PV Index summarizes average transactional prices from Sunstore, an online PV trading platform with 3 GW+ of components on offer, according to company information. The PV Purchasing Managers' Index (PMI) is a result of a survey filled by more than 300+ sun.store buyers, measuring overall demand outlook in the industry.

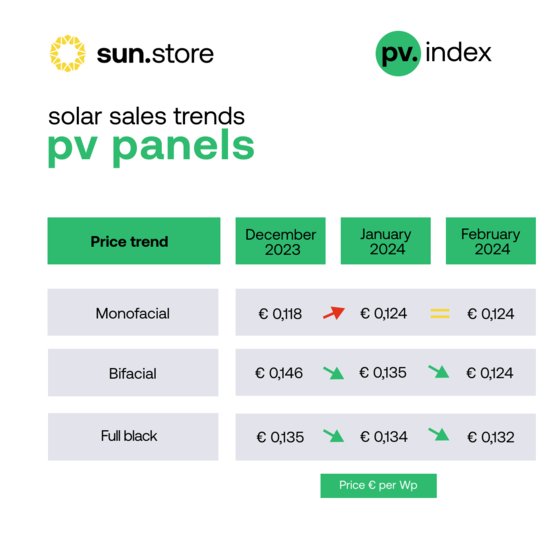

In February 2024, PV Index reading for monofacial module price remained at 0.124 EUR/ W, supported by elevated shipping prices (due to Red Sea crisis) and shortages in the module power classes for C&I installations. This has allowed for the bifacial module prices to catch up with monofacials, after dropping 8% from 0.135 EUR/ W in January to 0.124 EUR/ W in February. Bifacials are typically slower to react to market changes due to longer gestation time of C&I and utility projects. Hence the temporary extra premium that bifacial modules experienced since module prices started their downward march almost 18 months ago.

Significant manufacturing overcapacity in China

Despite the price drop in bifacials and full blacks in February, average monofacial module prices remain at a higher level than in December 2023. In retrospect it confirms that December price reading was an outlier, influenced by manufacturers and distributors scrambling to clear the warehouses of the monofacial modules (especially residential) by year’s end. Hence, a certain price recovery come New Year was to be expected.

“What is surprising to some is the return to the overall downward price trend in February. Many market participants were linking the low prices in Q4 2023 mostly with gigawatts of surplus module stocks in European warehouses. Hence, they hoped for the prices to recover to a EUR 0.16-0.18 range once those stocks clear. However, the current pricing is rather the product of significant manufacturing overcapacity in China – which means it will be more persistent.”, commented Agata Krawiec-Rokita, CEO & Co-founder of Sunstore.

Also interesting: Tier 1 list halved after adjustment of criteria

As for whether the prices will continue to fall remains to be seen. During the recent industry debate organized by sun.store, Maria Merdzhanova, Jinko Solar’s Head of Sales for Eastern, Northern Europe, and UK, was sceptical: „There is almost nowhere to go when it comes to cutting the costs of production. On top of that we’re seeing the logistics challenges with what’s happening at the Red Sea. All of this will lead to challenges with modules price reduction“, she said.

Also interesting: "The drop in prices is causing the industry in Europe problems"

Jinko Solar, which last year topped global ranking for the biggest module shipments, continued to also be the most popular module brand traded on the platform in February.

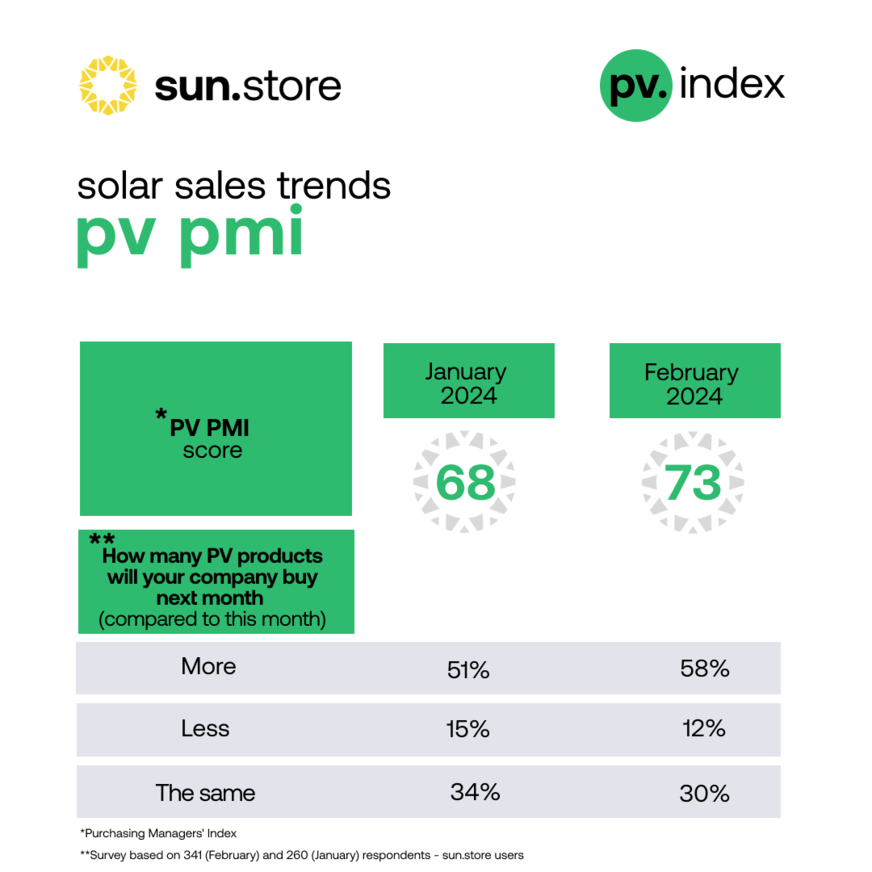

58% of respondents expecting to buy more in March vs February

March is traditionally a strong month for solar deployments across Europe, with many companies installing the backlog of contracts they had accumulated over the winter. This effect is further strengthened by the downward trend in component pricing, making solar systems more affordable for residential and C&I investors. Moreover, several governments either recently announced or are expected to announce soon additional support programs for solar installations.

Sunstore

These factors were reflected in the positive demand outlook that 300+ Sunstore buyers have shared in the PV PMI survey. Almost 60% of the respondents expect to buy more in March than they did in February. The overall PV PMI score was recorded at 73, signifying strong expansion phase in PV purchasing (scores above 50 indicate expansion, below 50 – contraction). By contrast, similar indices for other industries in Europe are mostly below 50, as European economy struggles to record growth. Solar industry – despite its challenges – remains one of the few bright spots left.

About – PV Index & The PV Purchasing Managers' Index

PV Index traces current trading prices for solar components on a monthly basis. Data is recorded on Sunstore, an online PV trading platform with 3 GW+ of components on offer, according to company information. Trading prices are weighted by power of components involved in the transactions to arrive at a reliable estimate for the whole market.

The PV Purchasing Managers' Index (PV PMI) is a measure indicating the overall sentiment towards the demand in the PV industry. It is calculated based on a questionnaire among 300+ sun.store buyers. PV PMI shows whether demand is expected to expand (above 50), remain stable, or contract (below 50), as perceived by purchasing managers.

The PV PMI was calculated as: PMI = (P1 * 1) + (P2 * 0.5) + (P3 * 0), where: P1 = percentage of answers reporting an improvement, P2 = percentage of answers reporting no change, P3 = percentage of answers reporting a deterioration. (hcn)