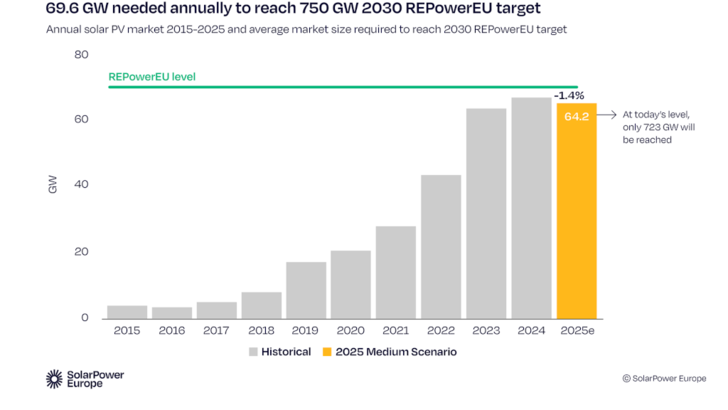

The new mid-year solar PV market analysis from SolarPower Europe forecasts a contraction in 2025, with a projected -1.4% growth in the most likely scenario. This follows exceptional market expansions in 2022 (+47%) and 2023 (+51%), with growth flattening in 2024 (+3.3%).

Current predictions suggest that the EU will install 64.2 GW this year, down from 65.1 GW in 2024. While still meeting the European Commission’s 2025 solar target of 400 GW, with 402 GW expected by year end, the trend is concerning.

Competitiveness and climate targets at risk

To meet the 2030 target and achieve decarbonisation and competitiveness goals, the EU must install close to 70 GW annually through the rest of the decade. Current trajectories would leave the bloc short, reaching 723 GW by 2030 instead of the required 750 GW.

The analysis coincides with positive headlines for solar in Europe. In June, solar delivered the largest share of monthly EU electricity, according to Ember. The UN reports that renewables now drive one third of EU economic growth. IRENA finds solar is 41% cheaper than the lowest-cost fossil fuels.

UNEF CEO José Donoso on Spain’s solar challenges: “Investments are stagnating”

Dries Acke, Deputy CEO of SolarPower Europe, commented: “The number may seem small, but the symbolism is big. Market decline, right when solar is meant to be accelerating, deserves EU leaders’ attention. Europe needs competitive electricity, energy security and climate solutions. Solar delivers on all of those needs. Now policymakers must deliver the electrification, flexibility and energy storage frameworks that will drive solar success through the rest of the decade.”

Residential roofing segment declining

The projected slowdown is primarily due to a weakening rooftop market, especially in residential solar. In traditionally strong rooftop markets including Italy, the Netherlands, Austria, Belgium, Czechia and Hungary, households are delaying installations as the impact of the 2022 energy crisis fades.

In most of these countries, incentive schemes have been withdrawn without adequate replacement, resulting in a collapse of over 60% in the residential rooftop market compared to 2023. Poland, Spain and Germany are also seeing declines of more than 40%.

Stay informed and subscribe to our free newsletters

Utiliy-scale solar still growing due to auctions

Despite the downturn, utility-scale solar is expected to continue expanding and is set to account for about half of new capacity additions in 2025. Since 2022, improved auction design has rebuilt investor confidence. In 2024, the EU awarded a record 20 GW of utility-scale solar. Hybrid and co-located storage projects, especially in Germany and Bulgaria, are helping drive auction momentum. Germany leads in solar auctions, followed by the Netherlands, France and Italy, with Poland and Ireland also stepping up.

PPAs wavering

New PPA signings fell by 41% between Q1 and Q2 of this year, raising concerns about short-term performance. Reforms to support frameworks will be needed to unlock the full potential of these contracts.

Storage and co-location seen as remedy for fragile PPAs

Looking ahead, 2025 auction plans suggest continued utility-scale solar growth. Germany’s latest innovation tender attracted 158 bids totalling over 2 GW, mostly for hybrid solar-storage projects. Prices dropped to €0.05/kWh, down from €0.07/kWh in October’s tender, which awarded only 487 MW. Well-designed auctions that promote flexibility and hybridisation with storage or wind are seen as key to long-term resilience in the utility-scale segment. (hcn)