As the system cost of PV plants declines, PV power generation is entering an era of parity, or even low prices. A large number of consulting organizations, including the International Renewable Energy Agency and BloombergNEF, believe that renewable energy is the most cost-effective power source, even without subsidies. The low cost is attributed to the accelerated iteration of PV product technologies and the continuous reduction of costs. PV modules and inverter enterprises have largely contributed to this

As an indispensable electrical device in PV power generation, the inverter has undergone reshuffles, technological innovations, and cost optimizations several times in the last decade. Take string inverters as an example. In 2010, SMA launched the Sunny Tripower 17000TL with a rated power of 17 kW, which was the most cutting-edge product at the time. In 2013, Huawei took the lead in intelligentization based on string inverters.

Shipment of string inverters started to exceed central inverters in 2017

After several years of development, string inverters have become the first choice for many consumers. According to third-party data, the shipment of string inverters started to exceed that of central inverters in 2017. In the next few years, string inverters have become the main choice in various scenarios. On September 26, 2020, the world's largest single-site plant with a total capacity of 2.2 GW connected to the power grid. This plant used solely string inverters, especially Huawei provided 1.6 GW inverters as the largest project share supplier. Manufacturers who previously promoted central inverters are now also starting to promote string inverters.

Optimization of costs and innovated technology

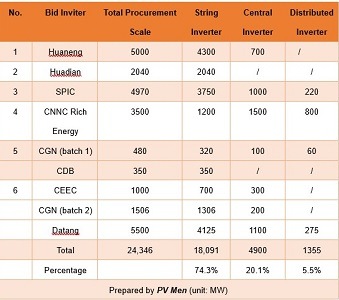

While the cost is being optimized, the inverter technology is also being continuously innovated. Increasingly popular in the inverter field, string inverters have occupied the majority of the utility PV plant market since 2020 thanks to their excellent power generation performance and reduced price difference with central inverters. According to a survey conducted by PV Men, a leading PV media based in China, in the biddings for state-owned electric power enterprises in the first half of 2020, the capacity of string inverters exceeded 18 GW, accounting for 74.3% of the total capacity 24.3 GW in the biddings. Huawei alone occupies approximately 80% of the market share.

PV Men

It can be clearly seen that string inverters are garnering increasing interest from plant owners. An R&D owner with more than 10 years of PV experience believes that if the prices of power electronic components are further lowered in the future, the competitiveness of string inverters will be more distinct. Compared with central inverters, in addition to the multiple MPPTs, string inverters can accurately identify faults in each PV string to facilitate precise O&M, greatly improving efficiency.

Pros and cons of central and string inverters

The owner explained: "Currently, the advantages and disadvantages of central inverters are clear. Specifically, central inverters have following advantages: relatively low average price per watt, over 98.5% single inverter conversion efficiency, low inverter power loss, simple and cost-effective cabling on the AC side, and small line loss. However, there are also notable disadvantages, including a relatively low IP rating (resulting in the cost of O&M dust removal), insufficient MPPT precision, and the fact that the energy yield is greatly affected when a fault occurs.

In contrast, with multiple MPPTs to improve the tracking precision and a conversion efficiency of up to 99%, string inverters not only are less affected by a single PV string fault, but also feature IP65 or higher protection and low O&M costs. In addition, the end-to-end system performance of string inverters is on par with that of the central inverters."

String inverters are becoming more popular for large-scale PV plants

As there is limited room to eliminate the disadvantages of central inverters, owners and developers have gradually started to use string inverters. Alternatively, string inverters are also becoming more popular among owners and developers of large-scale PV plants. The owner of the new energy department of an electric power design institute told PV Men: "At present, among the three mainstream inverters, distributed inverters are more expensive than string inverters.

Because of this, the distributed inverters are rarely used. This is reflected in this year's bidding result. However, the price of string inverters is reducing toward the same as that of central inverters, to nearly three cents per watt or lower. As the capacity of a single string inverter is increased, many owners prefer string inverters. The advantages of string inverters are also clear, especially in terms of power generation revenue and O&M."

A great deal of challenges await inverters

In 2019, the global PV inverter market exceeded US$9 billion, and the shipment reached 127 GW. According to the data provided by Wood Mackenzie, vendors who ranked in the top 10 globally are Huawei, Sungrow, SMA, Power Electronics, Fimer, Sineng, SolarEdge, Growatt, TMEIC, Ginlong Technologies. The Chinese brands occupy half the market. In the past few years, China's inverter enterprises have been working in both domestic and international markets. Their products cover 3–30 kW residential inverters and 30–250 kW string inverters.

Did you miss that? Sungrow signs 800 megawatt PV inverter solution contract in Qatar

Product and technology update and iteration is the most powerful driving force for the PV industry to increase its competitiveness in the power market. As one of the key devices, inverters play a significant role in the competition. With the diversification of PV application scenarios, various types of products will maximize their value in their fields of expertise. However, as the penetration rate of power grids increases and more requirements are raised, such as the demand for batteries, a great deal of challenges await inverters. (hcn)

Did you miss that? GoodWe to expand training and after-sales involvement