowatt-hour.

Expert view – storage is powering a new era for C&I

This ongoing stability highlights that commercial buyers operate on longer planning cycles, with pricing shaped by quarterly rather than monthly adjustments. As project pipelines remain steady, the market for medium and large-scale storage solutions continues to show resilience despite seasonal slowdowns.

sun.store

Most offered products

20–30 kWh segment

1. BYD Battery-Box Premium HVM 22.1

2. SolarEdge Home Battery 48V 23 kW

3. Felicity LUX-X-96050HG01 4

4. Huawei LUNA2000-21-S1

5. Felicity LUX-X-48100LG01 4

The 20 to 30 kilowatt-hour range remains a diverse testing ground for installers and distributors, combining established premium brands like BYD and Huawei with emerging mid-range names such as Felicity.

60–120 kWh segment

1. Deye GE-F60

2. KSTAR KAC50DP-BC100DE

3. Deye BOS-G80 Pro

4. SolaX AELIO-P60B100

5. SolaX AELIO-P50B100

The upper commercial range continues to be led by Deye and KSTAR, reflecting their firm position in the C&I segment. SolaX remains in the spotlight with two models in the Top 5, showing its strength in higher-capacity solutions. (hcn)

More on solar storage.