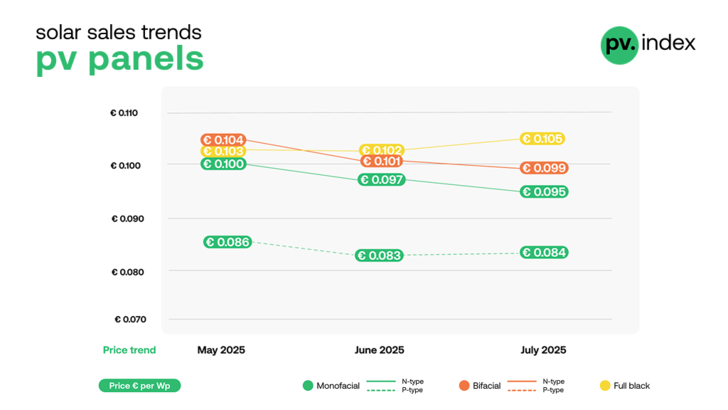

In July, average module prices fluctuated moderately, reflecting a market shaped by summer seasonality and uneven availability. Monofacial N-type modules recorded a 2 percent price drop to an average of €0.095/Wp – their second consecutive monthly decline, indicating continued price pressure and stable supply.

In contrast, monofacial P-type modules rose by 1 percent to €0.084/Wp, likely reflecting tighter availability in budget segments, particularly for smaller-volume orders.

Bifacial N-type modules mirrored the trend in N-type monofacials, falling by 2 percent to €0.099/Wp, while full black modules saw the largest price movement, rising by 3 percent to €0.105/Wp on the back of residential demand and reduced availability of visually uniform SKUs, which remain popular with installers focused on aesthetics.

EU solar stalls as residential rooftop and PPAs segments falter

The biggest shake-up came in the brand rankings. After several months of climbing, Jinko has reclaimed the number one spot as the top-selling panel brand on sun.store, overtaking Trina and others thanks to wider availability and strong pricing. LONGi and JA Solar continue to perform strongly. Aiko remains in the top five despite a significant drop in transaction volumes, which may see it replaced in future PV Index editions.

“At sun.store we have noticed lower availability of residential-size modules across the market. To address this, we are working to secure attractive offers and improve availability for our users. A market favourite that will soon feature more prominently on the platform is JA Solar,” said Filip Kierzkowski, Head of Partnerships and Trading at sun.store.

Top 5 solar panel brands — July 2025

1. Jinko

2. LONGi

3. JA Solar

4. Trina

5. Aiko

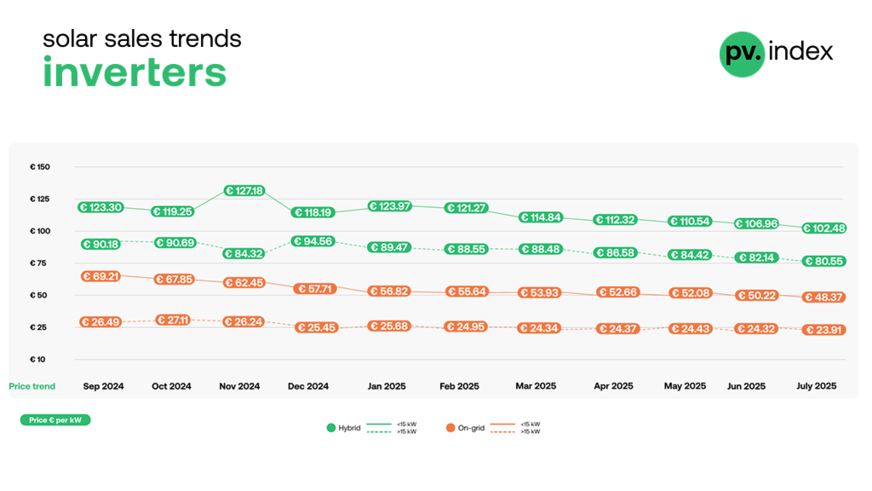

Inverter prices continue to slide

Inverter prices extended their downward trajectory in July, with both hybrid and string models seeing modest declines. This reflects intensifying competition among brands, as well as increasing selectivity on the part of installers and EPCs.

Hybrid inverter systems below 15 kW experienced a 4% price drop, averaging €102.48/kW, while larger systems above 15 kW declined by 2%, reaching €80.55/kW. These price movements point to growing price sensitivity in the mid-size residential and small-commercial segments, particularly where project pipelines remain active but margins are under pressure.

Smarter inverters deliver higher efficiency and expanded applications

String inverters (previously labeled "on-grid") followed a similar trend. Units under 15 kW dropped by 4% to €48.37/kW, while those above 15 kW now average €23.91/kW, down 2% month-over-month. Despite these reductions, some top-tier brands are maintaining value thanks to strong after-sales support and shorter lead times, both of which are increasingly prioritised by professional buyers.

sun.store

The brand rankings remained largely stable. In the hybrid category, Deye retains the top position, with Sungrow and GoodWe remaining strong contenders. A decline in trading activity for Fronius devices is likely to lead to its replacement in future editions of PV Index.

