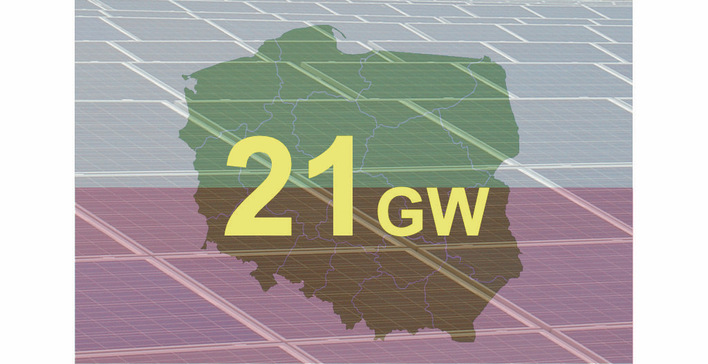

Last week, the international renewable energy trading platform LevelTen Energy published findings on the current state of the energy market in Poland. The report, titled ‘Poland's Renewable Energy Awakening,’ was compiled by energy analysts based on proprietary insights. The comprehensive report also provides background information on the current state of clean energy in Poland.

Michal Marona of SolarEdge: “A market with lots of potential”

Coal loses 11% in 12 months

Decarbonisation is progressing rapidly in a country once dominated by coal-fired power generation. According to the report, coal accounted for only 57% of Poland's electricity generation in 2024, a decline of 11% within 12 months. In 2015, coal-fired power still accounted for 87% of Poland's electricity generation. At the same time, wind and solar power supplied a substantial 26% of total electricity in 2024, and the trend will continue. Therefore, the trading platform LevelTen sees the increasing demand for power purchase agreements (PPAs) as a key driver for transactions involving renewable energy plants.

Patrik Danz of IBC Solar: “It’s a very exciting market”

Poland eases rules for renewables, but bottlenecks persist

Poland is reducing restrictions on renewable energies to further accelerate expansion. Nevertheless, challenges remain, such as expanding the electricity grid to accommodate numerous decentralised generation facilities and increasingly fluctuating generation. According to the report, Poland's main transmission system operator, Polskie Sieci Elektroenergetyczne (PSE), is increasingly rejecting grid connection applications from renewable energy plants. LevelTen speaks of around 6,000 connections being rejected by the operator between 2015 and 2021, preventing 30 GW of new renewable power from coming into operation. Other criticisms include the lengthy approval process and challenges in financing renewable energy projects. However, this primarily affects wind power, suggesting that photovoltaics should have an easier time. However, from our regular expert interviews, we know that PV bureaucracy and grid connection problems are both slowing down rapid expansion in recent years.

Caroline White of SegenSolar: “Poland is emerging as a key market”

PPA offer more attractive pricing than auctions for renewable energy operators in Q4 2024

According to the new report the most recent auction held in December 2024, photovoltaic power plants secured prices ranging from €57.50/MWh to €78.60/MWh, while wind turbines were awarded premiums between €35/MWh and €41.10/MWh. In comparison, LevelTen Energy's price index for Q4 2024 reveals that power purchase agreements offer significantly higher prices: €78/MWh for photovoltaics and €94.50/MWh for wind energy. This comparison clearly shows that, for plant operators, PPAs present the more lucrative option compared to auction prices.

Tobias Schuessler of Goldbeck Solar Polska: “The demand for solar parks is rising”

Poland mmerges as a strategic PPA market with high CO₂ savings and first-mover advantage

The report finds that power purchase agreement providers in Poland benefit from a first-mover advantage, thanks to the country’s still limited share of renewable energy in electricity production. Electricity buyers also stand to gain – especially in terms of climate impact. Because Poland’s energy mix still remains heavily reliant on coal, switching to carbon-neutral electricity via PPAs can lead to significantly higher CO₂ savings per megawatt-hour than in countries like Sweden, where the energy mix is already relatively clean.

Bartosz Majewski of Menlo Electric: “We are navigating a turbulent market”

Growing demand and economic expansion make an interesting market for PPAs

With a growing economy and increasing demand for clean energy, Poland represents a promising market for long-term PPAs. These agreements offer not only CO₂-free electricity but also stable, predictable pricing over extended periods. For the country’s many energy-intensive and manufacturing companies, PPAs provide a cost-effective and sustainable way to secure large volumes of clean power.

Positive outlook for Poland’s PV project market

Poland’s photovoltaic project market is poised for significant growth, according to LevelTen Energy. As the country accelerates its renewable energy expansion, a surge in market activity is expected – particularly in the form of project and corporate mergers, acquisitions, and sales. Analysts link this momentum to supportive EU funding initiatives like the “Green Deal” and the “Fit for 55 package”, which are improving financing conditions for clean energy investments. Additionally, Poland’s growing electricity demand is driving the need for clean energy solutions, further boosting the appeal of large-scale PV projects. LevelTen observed a rise in merger and acquisition (M&A) activity in 2024 and expects this trend to continue through at least 2025, supported by a more stable regulatory environment and the accelerated implementation of new legislation.

Grzegorz Rabsztyn: “The EIB is playing a key role in supporting renewables and grid development”

M&A Deals poised to drive Poland’s energy transition

Mergers and acquisitions are expected to play a pivotal role in accelerating renewable energy project deployment and advancing Poland’s progress toward climate neutrality, according to the report. Pieter van der Meulen, Senior Manager of Developer Engagement at LevelTen Energy explains: “The Polish renewable energy market is evolving at a rapid pace. With regulatory barriers steadily decreasing, we anticipate a surge in opportunities for both developers and corporate buyers. Regulatory reforms, government incentives, and a growing power purchase agreement market are creating the foundation for a new wave of investment across Poland’s renewable energy sector.” (mg)

Read the full report here