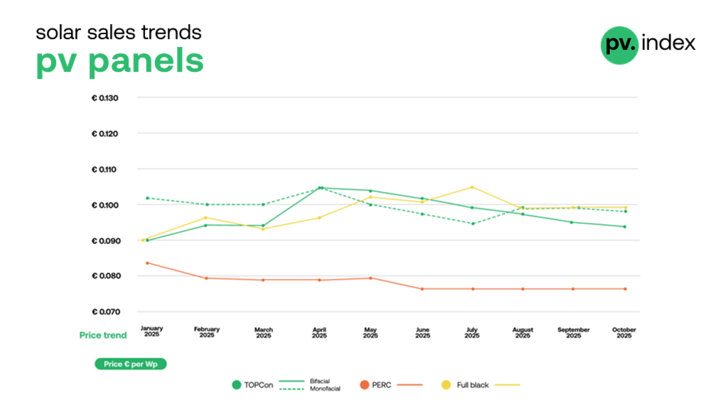

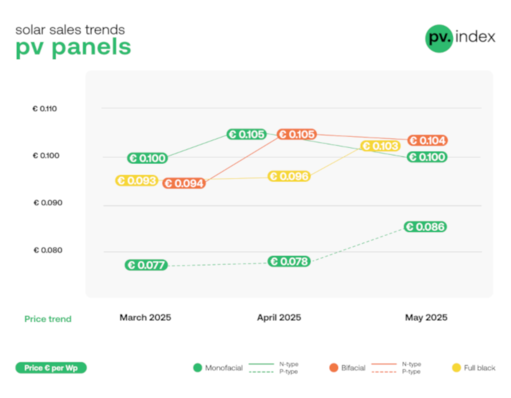

Over recent months, solar module prices across all major technologies have remained largely steady, with only minor downward adjustments in select categories. October data confirm the market has now settled into a stable pattern, underpinned by balanced supply conditions and steady purchasing activity from installers.

TOPCon modules continued a modest downward adjustment:

● Bifacial: €0.094/Wp, down 2 percent month on month

● Monofacial: €0.098/Wp, down 1 percent

PERC modules remained unchanged at €0.077/Wp, marking the fourth consecutive month of stability. Full Black modules also held steady for a third straight month at €0.099/Wp, buoyed by strong residential demand and their aesthetic appeal.

This stabilisation reflects a healthy balance between supply and demand. Channel inventories are now more closely aligned with installation activity, and distributors report smoother turnover with fewer aggressive discounts.

Changing of the guard: Jinko leads, JA Solar ascends

Jinko’s return to the top confirms its renewed supply strength and pricing competitiveness, while JA Solar’s move into second place underscores its growing momentum in European markets. LONGi, once dominant, now faces stronger competition from brands adopting flexible distribution and aggressive pricing strategies.

Top 5 solar panel brands - October 2025

1. Jinko Solar

2. JA Solar

3. LONGi

4. Trina

5. Canadian Solar

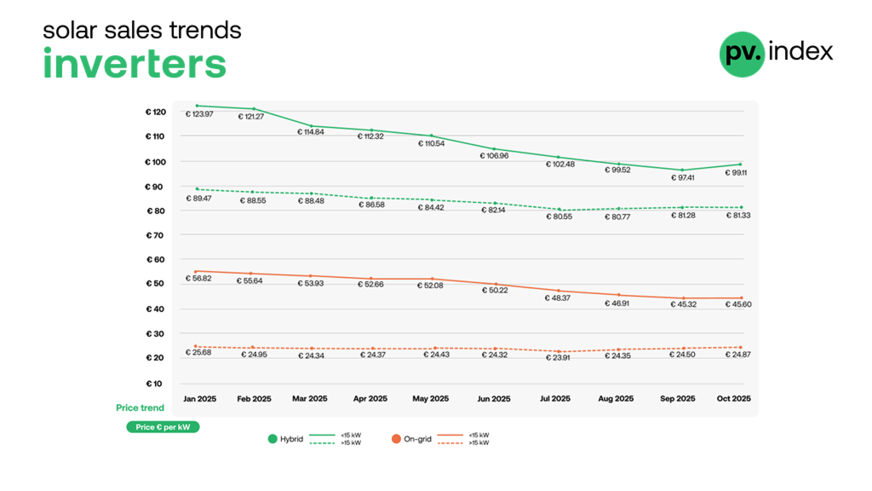

Inverter market: first positive movement in months

For the first time since spring, inverter prices saw a modest uptick, suggesting the price adjustment phase may have run its course. Stable component supply and stronger autumn demand contributed to a more balanced pricing environment across both hybrid and string segments.

sun.store

Hybrid inverters

○ Less than 15 kW: up 2 percent to €99.11/kW, marking the first increase since April. This rise was driven by steady residential demand and seasonal restocking as installers prepare for winter installations.

○ More than 15 kW: unchanged at €81.33/kW, reflecting ongoing stability in the commercial segment, where larger projects benefit from long-term procurement contracts and a steady project pipeline.

String inverters

○ Less than 15 kW: up 1 percent to €45.60/kW, ending a months-long decline. This uptick suggests the segment has reached its price floor as inventories normalise and distributors ease discounting pressure.

○ More than 15 kW: up 2 percent to €24.87/kW, supported by stronger commercial project activity and a modest demand recovery in southern Europe, where delayed summer installations are now being completed.

Overall, the inverter segment appears to have stabilised ahead of winter, with balanced stock levels and renewed buyer confidence following an extended correction phase.

