Last year’s figure of 2.48 GW was similar to 2010, when Italy’s solar market was the strongest in the world following the introduction of the transformative second feed in tariff (FIT).

Latest Italian data (from Gaudi portal of Terna) shows that the total number of built PV plants connected to the grid amounts to 1,221,045 of which 205,806 were built in 2022, bringing Italy’s cumulative installed power total to 25 GW.

Thanks to the Superbonus (the 110% deduction for the energy requalification of civil buildings, which also included pv systems and ESS with a view to improving the energy classification of buildings and therefore reducing CO2 emissions), residential plants up to 12kWp ahave expanded significantly; in 2022, 192,394 new installations of below 12 kWp were connected to the grid, equal to 1.10GW, or 44.5% of additional solar power last year. The continuation of the Superbonus in 2023 leads experts to estimate (Enea) that a further 500MW of residential solar arrays will be connected this year.

C&I market with a 28% share in 2022

The C&I market – which ranges from 20 kW to 1 MW system size – accounted for 28% of total new capacity last year, with around 678 MW, whereas utility-scale plants sized 1 MW and over contributed 23% , which was approximately 571 MW in capacity, across 112 new ground mount plants installed and connected.

The five most solar rich regions are Lombardy with 3.15 GW cumulative installed capacity (having installed 438 MW in 2022), followed by Puglia with 3.06 GW, Emilia Romagna with 2.51 GW, Veneto with 2.48 GW and Piedmont with 1.99 GW.

Looking to the south of Italy, Sicily is worth a mention. This is a region with solar irradiation that is 30% higher than the European average and which, thanks to two large ground-mounted plants, contributes a total of 1.74 GW to Italy’s solar footprint.

Other notable large (> 10 MW) utility scale plants have been connected in the regions of Basilicata, Lazio, Piedmont and Sardinia.

However, despite this encouraging progress, the climate objectives set by the PNIEC (Integrated National Energy and Climate Plan) for 2030 are still a long way off. To achieve them, a further 80 GW of new PV capacity needs to be connected to the Italian electricity grid within the next seven years, of which at least some 30% should be built on rooftops and/or industrial land, brownfield sites, or agricultural land.

What do we expect for 2023?

If last year the key market was residential, this year the most important growth rate will be represented by the C&I and utility market, while key trends to keep an eye out for include a better cost-benefit ratio and the advent of new, more high-performing technologies will lead the market to greater growth in an important way.

The minimum target in 2023 is at least 6 GW of new installations, but a more accurate estimate of expected capacity this year is closer to 3.5 GW. The gap between built and connected plants will be mainly caused by permitting on the one hand, and by scheduling on the other – managing connection and the adjustments of the network that will be digitalized, implemented and modernized will cause some headaches.

One positive news is the fact that the Ministry of Energy Security has given the go-ahead to 22 projects for adaptation and upgrading of smart grids, which will make it possible to absorb and manage a greater quantity of PV on the grid.

The market of Renewable Energy Communities

From a niche market with 35 operational CERs, 41 planned and 24 being set up, it is destined to evolve thanks to the incentives offered by the GSE, which provide for a tariff benefit for 20 years with a unit fee and a bonus, equal to 100 euro/MWh for collective self-consumption communities and 110 euro/MWh for energy communities for power plants up to 1 MW.

In this three-year period, approximately 20,000 potentially feasible renewable energy communities in Italy are estimated, with over 3.5 GW of new PV plant capacity, 1.3 GWh of installable storage capacity, and 5.5 GWh of grid losses avoided each year.

Energy communities are a valid alternative to self-consumption and the sale of excess energy with a contained increase in the investment cost.

This innovative sharing model will create an intelligent and interactive energy ecosystem made up mainly of SMEs and PAs who will become prosumers, therefore graduating from passive consumers to proactive energy producers.

In fact, the total revenues will not be limited to savings on bills and the sale of energy on the network, but will bring economic benefits with the sharing of excess energy with other members of the energy community.

The new agri-voltaic market

To help achieve Italy’s PV objectives in 2030, support will also come from the growing agri-voltaics market. Agri-voltaics is takes an innovative approach to land use, allowing the production of renewable energy on agricultural land, which in Italy is estimated at around 50-70 thousand hectares - equal to 0.4-0.6% of the usable agricultural area - and on disused quarries that can be converted into agri-voltaic parks.

The development of agri-voltaics will come with the implementing decree that will release the PNRR funds - equal to 1.1 billion euros - and which sets the goal of 1.04 GW of installed PV by 2026.

Q Cells

To date, there are 19 GW of Environmental Impact Assessment requests for agro-voltaic plants over 10 MW. Typically, construction costs for Agri-voltaics compared to traditional PV arrays are 25% higher in the case of a permanent crop system, and 60% higher for a system of arable crops . Consequently, the land rental market, with minimum contracts of 20-30 years, has risen between 2,500 and 4,000 euros per hectare per year.

