This is the second bond issue within the last month in which the company has acquired a total of PLN 200 million (EUR 42,4 million) of capital for the development of the Polish part of its PV project portfolio. R.Power is thus becoming one of the leaders of the renewable energy market in Poland. The company is also developing its projects more and more dynamically in the European market, including Spain, Portugal, Italy, Germany and Romania.

The issue for the Fund took place as part of a programme to issue green bonds with a total nominal value of up to PLN 1 billion. The total value of all R.Power bonds issued to date under the programme is PLN 450 million (EUR 95,4 million), and the PFR-managed Fund has become the company’s largest bondholder. R.Power intends to use the proceeds from the bonds issued for the construction of PV farms located in Poland in accordance with the current Green Bond Framework document.

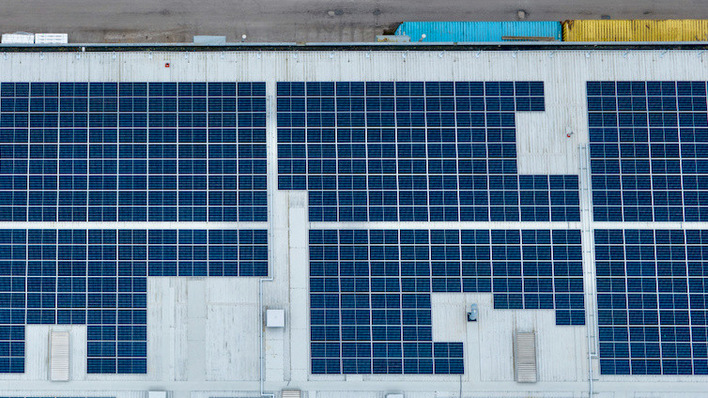

Promoting solar and the local value chain

“We seek to maintain our position as a leading independent power producer and developer of PV farms in Europe by dynamically developing our own project portfolio. The funds obtained from the Polish Development Fund will significantly accelerate this development. However, our collaboration is first and foremost another step towards decarbonising the Polish economy, reducing CO2 emissions and increasing energy independence. Renewable energy sources, especially photovoltaic, will play a key role in this process in the coming years”, claims Przemek Pięta, CEO and co-founder of R.Power.

Did you miss that? R.Power expands in Italy

“The investment in R.Power’s green bonds will allow to maintain the growth momentum of one of the most rapidly growing Polish companies in the area of renewable energy sources. This investment is part of the strategy by PFR GreenHub to support projects in renewable energy sources, presented in 2019. Our goal is for the energy transition in the global economy to become a catalyst for building not only new energy sources, but also the Polish RES sector and our domestic value chain.Therefore, investing in R.Power is our conscious choice and the core of our strategy. We are most pleased that our offer has stirred up a lot of interest and there are already more partners queuing up”, says Bartłomiej Pawlak, Vice President of PFR.

The issue date of the bonds was 2 September 2022. The bonds meet the criteria for green bonds under the Green Bond Principles developed by the International Capital Market Associacion, including in terms of using the proceeds from the issue to finance investments that have a positive impact on the environment and support sustainable development.

Important Polish Development Fund

The Polish Development Fund (PFR) is a group of financial and advisory institutions for entrepreneurs, local governments and individuals, investing in the sustainable social and economic development of the country. Our priorities are: infrastructure investments, innovation, encouraging the development of entrepreneurship, mergers and acquisitions, as well as the export and foreign expansion of Polish enterprises, support for local governments, the implementation of the Employee Capital Plans (PPK) programme and the handling of foreign investments. (hcn)

More about financing: Schletter Group: 65 million EUR for further growth