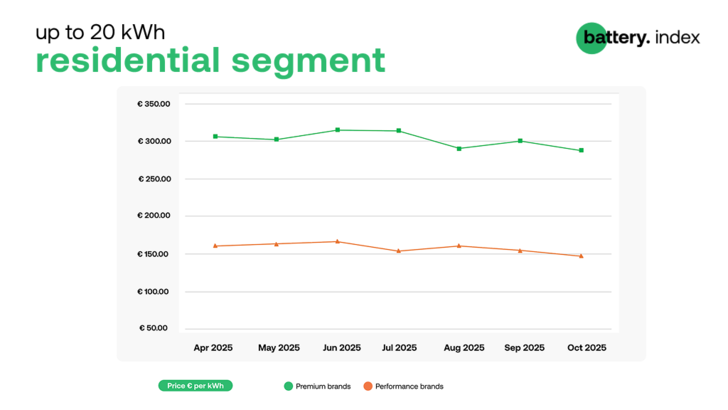

The European residential battery market saw a clear price correction in October. Average prices for premium brands fell by four percent, reaching €287.9/kWh, while performance brands declined by five percent to €147.5/kWh. This synchronised drop reflects the combined impact of easing component costs, increased competition among mid-tier suppliers, and a surge in product listings on the sun.store platform, which rose by more than one-third month-on-month.

While Huawei had held the top position for the past four months, October brought a notable shift in the residential battery rankings. Dyness returned to the number one spot for the first time since May 2025, driven by a sharp price drop and strong sales momentum across performance-oriented models. The brand’s competitive pricing strategy and wide availability allowed it to outpace Huawei in total GMV despite overall market softness.

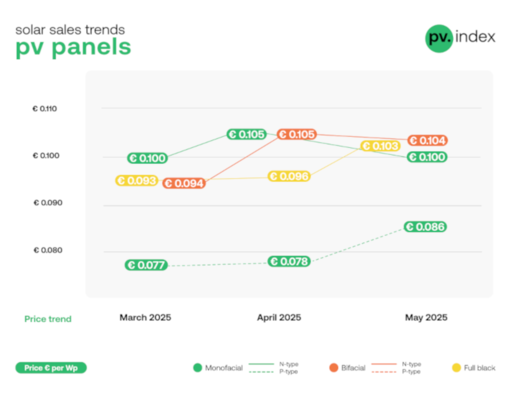

PV index October – module prices steady at historic lows

Huawei moved down to second place, maintaining flat pricing on its LUNA series but losing share to lower-cost alternatives. Deye slipped to third, reflecting steady but less aggressive activity in the mid-range segment. Pylontech and Sungrow retained their positions in fourth and fifth place respectively, both continuing to benefit from consistent demand and solid distribution coverage.

Price competition has returned

Overall, October’s reshuffle highlights a market where installers are increasingly optimising for value, seeking proven quality but with closer attention to system cost and channel support.

“October marks a meaningful shift in the residential storage landscape,” notes Grzegorz Furman, International Senior PV Trader at sun.store. “The four to five percent decline across both premium and performance tiers indicates that price competition has returned. Dyness’s rise above Huawei shows how value-driven purchasing is shaping the market – not because of weakened demand, but because buyers are optimising for cost-efficiency heading into winter.”

The widening gap between premium and performance batteries now exceeds 95 percent, confirming a structural duality in the market: premium buyers continue to prioritise brand reputation and integration, while cost-focused installers increasingly turn to performance-oriented alternatives.

Commercial segment – strong supply meets softer pricing

The commercial storage segment followed a similar trajectory, showing slight but consistent price decreases across both capacity tiers.

Expert view – storage is powering a new era for C&I

Systems in the 20–30 kWh range averaged €227/kWh, down seven percent month-on-month from €244/kWh, marking the steepest decline since spring. The drop reflects increased competition among small commercial system suppliers and intensified discounting in preparation for Q4 tenders.

Larger 60–120 kWh systems recorded only a one percent decrease, now at €231/kWh, underscoring the relative stability of large-scale C&I projects, which tend to operate on longer procurement cycles.

sun.store

Most offered products

20–30 kWh segment

- BYD Battery-Box Premium HVM 22.1

- PylonTech Force H3/409.6

- SolarEdge Home Battery 48V 23 kW

- Felicity LUX-X-48100LG01 4 –

- Dyness Tower Pro TP23

The smaller commercial range continues to attract a mix of established premium players and new challengers. BYD and SolarEdge retain strong presence, while Felicity and Dyness expand their offering with more price-competitive alternatives.

60–120 kWh segment

- Deye GE-F60

- Solax AELIO-P60B100

- KSTAR KAC50DP-BC100DE

- Solax AELIO-P50B100

- Deye BOS-G80 Pro

- Deye BOS-G60 Pro

The upper commercial range remains dominated by Deye, with multiple models leading sales volumes. SolaX continues to strengthen its foothold, securing two positions in the Top 5, while KSTAR retains visibility thanks to robust demand in the 60–80 kWh category. (hcn)