When European Commissioner Dan Jørgensen unveiled the long-awaited European Grids Package and Energy Highways initiative in late December, he likened Europe’s current energy planning to “trying to piece together a puzzle without looking at the box.” The fragmented, bottom-up approach, where national strategies are developed in isolation and only later aligned, no longer matches the pace of electrification sweeping across the continent. The Commissioner’s message was clear: if Europe wants a clean, competitive and resilient energy system, it must become more connected, more intelligent and far better at tapping into the flexibility available in millions of homes.

Breaking grid barriers – how solar empowers business growth

Residential battery storage is at the heart of turning this vision into reality. While Europe is still working toward a unified infrastructure strategy, one country already offers a glimpse of the market’s next direction. Germany, Europe’s largest residential battery storage market, has become an early indicator of the continent’s coming transformation.

Germany as an early indicator

Germany’s leadership is not just about scale. By mid-2025, the country is expected to surpass two million installed home storage systems, according to SolarPower Europe’s European Market Outlook for Battery Storage 2025–2029. Even in 2024, despite falling wholesale energy prices and a slowdown in PV growth, Germany recorded one of the highest coupling rates in Europe, with nearly four out of five new PV systems installed alongside a battery.

What makes Germany particularly compelling is how consumer behaviour shifts in response to changing external drivers. Following the remarkable boom from 2021 to 2023, fuelled by high energy prices and uncertainty, the market began to cool. Rather than indicating saturation, this cooling has revealed a more nuanced and mature consumer landscape. The focus is shifting from pure PV self-consumption towards flexibility, financial optimisation and urban accessibility.

Consumers rethink the value of batteries

A recent survey by Appinio and Rabot Energy highlights this transition. Although only 14 percent of German respondents currently own a home battery, nearly three-quarters believe storage can meaningfully reduce electricity costs, and over half say they would consider purchasing a system within a year if it offered clear financial savings. Interest is high, but conditional. Consumers are moving beyond the early-adopter mindset and now base their decisions on transparent pricing, convenience, and the ability to benefit from dynamic electricity tariffs. These expectations are already influencing business models and product strategies, with impacts likely to extend beyond Germany.

A European shift beyond PV-coupled storage

This trend is becoming increasingly apparent across Europe. SolarPower Europe’s outlook suggests that the next wave of growth in the residential sector will come from households without a rooftop PV system. Italy, historically the second-strongest storage market, has already seen its PV coupling rate fall from 89 percent to 76 percent. In the UK, only about half of new residential systems are paired with PV, driven by the rapid adoption of dynamic tariffs and robust retail competition. Austria and Sweden are following similar paths. These shifts do not signal weakening demand; rather, they mark a broader evolution from “self-consumption optimisation” to more active participation in a flexible energy system.

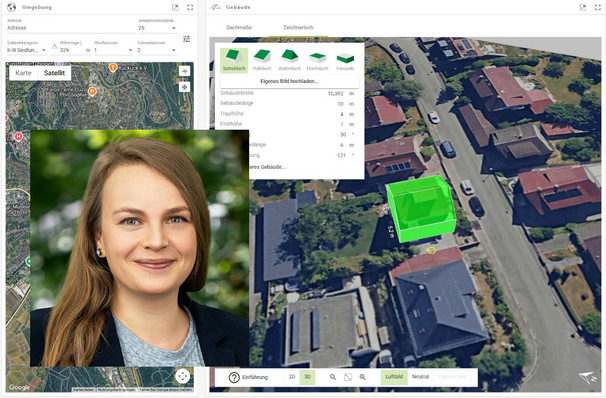

According to PV Europe’s coverage of SolarPower Europe’s 2025 Flexibility Strategy Day, the industry now sees flexibility, combining storage, demand response and grid innovation, as essential to integrating 50 percent more electricity demand by 2030. Germany stands at the forefront of this shift, showing how consumer behaviour changes as access to dynamic pricing expands, automated control becomes more user-friendly, and batteries are seen not just as backup devices but as everyday tools for cost-effective energy management. The growing interest among German tenants, who make up nearly half of all survey respondents, signals the potential to reach entirely new consumer segments. Storage is no longer just for detached houses with sunny rooftops; it is increasingly appearing in urban settings, modular solutions and rental properties. This expansion is exactly the kind of bottom-up flexibility that Europe’s grid planners need to unlock.

Information gaps remain a key barrier

Despite this momentum, Germany also highlights the challenges facing Europe as a whole. Many consumers still feel poorly informed about how storage works, its costs, and how it integrates with dynamic electricity tariffs. Concerns about long-term efficiency, installation complexity, and reliability continue to hold back widespread adoption. These uncertainties mirror the barriers identified by SolarPower Europe at the EU level: the storage market is held back less by technological readiness and more by gaps in understanding, transparency, and standardisation. Overcoming these obstacles will require clearer regulatory frameworks, credible and accessible consumer information, and a market design that rewards the flexibility households can deliver.

NL – Schoonschip floats new approach to virtual power plants

Another crucial lesson from Germany relates to intelligent control. Many existing systems remain underutilised because they are optimised only for PV self-consumption. Yet the value of storage increases significantly when systems can respond to real-time price signals, grid conditions and renewable generation patterns. As the Grids Package emphasises, Europe’s climate and competitiveness targets depend on unlocking the distributed flexibility currently hidden in millions of homes. Storage, when paired with automation and dynamic pricing, offers a scalable and cost-effective path to achieving this. Germany’s experience shows that once regulatory and digital foundations are in place, consumer participation will follow.

Infrastructure alone is not enough

The European Grids Package aims to enable Europe to connect and integrate energy flows at unprecedented speed. However, infrastructure investment on its own will not drive the transformation needed. The continent must complement its focus on large industrial consumers with a bottom-up approach that empowers households to take an active role in the energy system, supported by neo utilities delivering smart energy solutions. Germany’s market evolution shows that this shift is already underway. Residential storage is becoming smaller, smarter, more modular, and more accessible. It is moving from rural to urban areas, from homeowners to renters, and from self-consumption devices to flexible assets supporting the grid.

If Europe is to build an energy system that is clean, resilient and economically competitive, it must learn from these developments. Promoting dynamic tariffs, accelerating smart meter rollouts, simplifying installation standards and communicating clearly with consumers are not optional. They are prerequisites for a flexible, functioning European grid. Germany is not alone in this transition, but it is among the first where the outlines of the future are already visible.

Utrecht leads in V2G car-sharing with solar integration

Ultimately, the energy transition will be shaped not just by transmission corridors and cross-border interconnectors, but by decisions made in living rooms, stairwells, basements and flats across Europe. Residential storage is no longer a niche technology. It is fast becoming a cornerstone of Europe’s flexible energy future, and Germany is offering a glimpse of what that future could look like. (Jan Rabe/hcn)