Huawei continues to dominate the string inverter category, with Solis climbing to second place – a notable shift that highlights growing demand for flexible and cost-efficient systems.

Top 5 hybrid inverter brands — July 2025

1. Deye

2. Sungrow

3. GoodWe

4. Huawei

5. Fronius

Top 5 string inverter brands — July 2025

1. Huawei

2. Solis

3. SMA

4. Sungrow

5. SolarEdge

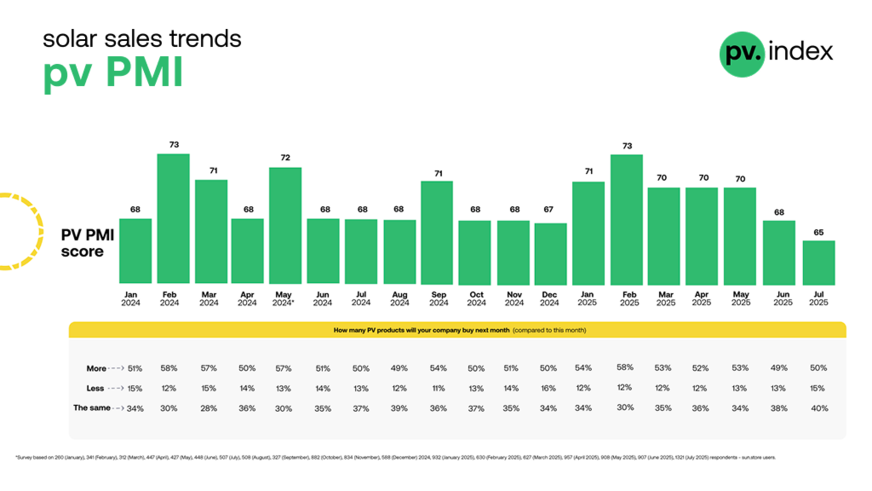

PV PMI: market sentiment drops to 65

In July, the PV Purchasing Managers’ Index (PV PMI) dropped to 65 – its lowest score since the launch of the index. This 3-point decline from June (68) is consistent with seasonal slowdowns, although last year’s July reading stood at 68. Thus, it is more likely a result of growing caution among buyers navigating a volatile macroeconomic environment. Of the 1,321 sun.store users surveyed this month:

● 46% said they plan to increase purchasing

● 39% expect to maintain current levels

● 15% anticipate a decrease in orders

While the index remains well above the 50-point mark that should indicate expansion, the downward shift reflects a mix of factors. Across Europe, August is traditionally a vacation month, particularly in southern markets – limiting both installer activity and investor responsiveness. At the same time, uncertainty surrounding future component prices, financing conditions and residential demand appears to be causing hesitation.

sun.store

“We are currently experiencing a seasonal summer slowdown – a trend observed even among our merchants, many of whom have enabled ‘holiday mode’ on the platform to signal limited availability and communication. Low stock levels and uncertain pricing in the coming weeks are compounding the situation. That said, we are closely monitoring the market to see whether activity picks up sharply in September or if this more cautious sentiment persists,” said Krzysztof Rejek, VP of Sales, sun.store.

Looking ahead, many in the industry are eyeing early autumn as a key turning point. Procurement is increasingly strategic and buyers are holding off on large-volume commitments in anticipation of clearer price signals post-summer.

Looking ahead: all eyes on September

With July behind us and most of Europe entering its traditional summer slowdown, the solar market finds itself in a period of strategic hesitation. Procurement volumes remain stable, but decision-making has slowed, not only due to vacations across southern Europe, but also as buyers pause to reassess pricing trajectories and inventory needs before peak Q4 installations.

Next investor newsletter: Solar mounting in complex environments

While current module and inverter prices appear relatively stable, that balance may prove temporary. Major Chinese polysilicon producers recently announced plans to shut down a third of national production capacity by 2027, backed by a government-supported €7 billion fund. Polysilicon and wafer prices are recording upward corrections and there is a widespread consensus that the 9% export rebate will be phased out soon. If the first effects of these changes materialize, prices for upstream components could begin rising as soon as Q4, cascading into module and inverter pricing in Europe.

About – pv.index & PV PMI

pv.index tracks monthly trading prices for solar components on sun.store, Europe’s largest B2B marketplace for PV equipment. Our pricing data is weighted by transaction power, providing a true market reflection.

Brand rankings are based on total sales value on sun.store between January and July 2025, identifying the most in-demand brands in each category. We update these rankings monthly to reflect current buyer preferences and market conditions.

The PV PMI gauges purchasing sentiment among verified sun.store users. It is calculated using the formula: PMI = (P1 × 1) + (P2 × 0.5) + (P3 × 0), where P1 = % expecting improvement, P2 = % expecting no change, and P3 = % expecting decline. A score above 50 signals a positive market outlook. (hcn)