The three projects – Gaskinstown (94.7 MWp), Rathnaskilloge (107.7 MWp) and Clonin North (69.4 MWp) – were developed under the Highfield Solar joint venture, in which ib vogt is a partner. Two of the plants reached commercial operation in 2025 and have now been transferred to international institutional investors, while the third is due online in mid-2026, with a sale expected after commissioning.

Ronan Power: “The outlook for Irish solar is very positive”

All three secured 15-year capacity contracts under Ireland’s Renewable Electricity Support Scheme (RESS 2), providing long-term income certainty in a market that has shifted from subsidy-driven schemes to competitive auctions. Taken together, the portfolio is expected to generate roughly 275 GWh of electricity per year.

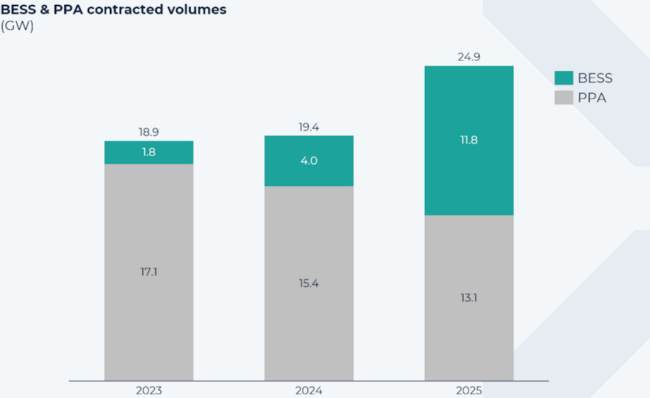

From an investor standpoint, the transaction highlights several trends shaping European solar. Operating and near-operating assets with contracted revenues remain liquid even amid higher interest rates and a more conservative investment environment. Alongside, developers that manage the full lifecycle – from early-stage development and approvals to build-out and operations – also remain well positioned to achieve higher prices at exit.

Ireland explores community solar with INNO-TREC pilot

Ireland has emerged as a case study. With a 2030 target of 80 percent renewable electricity, Ireland has leaned on auction-backed solar and wind to displace gas-fired generation. RESS-backed contracts and a relatively concentrated pipeline have produced bankable portfolios attractive to pension funds and infrastructure investors seeking long-term, inflation-linked returns.

For investors, the focus is less on volume than on asset quality and structure. Projects combining secured revenues, grid certainty and reliable delivery continue to attract buyers in competitive auction environments. (TF)