Following a successful pilot tender, the second official METÁR tender was launched on 15 of October 2020. On 11th February 2021, the list of the awarded projects was published on HEA’s website. Bids could be submitted in two categories: first, small PVPP producers between 0.3 MW and 1 MW, large between 1 and 49.99 MW, also referred to as large PVPP.

Fixed and tracking PV projects dominating the auctions

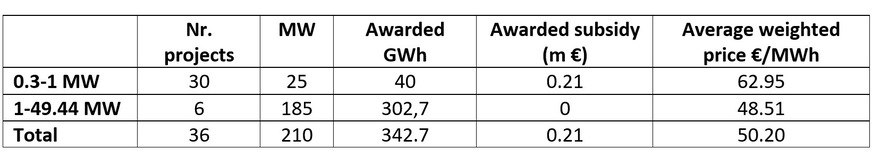

On the overall 257 projects were validly submitted, out of which 36 projects were awarded, 189 were valid but not awarded. Only 12 % of the submitted projects were disqualified for grounds of invalidity. This tender is technology-neutral however one geothermal project applied for 10MW installed capacity for 70GWh/year and one deposit gas with 0.5MW for 3.5 GWh/ year. With the above two exceptions, only fixed and tracking solar technology projects participated at the auction.

Out of the 225 valid projects, 107 for the small category 118 GWh/y capacity, 3-times oversubscribed the available 40 GWh. The other 118 projects are in the large category, 1842 GWh/year, 5.3-times oversubscribed the 350GWh annual capacity.

Ferenc Kis

Prices are contracted in Hungarian Forint, but for simplicity, prices are converted to EUR at 355 HUF/EUR rate. Compared to the KÁT feed-in tariff for 2020, i.e 0.1057 €/KWh, the second tender awarded bids were significantly lower, varying from 0.04557 €/KWh to 0.05062 €/KWh in the bigger category and from 0.05915 €/KWh to 0.06487 €/KWh in the smaller category. This difference is not only significant in comparison with the KÁT feed-in tariffs, but also compared to last years’ pilot tender winner bids, i.e € 0.0569 to € 0.06408 for bigger scale projects and € 0.5972 to € 0.07307 for smaller scale projects per kWh. The average bid in the small category was 0.06296 €/KWh, while it was 0.04851 €/KWh in the large category.

Capacity limit increased from 20 MW to 50 MW

The size of each category has also changed since last years’ pilot tender, where the total capacity to be granted was 66 GWh and 134 GWh, whereas in the second tender the smaller category slightly decreased to 40 GWh and the large category grew significantly to 350 GWh, meaning that larger scale investments were prioritized. Within these thresholds, in the category up to 1 MW 30 projects could be awarded, while in the category up to 50 MW six were awarded. While the maximum amount of capacity to be subsidized per applicant was 15 GWh/year in both categories of the first tender, such amount increased to 50 GWh/year and 175 GWh/year in the case of each category in the second round of the tender.

Did you miss that? Hungary trials auctions for up to 5 GW of PV

“As the capacity limit was increased from 20 MW to 50 MW, bigger scale projects had a favourable effect on foreign investor’s appetite. In this regard, half of the projects awarded in the large category were submitted by individual foreign investors or in the form of a joint venture in cooperation with one of the key players of the local market,” commented the results Kinga Máté, energy expert.

New rules for the screening of foreign investments

She also added: „As a parallel phenomenon to the second auction, numerous transactions are taking place between the local developers of the projects awarded in the earlier tender and international investors. However, due to the COVID-19 pandemic, Hungary has introduced new rules for the screening of foreign investments, including energy related strategic transactions.

Did you miss that? 43 MW solar park grid connected

The aforementioned regime creates an obligation to preliminary notify the competent minister for the approval of such transactions concluded until 30 June 2021, claiming that those have critical impact on national interests. Additionally, any acquisition of influence in a PVPP reaching the thresholds set by law, whether directly or indirectly, is subject to HEA’s acknowledgement, the absence of which may bring about a fine amounting up to 1% of the revenue or HUF 100 Mio.”

Ferenc Kis

In the first two METÁR calls for proposals, the support period was reduced to 15 years compared to the 20-25-year support period of KÁT. In addition to that, producers in the KÁT scheme have previously been exempted from bearing the so-called balancing costs. In contrast, the winners of the present METÁR auction will bear 100% of balancing cost as from the commercial operations date. Balancing costs averaged 0.0084 €/KWh in 2019, but it is prone to change due to many technical, natural gas market-driven, weather forecasting and legal factors.

Priority of brown field projects

It also worth mentioning the relevance of the brownfield areas: in case of the same prices offered, the brown field projects have priority. This criterion was claimed in 32 cases at the first auction, out of which 7 cases not documented properly, 18 cases winner, 7 cases not a winner bid (and by one exception 6 were in the Large PVPP category). The second round showed that 30 valid bids claimed that the project will be implemented on brownfield sites, 20 in the large category (none of them among the winners) and 10 in the small category (4 of them awarded contracts).

Notably out of the 30 brownfield projects, only one 7.5 MW plant choose tracking system all the others planned fixed structures. Even more, on 19th February 2021, the vice-president of HEA emphasized the importance of the brownfield areas for solar PV developments at an online event, and urged for more incentives for this segment.

Legal framework hinders market-based renewable production

„In the large category, out of the 6 winner projects, 4 were choosing tracking systems, whereas in the small category half of the projects. When we look at the lowest price offered in the large category in 2019, we will see, that 32 projects offered lower price than that and not on the winner’s list, with an accumulated 335 MW capacity. Although, at this tender early-stage projects could submit their bids, the heavily oversubscribed tender shows the solid solar market in Hungary.

The case of the decreasing subsidies is signalling the potential boom of PPA contracts, however in Hungary due to the legal framework in force market-based renewable production is hindered by an extra tax, originally supporting the competitiveness of smaller district heat producers.

Hope for PPA projects in the coming years

As a summary, over 1 GW project was not awarded contracts at this tender, while only 9% of the budgeted subsidy was committed at an annual value of € 200,000. The unsuccessful bidders may re-evaluate their project costs and submit their projects in the upcoming four tenders by mid-2022, as this schedule was communicated in the ministry’s announcement. As an alternative, the 29 projects at the 10MW+ scale may also wait for the changes of the unfavourable renewable energy tax and head towards the purely merchant PPA projects in the coming years”, mentioned Ferenc Kis, Renewable Energy Business Development Director at RSK Europe. (hcn)