Beyond short-term price movements, structural shifts in global PV policy are coming into focus. Chief among them is the planned abolition of China’s export tax rebates from April 2026, which is altering expectations around cost pass-through, procurement timing and competitive positioning.

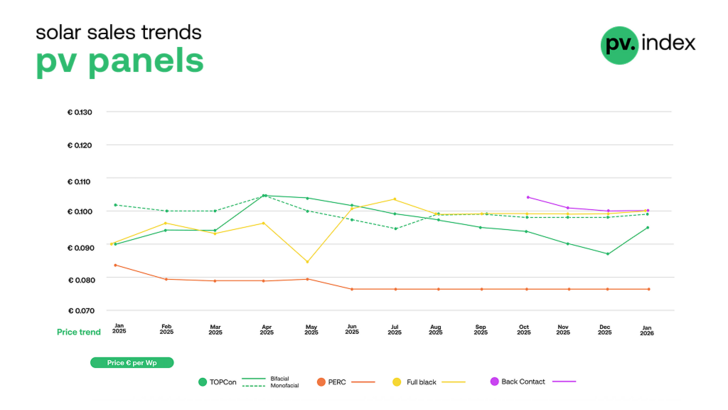

Solar module market: selective rebounds and normalisation

After the unusual price inversion seen in late 2025, January module pricing points to a return to normalisation rather than disruption, with clear divergence across technologies.

TOPCon modules

● TOPCon bifacial: €0.095/Wp (+8% m/m)

● TOPCon monofacial: €0.099/Wp (+1% m/m)

The sharp recovery in bifacial pricing stands out as a market signal. After year-end discounting and mid-Q4 distortions, renewed interest from utility-scale and larger commercial buyers has helped rebalance the bifacial segment, bringing prices closer to monofacial equivalents rather than below them.

Design-oriented and high-efficiency technologies maintained discipline:

● Full Black modules: €0.100/Wp (flat)

● Back Contact: €0.100/Wp (flat)

Both segments hold stable positioning, underlining value consistency in categories that continue to command interest beyond pure cost-based decisioning.

This pricing environment may also reflect forward procurement ahead of the scheduled removal of export VAT rebates for Chinese PV products from 1 April 2026, a move industry sources expect to raise export cost structures and prompt short-term inventory building.

Top module brand rankings: leadership reshuffles at the top

January data point to a notable reshuffle among leading module brands, with changes concentrated at the very top of the rankings rather than in the long tail. This rotation suggests shifting short-term demand patterns and channel availability, rather than a structural loss of competitiveness among incumbent manufacturers.

1. Trina

2. JA Solar

3. Jinko

4. Canadian Solar

5. LONGi

Trina moves into the leading position, reflecting strong early-year availability and competitive positioning across TOPCon product lines.

JA Solar advances to second place, gaining visibility as buyers prioritise reliable supply and execution speed at the start of the year.

At the same time, Jinko slips to third, indicating relative rotation in transactional momentum rather than a collapse in demand.

Lower in the ranking, Canadian Solar and LONGi maintain stable positions, underscoring that the January shift is concentrated among the top three brands rather than signalling a broader reordering of the market.

Stay informed, subscribe to our newsletters

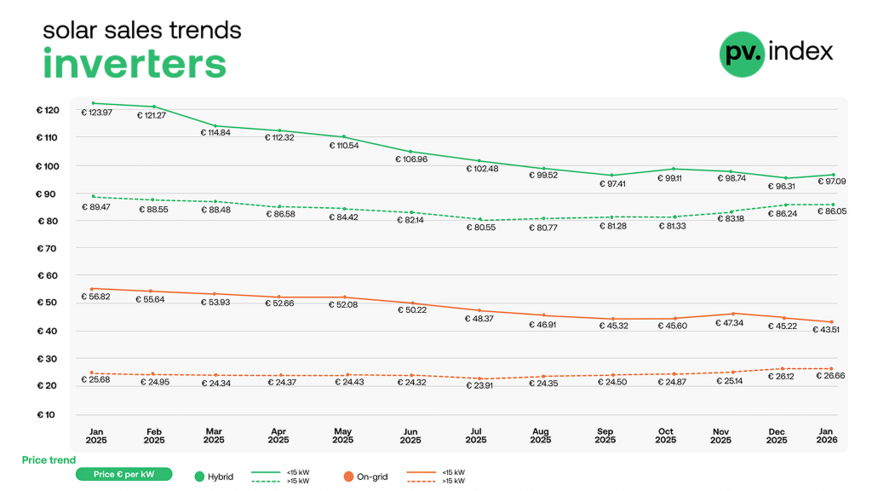

Inverter pricing: stability in hybrids, mixed signals in string

Hybrid inverters

● 1–15 kW: €97.09/kW (+1% m/m)

● >15 kW: €86.05/kW (flat)

Hybrid system pricing continues to show resistance to downward pressure, with smaller systems edging higher as residential reactivates and larger commercial classes holding steady.