Also interesting: Land of the Sun project in Italy

For these applications, bifacial double glass modules are recommended because they increase the overall production efficiency of the agri-voltaic system.In fact, they can produce an additional energy yield based on the reflectivity of the surface, generating 10% to 25% more energy from the rear compared to a monofacial module with ideal installation conditions.

The evolution of pv modules thanks to technological innovation

The solar industry has accelerated towards the TopCON N-Type and HJT era thanks to continued technological innovation - an indispensable driver for the development of the PV business, in addition to quality and cost.

Switching to these new technologies for the same surface area ensures better performance, greater power and a longer life for the modules, providing higher energy yields driven by greater efficiency and a lower temperature coefficient.

PERC P-type cells have approached their theoretical efficiency limit. Terefore, N-type cells, offering efficiencies above 25%, will gradually increase market shares this year. Qcells estimates that N-type-based solar modules will account for 20% market share in 2023, and for this rate to double in the coming years.

At the same time, HJT technology will grow, most particularly in the residential market, which offers a high conversion efficiency of over 26% and low degradation. However, for greater diffusion in the C&I and utility segments, HJT will have to overcome the challenge of reducing production costs due higher investment costs.

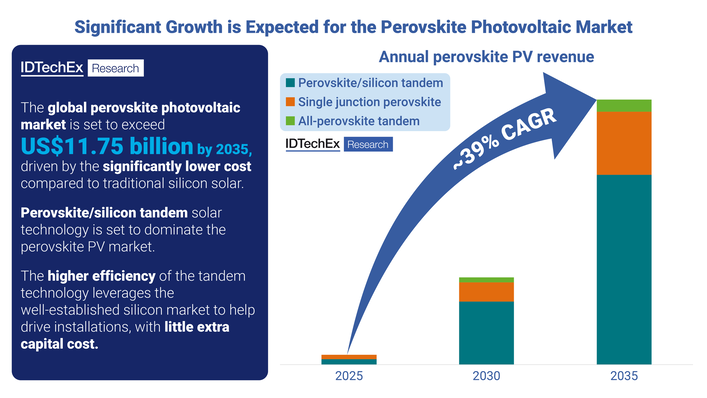

A further improvement in performance will be achieved with the tandem solar cells based on silicon and perovskite. To date they have arrived in the laboratory at a conversion rate of 32.5%, which will allow us to enter a new evolutionary phase of solar technology.

Reshoring the solar industry

The scenario for improving Europe’s PV manufacturing landscape is contingent upon greater government support and incentives. Stateside, the conditions underway in the US thanks to the recently introduced Inflation Reduction Act (IRA) have proven a catalyst for investment in domestic manufacturing – not least by Qcells and Hanwha Solutions, which have pledged a $2.5 billion investment to develop a complete and holistic manufacturing industry to the US, from ingot to module. The European Commission has belatedly begun making plans to support industry in Europe, and the landscape is likely to change cisgnificantly this decade. The road is not easy; indeed, it is very challenging: Italy too will have a key role in reducing its dependence on China which, since 2011, has invested more than 50 billion dollars in its solar industry, which is essentially ten times more than Europe during the same timeframe.

This has led to an almost absolute monopoly, bringing China's market share to exceed 80% in all stages of module production (polysilicon, ingots, wafers, cells and modules).

Italy's commitment will be to contribute within two years to a completely European supply chain and a Carbon Foot Print estimated at one third of that of components made in East Asia, but the role of future European industrial policies in support of PV will be fundamental if we want to increase the attractiveness of solar production in Europe.

The storage systems market

The development of the residential PV market thanks to the Superbonus led in 2022 to a significant growth in the proliferation of storage systems (ESS), of which 93% were sized less than 20 kWh and almost all batteries are combined with domestic PV systems.

As at 30 September 2022, some 159,724 storage systems were installed, for a total power of 949 MW and a maximum capacity of 1,816 MWh. A total of close to 200,000 storage systems are expected pending the definitive figure.

Did you miss that? Over 1 million European homes solar battery-powered

The market for large-scale storage systems (BESS), on the other hand, is still in the doldrums even if some should have entered into operation last quarter. The big challenge will be the right balance between price and technology offered as well as a regulatory framework that will allow moderate diffusion in the long term.

The development of charging infrastructure

The development of PV will also help the growth of the e-Mobility market this year, with an ever-increasing network of EV chargers with power capacities from 7 to 22kW and up to 350kW for ultra-fast charging at service stations.

The Ministry of the Environment and Energy Security (MASE) aims to build over 21,000 charging stations for electric vehicles - at least 7,500 super-fast charging infrastructures on extra-urban roads, excluding motorways, and 13,755 fast charging infrastructures in cities - to be made operational by the end of 2025.

Technological development will allow easier installation and maintenance, remote diagnostics, connectivity, modularity and integration with PV and ESS. (Alberto Nadai/hcn)

Did you miss that? Enel Green Power built 5,2 GW renewable capacity in 2022