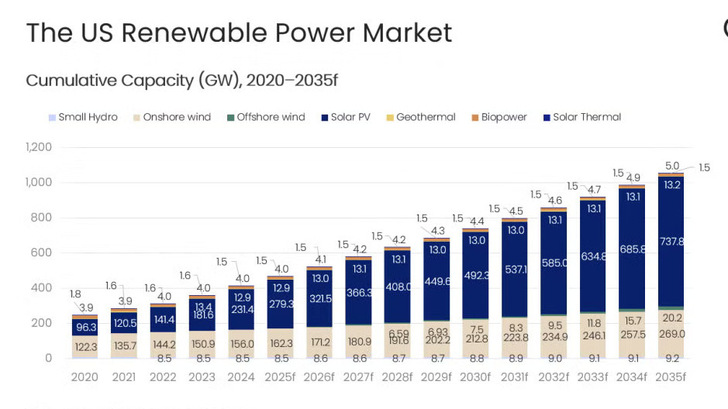

Solar is set to be the main engine of US renewable growth over the coming decade, according to a new forecast from data and analytics firm GlobalData. The report projects that solar capacity will triple from 231.4 GW to around 737.8 GW by the mid-2030s, driven by state procurement mandates, incentives for distributed generation and strong corporate power purchase activity in key markets including Texas, California and the Midwest. Onshore wind is also set to expand, though at a slower pace, rising from 156 GW to nearly 269 GW over the same period.

Record US solar quarter as investment turns towards Europe

Offshore wind diverges sharply from this growth trajectory.. Federal interventions disrupted the project pipeline throughout 2025: construction at Empire Wind 1 off New York was halted in April despite all permits having been secured. Elsewhere, Revolution Wind off Rhode Island faced a similar suspension in August before courts allowed work to resume, while nearly $680 million in federal port infrastructure funding was cancelled in the same month. By December, the Trump administration had placed five major Atlantic coast projects on hold, citing national security concerns.

“The US power sector continues to attract large-scale investment in renewables, supported primarily by state clean energy mandates, long-term utility procurement, and sustained corporate PPAs,” said Mohammed Ziauddin, power analyst at GlobalData. Investment in renewables is expected to total around $442 billion between 2025 and 2030.

Tariff headwinds and transatlantic parallels

Trade measures enacted in 2025 have added uncertainty, especially for supply chains reliant on imported modules, batteries and critical materials. Higher costs have stretched project timelines and triggered delays or cancellations, even as demand for new capacity remains robust.

US posits tariffs of over 3,500% on solar modules

Similar tensions are shaping European energy policy. Germany’s Solar Package I prioritises faster permitting and support for rooftop and community installations, while the EU’s Net-Zero Industry Act aims to rebuild domestic manufacturing. Both sides of the Atlantic are grappling with how to balance deployment speed against supply chain security.

Thermal generation is evolving in parallel. Coal and oil-fired plants continue to retire, while natural gas is projected to edge up from 573 GW to around 621 GW by 2035. Nuclear is expected to grow marginally, from 97 GW to about 102 GW, supported by life extensions and advanced reactor development.

EU Grids Package to spur investment and ease permitting

“Despite policy shifts and tariff-related cost pressures, renewable energy remains the primary driver of US capacity growth through 2035,” said Ziauddin. “Solar and wind continue to expand at scale, supported by state policies and private sector demand, while gas and nuclear investments address capacity adequacy and longer-term system needs.” (TF)