According to a recent report from international energy analysts drawing on official data and third-party research, including Carbon Brief’s assessment of China’s 2025 economic performance, China’s clean energy industries have become a central investment driver. Renewables, batteries and related technologies account for more than 90 percent of net investment growth and contribute over one third of overall economic growth.

Sector growth outpaces job creation in global renewables

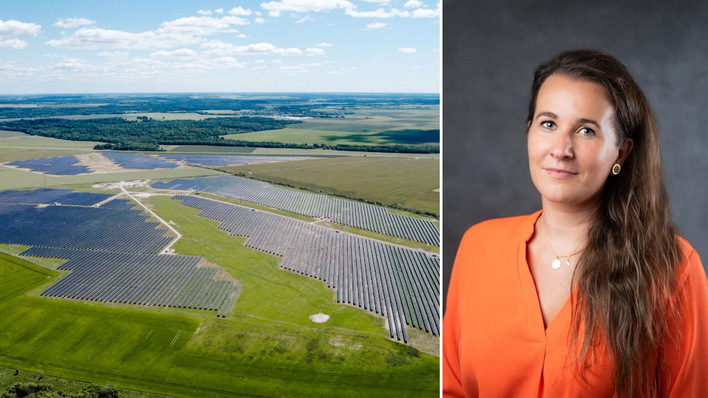

This surge is reflected in deployment figures. China now operates well over 1 TW of installed solar PV capacity, with annual additions measured in the hundreds of gigawatts, and continues to expand utility-scale battery storage at a rapid pace. Battery installations and manufacturing capacity are growing in parallel, with storage increasingly deployed alongside new solar projects to manage grid constraints and variability.

This has clear implications for global solar and storage markets. China remains the world’s largest PV market and the dominant source of modules, while domestic project development is increasingly combining solar with storage to address system flexibility. The scale of deployment, spanning hundreds of gigawatt-hours of new storage capacity, is shaping global expectations around project design, pricing and investment returns.

EU warned over shortfall in renewable energy raw materials

Manufacturing scale, policy support and electrification-driven demand continue to underpin investment growth, with solar anchoring new capacity additions and storage moving into a core role. For global solar and storage markets, the implications centre on scale and timing, as China’s investment trajectory remains a key reference point for availability, pricing and competition. (TF)