Exporo, a platform for digital real estate investments, is expanding its offering to investors with a second asset class. In the future, the company will also offer its investors the opportunity to invest in renewable energies, here primarily in photovoltaics.

Solar experts brought into the team

The offer is based on more than ten years of experience of Exporo in the field of due diligence. In addition, Exporo has a lot of expertise with the regulations of the German Federal Financial Supervisory Authority and the monitoring of brokered loans.

See also: Norway pours millions into promoting clean shipping

In order to build up and further develop the new offering, Exporo has also brought experienced experts from the field of renewable energies into the team. Among others, Tobias Schütt, founder of the provider of rental solar plants DZ-4, will act as an advisor.

Enabling small investors to invest

As with access to real estate investments, Exporo thus offers smaller investors the opportunity to invest in another asset class that was previously only accessible to institutional investors in this form.

The aim of the investment platform is to provide investors with attractive investments with a short minimum investment period. For this reason, Exporo generally offers investment opportunities in solar plants with a term of twelve to 18 months on its digital platform.

Investment risk decreases

The photovoltaic plants on offer have all reached construction maturity. This already eliminates a lot of risks for investors. Only the relatively short construction phase has to be financed. This reduces the investment risk compared to an earlier entry, for example during the pre-planning or approval process.

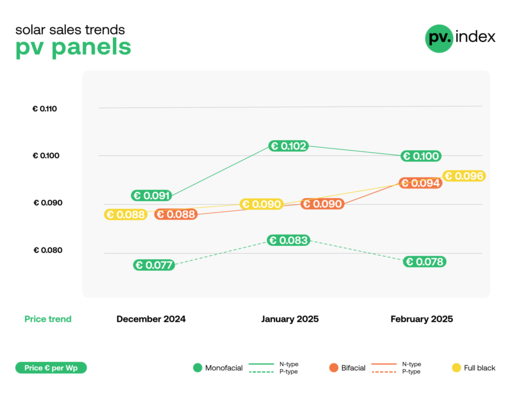

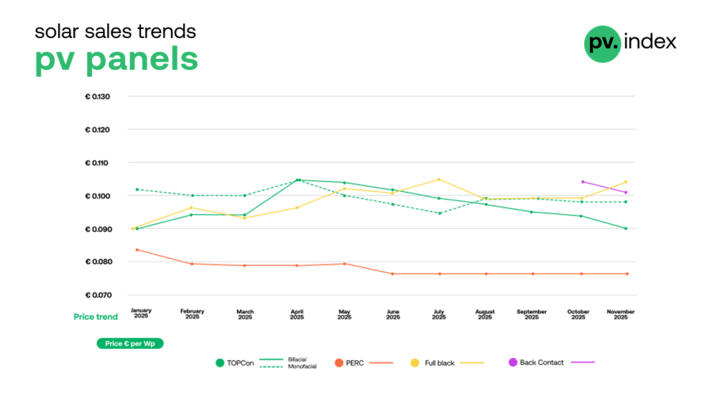

Also interesting: Solar modules are cheaper than ever before

This allows investors to diversify their portfolio in two uncomplicated and flexible ways. Firstly, they can invest in renewable energies in addition to real estate. Furthermore, they can diversify within the new asset class, as investments are possible from as little as 500 euros.

"Investments in renewable energies are not only important for driving the energy transition, but can also be extremely attractive for investors," says Simon Brunke, Managing Director of Exporo, explaining the move into green energy investment.

Investment demand in renewables is high

After all, he says, the growth potential of the renewable power generation market is huge. "The need for capital to finance such projects is high," Simon Brunke emphasises. "The expansion of photovoltaics alone will mean annual investments of several billion euros in Germany by 2030."

Thomas Lange, Head of Credit Risk at Exporo, adds: "In an EU comparison, Germany is below the average of all 27 member states in terms of gross energy consumption through renewable energies. This results in a great need to catch up. Thanks to state subsidies, this creates great opportunities in Germany not only for project developers but also for capital investors to benefit from the expansion of renewable energies," Thomas Lange is certain. (su/mfo)