While the general expectation is that general economic demand will pick up and prices will therefore rise again, this development isn’t visible yet. The longer a company waits to buy, the lower the prices, but that brings inventory risks.

Chinese suppliers are becoming nervous. Demand is disappointing and even though they are cutting production and prices, stocks continue to grow.

On the other hand, many buyers postpone their purchase because they see market prices falling and assume further price drops. This creates an almost self-fulfilling prophecy that prices continue to fall, because demand does not pick up in this way.

"In order to avoid a rock bottom price of polysilicon, the producers sat down together," says Scheper. "There they again made certain base price agreements. If the polysilicon price were now based on the actual supply-demand ratio, the price would drop completely. "

There has therefore been a sudden increase in the price of quartz sand. This now suddenly costs 400 percent more than in the same period last year. To make polysilicon, manufacturers need silicon dioxide, or sand. There are a few more purification steps after that before you finally have wafers. These wafers then go through a process to build up the cell structure before going the module factory.

At the end of last year, the polysilicon producers also made price agreements to artificially inflate the price. Then there was a temporary demand shortage due to high material prices, an unexpected PV module surplus and Chinese New Year.

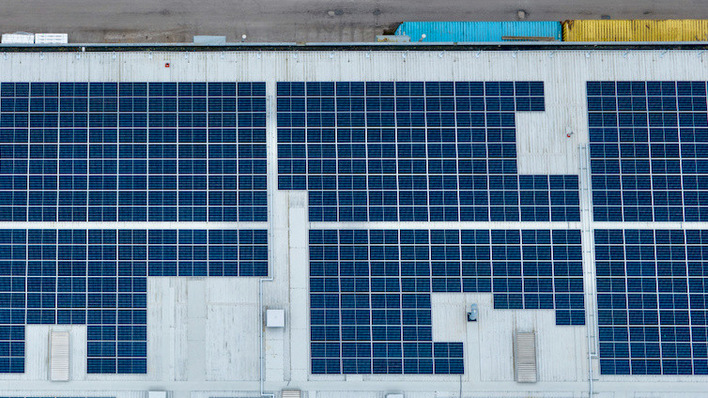

Low prices, but the commercial business case remains difficult.

Previous month, Scheper talked about the battle between Mono PERC panels and the N-type solar panels. Many buyers would like the more efficient N-type solar panels, but the supply cannot yet meet the demand. "To entice customers, the prices of Mono PERC cells and panels are lowered."

That turnaround seems to have been partly successful. Although the Mono PERC cells and solar panels have also dropped in price, they haven’t dropped as much as the solar panels with TOPCon cells (N-type) and heterojunction technology (HJT), a combination of PERC cells with a layer of thin-film PV on top.

"The purchase prices are really at a very low level," says Scheper. "Prices are 7 to 8 euro cents per watt peak lower than a year ago, why wait any longer? Of course, demand is still disappointing, but how long will that last? On the other hand, manufacturers are struggling with high stocks that they have to deal with at some point."

Did you miss that? Solar module prices continue to decline

Nevertheless, Scheper is not entirely enthusiastic about the current market conditions. "It looks like a oil tanker moving in slow circles. Yes, prices are again a lot lower than a few months ago, but the banks and insurance parties remain much more cautious. For example, the interest rates have risen sharply from an average of 1.5 percent to more than 4 percent, which remains a considerable cost item for a project."

The attitude of banks and insurers is one that surprises Scheper, but which he can also understand. "On the one hand, we have seen a period of extremely high energy prices and prices are still higher than before the war in Ukraine. Solar projects are now just getting high turnover," he explains.

Download the new full report of European Solar for free here

"But on the other hand, firstly, you see huge fluctuations in prices and, secondly, a lot of entries from other sectors. The industry is growing so fast that 30 to 40 percent of people are just new, whether they are quality inspectors, installers or financial planners. In addition, there are many acquisitions, also coming from the oil and gas indutry that try to integrate a completely different working method. All these kinds of changes make banks and insurers nervous." (Gerard Scheper/hcn)