After several months of gradual price normalisation, the inverter segment saw renewed activity in October, along with subtle but notable shifts in brand rankings. Both hybrid and string categories reflect a market that is stabilising, yet remains highly competitive at the top.

China’s solar rebate rollback signals squeeze on margins

Hybrid inverters: Deye back in first place

After a brief drop to second place in September, Deye has regained the No. 1 spot in the hybrid inverter ranking. The brand’s strong European distribution channels and attractive price-performance ratio helped it build momentum heading into Q4. Huawei moves to second, maintaining close competition with its expanding hybrid portfolio and strong demand from premium residential installers. GoodWe holds steady in third, supported by consistent supply and reliability in mid-range projects. Fronius and Sungrow round out the Top 5 with stable performance and broad market coverage.

Top 5 hybrid inverter brands: October 2025

1. Deye

2. Huawei

3. GoodWe

4. Fronius

5. Sungrow

String inverters: Huawei leads, Fronius climbs to fourth

In the string inverter category, Huawei has maintained its unbroken lead, holding the top spot throughout 2025 and further widening its advantage over competitors. The real movement took place just below: Sungrow and SMA traded places in second and third, continuing their close rivalry across key European markets. The main change this month occurred further down the list, as Fronius advanced to fourth place, overtaking SolarEdge, now in fifth. This shift reflects improved availability and stronger channel activity for Fronius in Central Europe, where installers increasingly value local support and reliable service.

Top 5 string inverter brands: October 2025

1. Huawei

2. Sungrow

3. SMA

4. Fronius

5. SolarEdge

October’s ranking updates show that while Huawei’s dominance remains uncontested, other manufacturers are actively repositioning in a now-stable market. The renewed rise of Deye and Fronius highlights a broader shift toward reliability, regional support, and channel consistency as key differentiators heading into 2026.

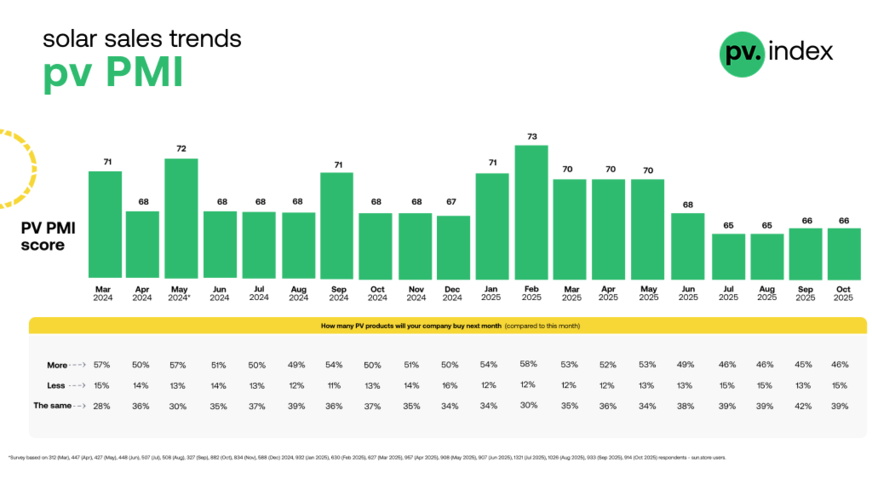

PV PMI sentiment remains stable

The pv.index PMI held steady at 66 points in October, unchanged from September.

Survey data from 914 sun.store users show:

● 46% expect to buy more PV products next month

● 15% expect to buy less

● 39% expect no change

sun.store

This stability indicates that distributors are maintaining a cautious but steady purchasing rhythm as the installation season winds down. Market participants are placing greater emphasis on predictability and stock optimisation rather than speculative buying.

PV systems under pressure from increasing cyber risks

Expert commentary

“October confirms that the European PV market has reached equilibrium. Module prices have flattened across technologies, and inverter pricing has finally stabilised after months of decline,” says Filip Kierzkowski, Head of Partnerships & Trading at sun.store.

“What we’re seeing now is not a downturn, but normalisation. The market has adapted to post-correction dynamics with a stable PMI, generally balanced inventories, and growing confidence heading into the winter months. However, for some manufacturers we are observing a noticeable increase in shipments to Europe, which could once again lead to temporary stock accumulation and intensified clearance activity – a scenario similar to what we saw late last year.”

Summary

October’s pv.index reflects a steady and balanced market.

● Prices: mostly flat or slightly up across categories

● Sentiment: stable PMI at 66 points

● Rankings: Jinko back on top, Huawei and Deye maintain leadership

As 2025 draws to a close, the European PV market appears firmly grounded. Following a year marked by adjustment and recalibration, the sector is now poised for a more predictable and sustainable start to 2026.

Stay informed – subscribe to our free newsletters

About – pv.index & PV PMI

pv.index tracks monthly trading prices for solar components on sun.store, Europe’s largest B2B marketplace for PV equipment. Our pricing data is weighted by transaction power to provide an accurate reflection of the market. Brand rankings are based on total sales value on sun.store between January and October 2025, highlighting the most in-demand brands in each category. We update these rankings monthly to capture current buyer preferences and market conditions. The PV PMI gauges purchasing sentiment among verified sun.store users. It is calculated as follows: PMI = (P1 × 1) + (P2 × 0.5) + (P3 × 0), where P1 is the percentage expecting improvement, P2 the percentage expecting no change, and P3 the percentage expecting decline. A score above 50 signals a positive market outlook. (hcn)