Recently, more than 170 installers from across Europe attended your conference on C&I storage applications in Como, Italy. What were the key takeaways?

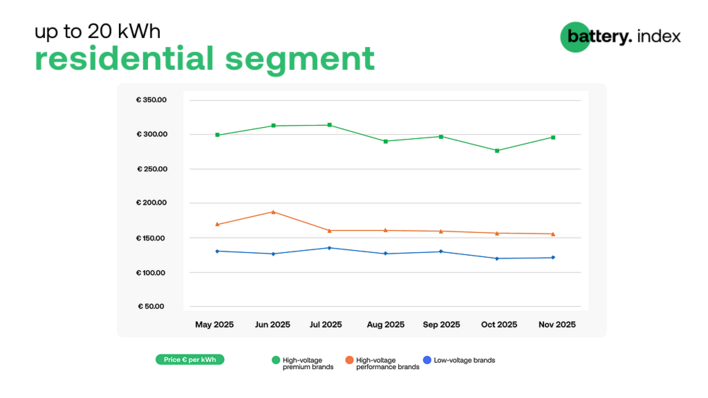

In many European countries with high electricity prices, such as France, Germany, Italy and the United Kingdom, demand for C&I storage applications is strong. This is further reinforced in countries facing grid constraints, like the Netherlands. It also became clear that these applications do not require dedicated subsidies to be economically viable, provided policy-makers do not intervene. Currently, the main driver of the C&I market is peak shaving, due to the high costs of grid connection in many countries with a substantial share of renewables, as well as the ongoing drop in battery prices, which is making many projects viable—this year alone, prices have fallen by 40 to 45 percent.

Which other applications for C&I storage are trending or proving economically viable?

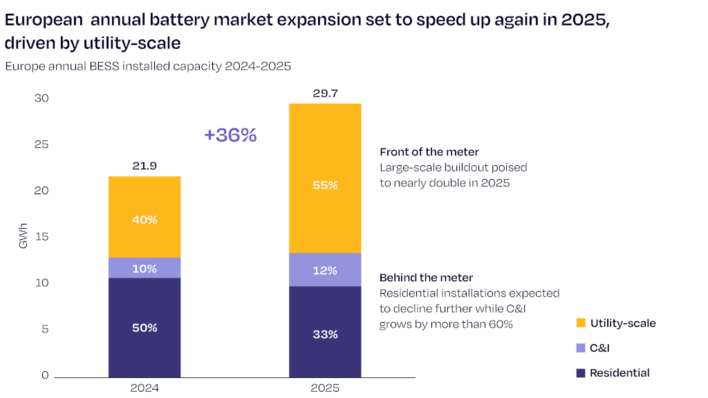

Maximising self-consumption and integrating charging stations are currently among the most attractive “behind the meter” applications, typically in the range of several hundred kilowatts up to a few megawatt hours. However, we are also seeing larger megawatt-hour projects in the “front of the meter” segment, including electricity trading, grid services and arbitrage. This is becoming another important pillar for C&I projects.

Can the new DC-coupled, modular C&I battery storage system Power Keeper, which was unveiled in Como, cover both use cases?

In principle, yes. However, the Power Keeper is primarily designed for peak shaving and optimising self-consumption. In addition, there is strong demand for retrofitting large C&I projects. To meet this need, we are offering new products, such as our SH-125 CX battery inverter, which allows battery modules and additional components—including charging stations or heat pumps—to be connected to existing PV systems while retaining the original module strings. These can then be integrated into our iSolar Cloud platform for monitoring and control.

How important is cybersecurity for such networked applications from the perspective of installers? Is this a major concern in the market?

In the utility segment and at the level of 380 kV transmission networks, cybersecurity is a topic that receives a lot of media attention. It is also a key consideration for us in product development. But despite the ongoing discussion, I have never had this question raised by customers in the C&I sector. Furthermore, we use European servers in Frankfurt and hold all relevant certifications for our products.

What other aspects are of interest to installers when it comes to C&I storage applications—where are the main pain points? Is it mainly about costs?

It is also about convincing potential customers—being able to explain complex projects clearly and demonstrate the economic benefits. Another key topic in Como was the various aspects of project development, such as grid connection and permitting, as well as local and regional building regulations, for example in relation to fire protection. Overall, there is still a great deal of uncertainty at the municipal level when it comes to developing C&I storage projects, partly because building authorities generally lack experience in this area. Fire safety for C&I battery storage systems is a major concern for installers, as is the ability to have a technician on site quickly or resolve issues remotely to keep downtime to a minimum.

Interview by Hans-Christoph Neidlein