String inverters

● 1–15 kW: €43.51/kW (−4% m/m)

● >15 kW: €26.66/kW (+2% m/m)

In the string category, the residential segment remains soft, while higher-capacity systems benefit from stabilised procurement in commercial and industrial channels.

sun.store

Inverter brand leadership – evolving yet anchored

Hybrid

1. Deye

2. Huawei

3. Sungrow

4. GoodWe

5. Fronius

String inverters

6. Huawei

7. Sungrow

8. Fronius

9. SMA

10. SolarEdge

These rankings underscore ongoing brand momentum, with established players maintaining share even amid selective segment rotation.

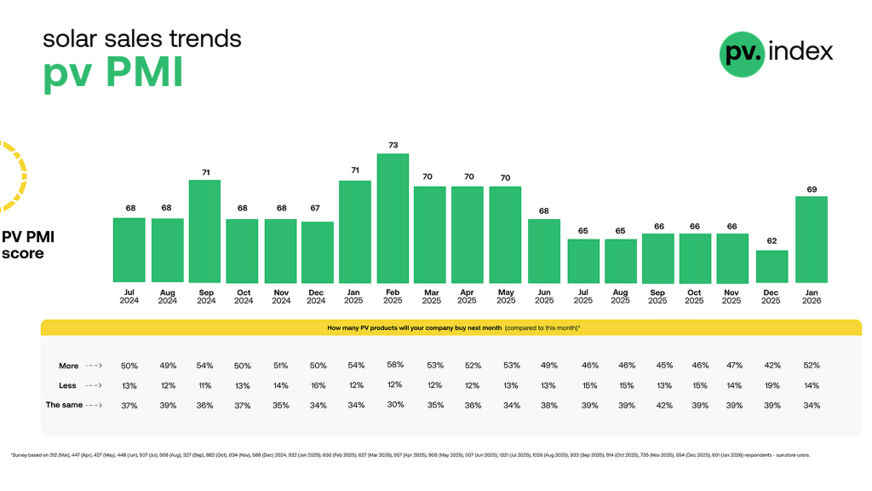

PV PMI climbs — sentiment enters constructive territory

The PV Purchasing Managers Index (PMI) rose to 69 in January – a meaningful increase and the highest reading since May 2025. This rebound suggests renewed buyer confidence following the typical seasonal contraction at year-end, and hints that 2026 may begin with proactive purchasing rather than defensive backlog clearing.

sun.store

Global policy winds: China’s export rebate removal reshapes cost expectations

A major structural theme influencing early-year pricing psychology is the upcoming removal of export VAT rebates for photovoltaic products in China, effective 1 April 2026. This policy change ends a longstanding export subsidy mechanism and is widely expected to raise export costs for manufacturers, leading to:

● forward procurement ahead of the rebate expiry

● short-term supply tightness or price adjustments

● accelerating consolidation among less efficient producers

While the full impact will unfold through Q2 and beyond, the anticipation of higher net export prices is already feeding into buyer behaviour and helping support early-year price stability.

Europe races to secure supply as China ends export incentives

Market outlook – normalisation with a cautious forward bias

The January data portray a market that is neither contracting nor overheated, but disciplined and adjusting to both seasonal and structural signals:

● Module prices show selective rebounds rather than broad weakness.

● Inverter pricing remains stable overall, with segment nuances.

● Brand leadership remains consistent.

● Sentiment (PMI) is improving meaningfully.

● Policy shifts (e.g. China export rebate removal) add new dynamics to procurement strategies.

For buyers and planners, the early 2026 environment suggests that timing and strategic procurement may be as important as headline pricing, particularly as policy-induced cost pass-through starts to materialise in sourcing windows.

Key takeaways

● Modules: pricing rebounds selectively – TOPCon bifacial regains ground, other technologies hold.

● Inverters: hybrid stability contrasts with mixed string movements.

● Brand rankings: leadership remains stable.

● PMI: reflects strengthening sentiment into early 2026.

● Policy: removal of export tax rebates in China is influencing forward buying and pricing confidence.

About pv.index & The PV Purchasing Managers’ Index (PV PMI)

pv.index tracks monthly trading prices for solar components on sun.store, Europe’s largest B2B marketplace for PV equipment. Our pricing data is weighted by transaction power, providing a true market reflection.

Brand rankings are based on total sales value on sun.store between January and October 2025, identifying the most in-demand brands in each category. We update these rankings monthly to reflect current buyer preferences and market conditions.

The PV PMI gauges purchasing sentiment among verified sun.store users. It is calculated using the formula: PMI = (P1 × 1) + (P2 × 0.5) + (P3 × 0), where P1 = percent expecting improvement, P2 = percent expecting no change, and P3 = percent expecting decline. A score above 50 signals a positive market outlook. (hcn)