Photovoltaics have become an essential part of the Polish economy over the past few years, and leading installers have become household brands. But, have Polish photovoltaic wholesalers also benefited from the rise in popularity of photovoltaics?

PV industry observers often overlook the distribution segment. Meanwhile, its importance is significant. The Polish market grew from 2018 until 2021 at an incredible pace. We owe this to distributors, among others. If not for the availability of components supplied by distributors, many installers would never have been established or would not have been able to reach the current scale of business. The distributors took the risk and entered into large contracts to supply components without any assurance as to whether they would find a clients for them. In doing so, they enabled the creation of thousands of jobs in the PV industry and impacted its shape. Currently, three out of five biggest players in the Polish PV market by revenues are distribution companies – including Menlo Electric.

What is the current state of the Polish PV market?

The growth of domestic PV wholesalers, as well as of the entire industry in Poland, was made possible by the high interest of Poles in residential installations. That was largely a result of the net metering system combined with the government's "My Electricity" (Mój Prąd) subsidy program, which awarded up to EUR 1,100 to each household that purchased a solar installation. However, by March 2022 net metering was replaced with less favorable net billing, and “My electricity” was significantly reduced. This led to a significant slowdown in the market in the second quarter.

What impact will the change in the support system from net metering to net billing have on the PV industry in the long run?

We should analyze the change in the RES support system in the context of overall market changes. Net billing itself is slightly less profitable for households than net metering. However, the rapidly rising electricity prices have shortened the payback period for residential or commercial installations to barely 4-6 years. That means a PV system is more attractive than ever.

Moreover, new incentives have been introduced for investments in heat pumps and energy storage. As a result, we see distributors and installers expanding the range of solutions offered to customers, stabilizing their business models.

All in all, now installers’ and distributors’ performance will depend on market forces and their own performance rather than regulatory-induced “demand boosts”. For top-performers, this is hardly bad news.

How are distributors responding to changes in the domestic PV market?

The distribution market in Poland is undergoing gradual consolidation. In today’s market, product quality, cost-effectiveness, and operational proficiency are increasingly important. Leading component suppliers additionally strengthen this trend. Manufacturers prefer having no more than 3-4 distributors in each market. Thus, they are steadily raising the minimum required order quantities. Smaller distributors find it difficult to meet such requirements.

Will distributors not get circumvented by installers, hoping to contract directly from manufacturers?

Polish market is gradually maturing. In the more mature markets of Western Europe, installers rarely bear the cost and risk of contracting directly with Asian manufacturers. Instead, they prefer to focus on marketing, sales, and improving customer service, which are their core competencies. It is the distributor's responsibility to ensure the availability of components at affordable prices.

Procuring components directly is a multi-step process that requires time, experience, and commitment. Requirements regarding advance payments to manufacturers mean freezing working capital. In addition, direct purchases from manufacturers involve arranging logistics, customs clearance, and meeting environmental obligations, which exposes the importer to the risk of changes in component prices, logistics costs, and exchange rates.

Of course, large installation companies can afford to buy directly, but the vast majority of installers are small businesses. Because of their size, they have difficulty getting appropriate assistance from the manufacturer or logistics company in case of unexpected delays or price changes. Thus, buying components directly from manufacturers for most smaller installers involves unnecessary complications to their operating model.

What is the current situation in the PV market from a component supply perspective?

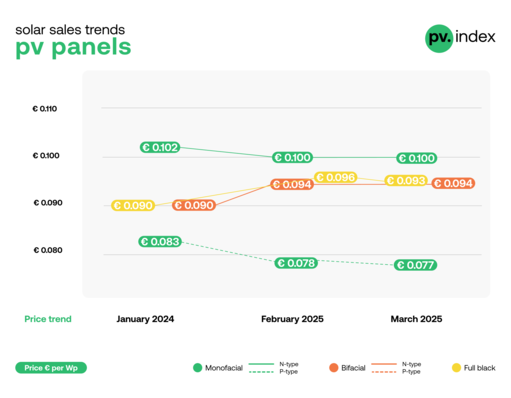

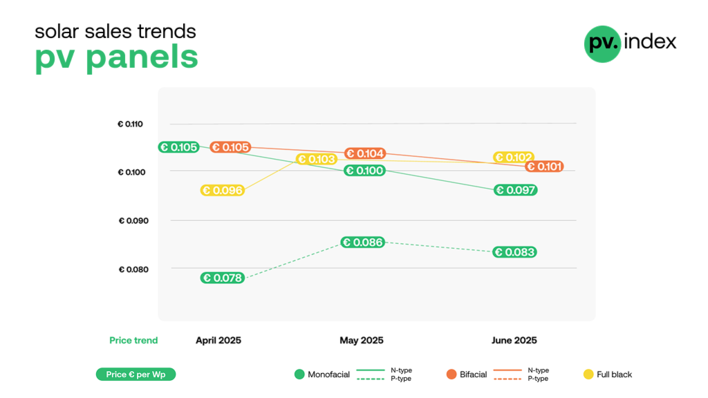

As I mentioned, 2021 and 2022 are challenging times for the PV industry. There has been a change in the long-standing downward trend in module prices. The most significant impact has been the almost 3-fold increase in polysilicon prices. It now accounts for about 40% of module production costs. As a result, module delivery prices to Rotterdam have almost doubled in the past two years.

Manufacturers had to contend with power outages at their Chinese plants or substantial COVID restrictions at logistics hubs. These kinds of events have far-reaching rippling effects. The blockade of the Suez Canal by the container ship Ever Given showed how fragile global logistics chains are. Although the ship was unblocked after just a week, it took many times longer to unload due to delivery delays.

What are the forecasts for the next months of 2022 in terms of prices and availability of components?

Current growth in demand for components will continue to be very strong. It will be additionally reinforced by rising electricity prices. This means module prices will continue to rise until the end of the year. On top of that, relatively high shipping rates persist.

How is Menlo Electric dealing with the current changes?

Menlo Electric was from the get-go built as an international distributor. The first EUR 2M in revenues came almost exclusively from Western European clients. Today, we deliver more than EUR 10M worth of goods per month to more than 20 countries, from the UK to Ukraine and from Estonia to Slovenia. Poland is not even the biggest market for Menlo Electric anymore. We look forward to further growth in the second half of 2022 and beyond. (hcn)

Did you miss that? Menlo Electric: 200 MW distribution deal with Jinko Solar

Sungrow expands in Poland through partnership with Menlo Electric