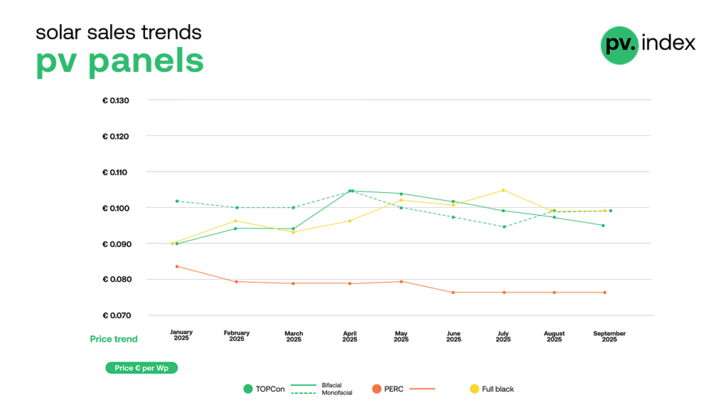

The newly refined pv.index segmentation, now distinguishing between TOPCon (bifacial and monofacial), PERC, and Full Black modules, offers a more precise view of current sales trends and pricing structures across the market.

● A 2 percent decline in TOPCon bifacial modules, from €0.097/Wp to €0.095/Wp, signals a moderate shift following months of stable pricing.

● TOPCon monofacial prices remained stable at €0.099/Wp, driven by balanced supply and steady demand.

● For the fourth month in a row, PERC modules held steady at €0.077/Wp, maintaining their strong role in cost-sensitive projects.

● Full Black modules remained flat at €0.099/Wp, highlighting continued demand for premium residential installations.

Expert view: China signals the end of rock‑bottom solar prices

Overall, September’s data confirm that the PV module market has reached a state of equilibrium: price volatility is low, inventories are manageable, and distributors are maintaining healthy turnover without aggressive price movements.

Aiko out, Canadian Solar in

To align with actual sales data, pv.index has updated its Top 5 PV brand ranking. Canadian Solar joins the list, replacing Aiko, based on cumulative 2025 sales performance. Canadian Solar’s inclusion underscores its strong European presence and competitive channel strategy, while interest in Aiko has declined following a period of significant attention.

Throughout the year, Jinko and LONGi have alternated in the top positions, while JA Solar and Trina have consistently held the following ranks.

Top 5 solar panel brands – September 2025

- LONGi

- Jinko

- Trina

- JA Solar

- Canadian Solar

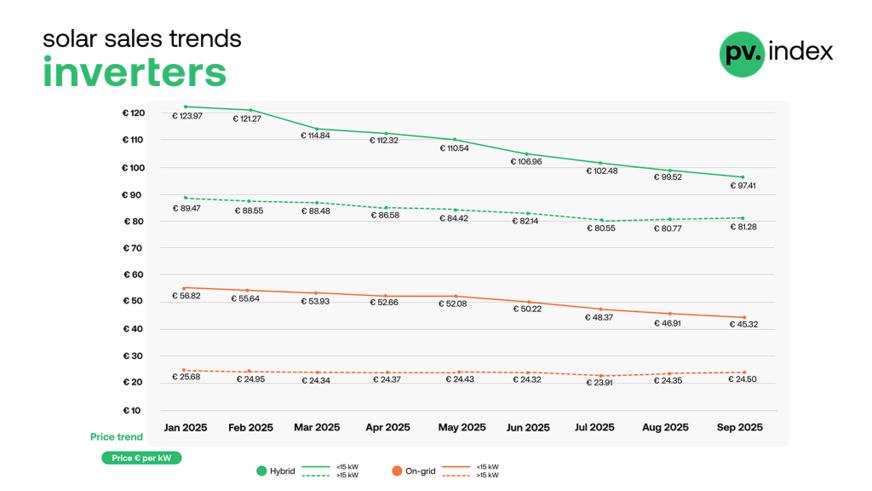

Inverter prices continue gradual correction

In the inverter segment, prices edged lower in the <15 kW category but stabilised in the >15 kW segment.

