Record renewable energy deployment collided with structural headwinds in 2025, significantly changing power price formation, according to Pexapark’s latest annual report. These dynamics enabled utilities and commodity traders to expand their market share and pushed independent power producers to double down on battery energy storage systems. As renewables accounted for nearly half of EU electricity generation in 2025, structural volatility and price cannibalisation shifted from transitional risks to persistent, systemic market realities.

PPA price gap stifles renewable project deals

“2025 marked the moment renewables became the dominant technology block in Europe, but that success brings complex new headwinds,” said Luca Pedretti, COO and Co-Founder at Pexapark. “We are seeing a ‘Big Repricing’ where the focus is no longer just on capacity build-out, but on managing structurally higher volatility. The winning model is shifting from asset-centric to revenue-centric.”

Utilities with stronger position

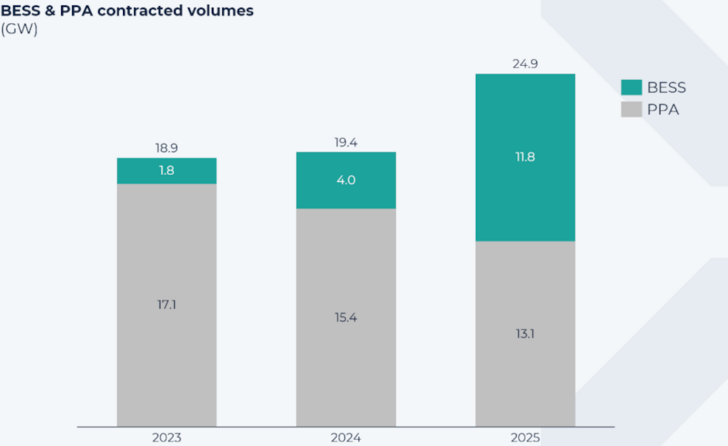

In a record-breaking year for flexibility in Europe, nearly 12 GW and 23 GWh of battery energy storage system capacity was contracted under flexibility purchase agreements and optimisation deals in 2025, tripling the volume seen in 2024. Flexibility purchase agreements have become the backbone of BESS bankability, unlocking capital and driving rapid scale-up beyond Great Britain into Germany, Italy, and the Netherlands.

Why trading – not ancillaries – is crucial for BESS profitability

In contrast, traditional European PPA momentum slowed in 2025 as the market adjusted to lower capture expectations. Total disclosed contracted PPA capacity fell to 13.1 GW across 247 deals, down from 15.3 GW in 2024. Amidst these cooler PPA market conditions, utilities firmly repositioned themselves at the centre of power markets, drawing on their diversified portfolios to intermediate volatility. Utilities increased PPA offtake volumes by more than 200 percent year on year and accounted for 77 percent of contracted FPA volumes in Europe in 2025, leveraging portfolio scale, strong balance sheets and flexibility assets.

Meanwhile, the traditional ‘invest-and-forget’ model for independent power producers is being redefined amid tighter market conditions. Value creation is no longer anchored solely in asset ownership, pushing IPPs further downstream towards revenue management, structuring and portfolio optimisation. At the same time, corporate buyers are dividing into two groups: a small cohort of advanced players—particularly big tech—moving towards firm power and utility-style strategies, while much of the wider corporate market grapples with complexity and, in some cases, holds back on procurement.

Spain largest PPA market

Despite the overall slowdown in European PPA activity, Spain maintained its position as the continent’s largest PPA market with 3.9 GW contracted, followed by Italy at 1.8 GW and Poland at 1.5 GW. In contrast, Germany saw the sharpest year-on-year decline among major markets, as severe solar cannibalisation and a widening gap between buyer and seller expectations effectively eliminated the transactable price range.

EU battery storage up 45 percent to 27.1 GWh in 2025

Iberdrola once again secured the top seller position globally, contracting 1,088 MW across 13 deals, while Amazon remained the leading corporate buyer with 711 MW closed across five deals. “As volatility becomes the dominant market force, flexibility is becoming the real source of value. Storage, optimisation and portfolio-level strategies are no longer just ways to improve returns – they are essential to remaining bankable and competitive in today’s power markets,” Pedretti said. (hcn)