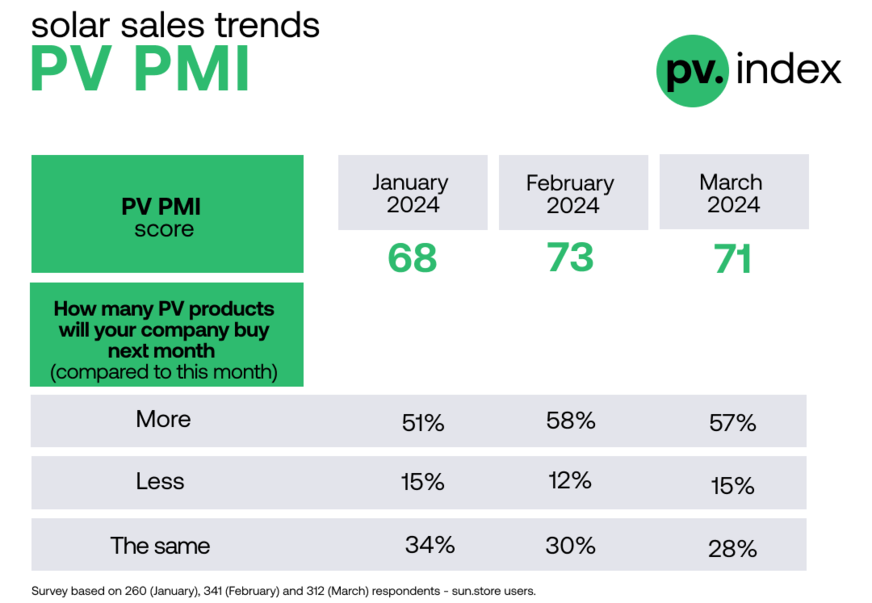

PV PMI (Purchasing Managers’ Index) score remained above 70 points, with almost 60% of buyers planning to buy more in April than they did in March. The PV Purchasing Managers' Index (PMI) is a result of a monthly survey filled by more than 300+ Sun.store buyers, measuring overall demand outlook in the industry. PV.Index summarizes average transactional prices from solar trading platform Sunstore, headquartered in Amsterdam/Netherlands.

PV Index - price increases in key categories

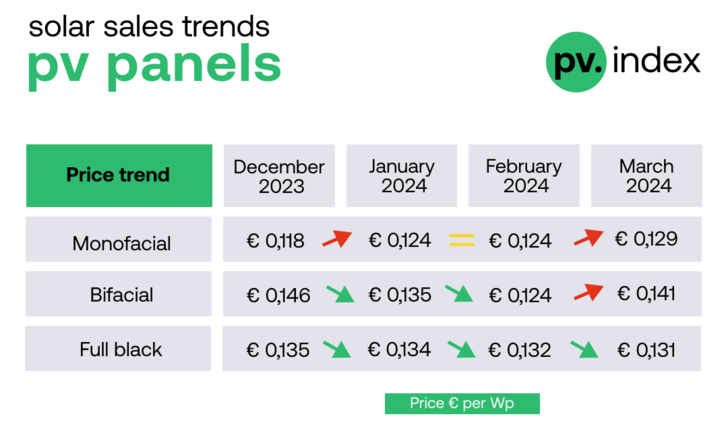

In March, there was a noticeable uptick in average trading module prices across primary product categories. monofacial module prices climbed from 0.124 to 0.129 EUR/W, and bifacial modules experienced a more pronounced rise from 0.124 to 0.141 EUR/W.

This resurgence in prices can be attributed to several factors. March is traditionally the onset of the installation season, resulting in higher demand among installers. Meanwhile, European distributors have substantially cleared their warehouses of excess stock over the winter. Consequently, the prices of the most sought-after PV products were experiencing an upward trajectory. This was particularly noticeable for modules for C&I installations (monofacial and bifacial modules 450-550 W) and ground-mounted utility projects (bifacial modules 550 W+).

Demand for residential panels remained sluggish, as exemplified by full black modules. Here, a slight price dip from 0.132 to 0.131 was recorded.

See also: Module prices continue to spiral downwards

Such divergence in pricing does not come as a surprise to market leaders. During a recent debate organized by Sun.store, Daan van Lin, International Sales Manager at Solar Today Franchise B.V. remarked, "2024 is poised to be another year of challenges and opportunities as the landscape rapidly evolves. We are transitioning from a period of panel oversupply across the board to shortages in select categories. "

Jinko Solar remained the most frequently purchased module brand on Sun.store maintaining a top stop held since December 2023.

PV PMI – demand outlook remains strong

Despite the recorded price growth, the buyers maintain a positive outlook. The PV PMI (Purchasing Managers’ Index) registered a score of 71. Despite a slight 2-point decrease in buyers’ sentiment compared to the previous month, the score above 70 points signifies an expansion phase of the cycle.

"Almost 60% of buyers participating in our survey stated that they expect to buy more in April than in March. This contrasts with the PMI score for other industries in the EU and emphasizes the importance of the renewable industry as one of few remaining growth engines for the economy in our continent" – commented Agata Krawiec-Rokita, Sun.store CEO.

Sun.store

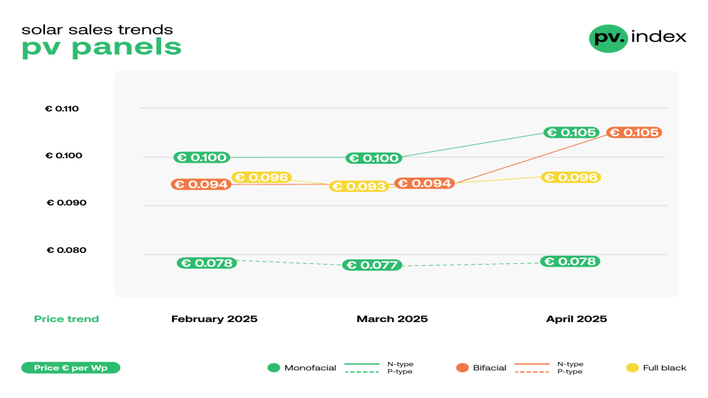

PV Index traces current trading prices for solar components on a monthly basis. Data is recorded on Sun.store, an online PV trading platform with 3 GW+ of components on offer according to own information. Trading prices are weighted by power of components involved in the transactions to arrive at a reliable estimate for the whole market.

The PV Purchasing Managers' Index (PV PMI) is a measure indicating the overall sentiment towards the demand in the PV industry. It is calculated based on a questionnaire among 300+ sun.store buyers. PV PMI shows whether demand is expected to expand (above 50), remain stable, or contract (below 50), as perceived by purchasing managers.

The PV PMI was calculated as: PMI = (P1 * 1) + (P2 * 0.5) + (P3 * 0), where: P1 = percentage of answers reporting an improvement, P2 = percentage of answers reporting no change, P3 = percentage of answers reporting a deterioration. Survey based on 260 (January), 341 (February) and 312 (March) respondents – Sun.store users. (hcn)