sun.store

Hybrid inverters

● <15 kW: down 2 percent, from €99.52/kW to €97.41/kW

● >15 kW: up 1 percent, from €80.77/kW to €81.28/kW, reflecting stable commercial demand

String inverters

● <15 kW: Down 3 percent, now at €45.32/kW, marking another month of soft correction

● >15 kW: Up 1 percent to €24.50/kW, following several months of limited movement, confirming that inverter pricing is stabilising across power classes

Huawei strengthens its lead in inverters

The hybrid inverter segment maintained momentum for Huawei, which claimed the top position after a steady ascent since July. Deye held firm in second place, followed by GoodWe, Fronius, and Sungrow.

PV systems under pressure from increasing cyber risks

This represents a notable shift in the competitive landscape, as Huawei consolidates its dominance through a broad product range and deep market penetration in both residential and small commercial installations.

Top 5 hybrid inverter brands – September 2025

- Huawei

- Deye

- GoodWe

- Fronius

- Sungrow

In the string inverter category, Huawei has retained its firm lead, holding an undisputed first place throughout the year. SMA reclaimed second position ahead of Sungrow, while SolarEdge and Fronius complete the updated Top 5.

This month’s ranking reflects a methodological update by pv.index, as Fronius replaces Solis following a revision to the sales dataset to better capture transaction volumes on the sun.store platform.

The overall segment remains stable and mature, marked by consistent brand preferences and strong customer loyalty among European installers.

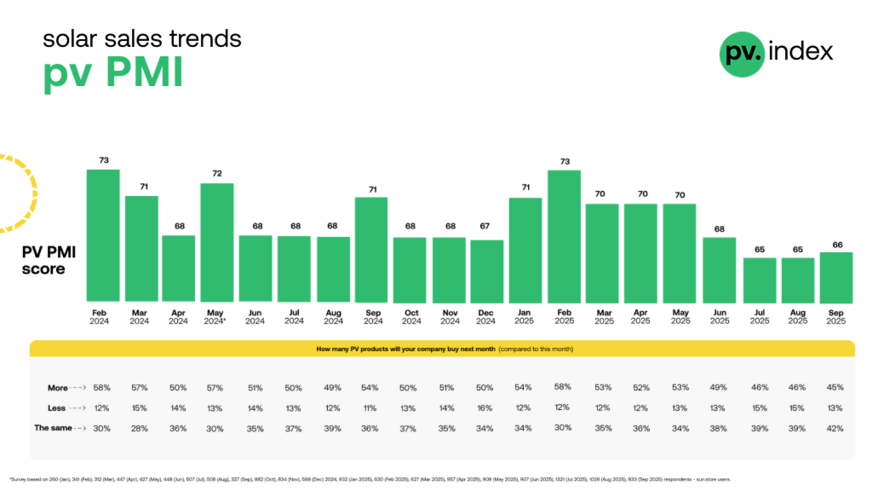

PV PMI rebounds slightly after summer slowdown

The pv.index PMI rose from 65 to 66 points in September, ending a three-month decline. While modest, the improvement indicates a slight recovery in short-term purchasing confidence.

sun.store

Survey data from 933 sun.store users show:

● 45 percent plan to increase PV purchases next month

● 13 percent expect to buy less

● 2 percent anticipate no change in purchasing levels

This rebound indicates that distributors are gradually replenishing inventories after the slow summer months, anticipating steadier activity in Q4.

EU solar workforce set to drop 5% amid weaker growth

Summary

September’s pv.index reflects a market in consolidation: stable prices, improving sentiment and clearer competitive structures. While demand remains moderate, installers and distributors show greater confidence heading into the final quarter.

With logistics pressures easing and exchange rates stabilising, the European PV sector is on track for a steady and sustainable close to 2025. (hcn)