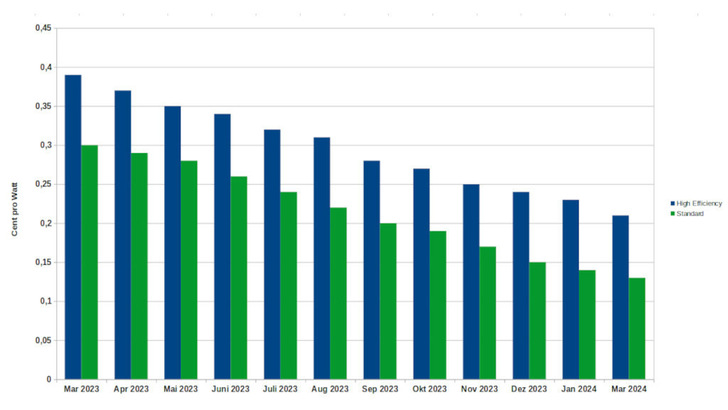

As in recent months, prices for solar modules on the market are continuing to fall. Standard modules are now being traded for an average of 13 cents per watt. This is one cent less than in January of this year. Compared to the same period last year, this is a drop of seven per cent. That may not sound like much, but for a 100-kilowatt solar project it adds up to 7,000 euros. For a solar park with an output of one megawatt, where such modules are usually used, this means a cost saving of 70,000 euros.

See also: The drop in prices is causing the industry in Europe problems

Prices for modules with a higher efficiency of at least 22 per cent and modern cell technologies have fallen even more sharply. Their costs have fallen by two cents per watt compared to January of this year. Compared to March 2023, they actually cost 18 cents per watt less. This is because these modules are currently trading at an average of 21 cents per watt.

Many standard modules still in stock

Martin Schachinger, Managing Director of the online marketplace for solar components PV Xchange, did not expect this development. He had assumed that module prices would largely stabilise. "The further fall in prices for standard modules can perhaps be explained by the continued high stock levels in the PERC module segment, which still exist due to the not yet exhausted demand at the beginning of the year and urgently need to be reduced," explains Martin Schachinger. "However, in the 'High Efficiency' class, which mainly includes products with Topcon, HJT or IBC cells, a further fall in prices cannot be argued with this."

Efficient modules are becoming scarcer

This is because imports of these modules were severely restricted in January and February of this year. "No more products should enter the European market without a binding prior order," says Schachinger. "There are no high-efficiency modules available at short notice, at least from the better-known manufacturers themselves - new deliveries are stretching well into April and May, and in some cases actually into June."

Are wholesalers also adjusting prices?

He therefore assumes that wholesalers are now also tightening the price screw because they have miscalculated. They have ordered excessive quantities that cannot currently be sold due to the restrained demand. "The modules of well-known brands with outputs from 425 watts upwards that are constantly arriving are currently landing on the market at prices that can barely cover the production costs, let alone include an adequate trade margin," says Schachinger.

Also interesting: Fraunhofer ISE provides module manufacturers with modern laboratories

"At a wholesale price of between eleven and 14 eurocents per watt, nothing has been earned, as any reputable manufacturer, even from China, will confirm. This makes it all the more difficult to understand the strategy behind such predatory prices - is it pure necessity or is the aim here to damage and suppress competition?" asks the PV-Xchange boss. (su/mfo)