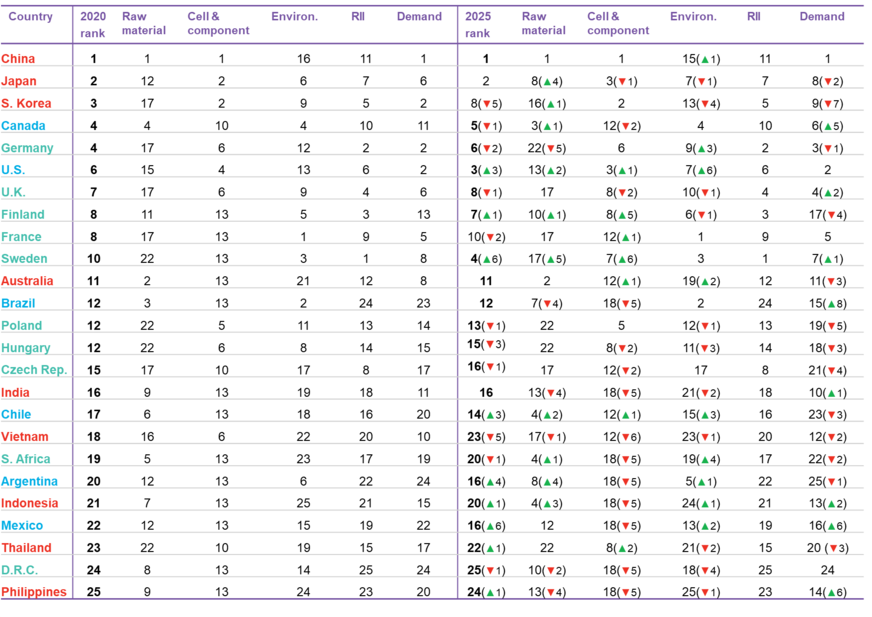

China dominates BloombergNEF’s (BNEF) lithium-ion battery supply chain ranking in 2020, having quickly surpassed Japan and Korea that were leaders for the majority of the previous decade. China’s success results from its large domestic battery demand, 72GWh, and control of 80% of the world’s raw material refining, 77% of the world’s cell capacity and 60% of the world’s component manufacturing, according to data from BNEF.

Higher environmental regulations in Japan and Korea compared to China

In 2020, Japan and Korea rank number two and three respectively. While both countries are leaders in battery and components manufacturing, they do not have the same influence in raw materials refining and mining as China. What they lack in the control of the raw materials supply chain, they make-up for in higher environmental and RII (regulations, innovation & infrastructure) scores compared to China.

Europe faster than the U.S. to capture more of the raw material value chain

James Frith, BNEF’s head of energy storage, said: “China’s dominance of the industry is to be expected given its huge investments and the policies the country has implemented over the past decade. Chinese manufacturers, like CATL, have come from nothing to being world-leading in less than 10 years. The next decade will be particularly interesting as Europe and the U.S. try to create their own battery champions to challenge Asian incumbents who are already building capacity in both places. While Europe is launching initiatives to capture more of the raw material value chain, the U.S. is slower to react on this.”

Supply ranking with 5 key themes

BNEF’s lithium-ion battery supply chain ranking provides a snapshot of a country’s position in 2020 and where it will place in 2025, based on its current development trajectory. The work ranks countries across five key themes related to the supply chain: raw materials, cell & component manufacturing, environment, RII and end demand (across electric vehicles and stationary storage). The five key themes were given equal weightings in the overall ranking.

Growing EV demand as driver

As EV demand grows there is an increasing need for cell manufacturing facilities close to automotive production. This has led to a boom in European cell plants, and the rest of the supply chain is also slowly making its way to Europe. The growing industry within the region and Europe’s strong environmental credentials helped five European countries place in the top ten ranking for 2020.

BNEF’s 2025 rankings are based on a country’s current trajectory, but if a country enacts targeted policy and regulations there is ample time to improve their position. The U.S. languishes in sixth place in 2020 but the upcoming presidential election could change things. If the U.S. were to increase its investment in raw materials and promote EV adoption, it could overtake Japan and China to be number one in 2025. In contrast, the U.K. could see its position in the rankings fall in 2025 if it becomes unable to access the large demand in continental Europe, which, at 152GWh, will be around five times the size of its domestic market.

Availability of cheap but clean energy

Sophie Lu, head of metals and mining at BloombergNEF, added: “A key concern of many raw materials producing countries is how to leverage resource wealth into more value-add, and attract further downstream investments, like battery manufacturing. Key distinguishing factors are the environmental footprint of industry, the availability of cheap but clean electricity, a technically skilled labor force, and incentives driving battery demand. These factors may be more important than a monopoly on one specific critical metal.”

Bloomberg NEF

Sustainability and carbon footprint of growing importance

Sustainability and carbon emissions associated with the supply chain are of growing importance. Making sure that the electricity used in material processing and cell manufacturing is low-carbon is vital. France performed best in the environmental category, helped by its electricity grids low carbon emissions factor, at 28gCO2/kWh in 2019. The introduction of carbon border taxes as proposed by the European Commission and Joe Biden, the U.S. Democratic presidential candidate, could give regions or countries leverage to secure localized supply chains.

Crucial material refining

Kwasi Ampofo, BNEF’s lead analyst covering battery raw materials, said: “Access to raw materials, talent and infrastructure are vital in attracting investment into the value chain. In addition to making significant investments into mining of critical minerals all around the world, China is also the dominant player in materials refining. This has given it the advantage over Japan and Korea. Other countries seeking to be dominant players in the overall value chain may need to support upstream metals mining and refining development, while also formulating policies that will safeguard the environment.” (hcn)