„Whether you are a believer or non-believer in climate change, 2019 became the year where extreme weather caused an unprecedented number of droughts and floods. Crops were impacted many places and an entire country became engulfed in fire ringing the alarm bells in every capital around the world. We have no strong views on the climate debate but we do recognise the enormous political capital that is being mobilised everywhere to combat the impact of the changing climate. The world is entering a new era where the operating principle of our society will be that of less focus on economic growth and more on the environment whether local or global. Governments action to improve the environment will unleash significant investments and stimulus starting a new mega trend in society.

In the tailwind of this transition to a less carbon intensive economy many opportunities will arise for investors and that’s why we have taken the opportunity to research and provide to our clients an inspirational list of stocks in those important “green” industries that we believe will benefit the most. We believe that some of these green stocks could over time overtake technology companies and become the world’s most valuable companies.

The industries and stocks to green your portfolio

Several industries will drive a less carbon intensive future, the most obvious of which are solar, wind, fuel cells, electric vehicles, hydro, nuclear, bioplastic, recycling, water, building materials and food. Some of these industries are mature and experiencing a renaissance while others are emerging technologies.

We have identified 49 stocks that give investors exposure to these green industries among them solar companies like SolarEdge, First Solar, Enphase or Scatec Solar.

Did you miss that? https://www.pveurope.eu/financing/eu-over-100-pv-market-increase-2019

We have chosen the companies with no consideration for historical performance or predictions for the future. Instead we have focused on market cap, preferring larger over smaller companies within the industry, and an emphasis on pure plays whenever possible.

Green industries have different risk profiles

The risk factors impacting the different industries are both systemic and idiosyncratic. From a risk perspective relative to the general equity market the hydro, nuclear, recycling and water industries are less risky as their demand profile is more stable than the overall business cycle. The solar, wind, electric vehicles and building materials are more cyclical than the general market and would be impacted more negatively during a recession.

The fuel cell, bioplastic and food (in this case plant-based) industries have far more idiosyncratic risks as they are far more nascent than the other industries. The fuel cell industry is heavily dependent on government subsidies as the industry rolls down the technology curve in terms of cost of production and thus the industry is very high risk. The bioplastic industry is likely to experience very high growth rates as many consumer companies, McDonald’s and Unilever to name a few, have said they will improve their plastic packaging over the next decade. But bioplastic is a small fragmented industry and the publicly listed bioplastic companies could easily lose out to larger names in the traditional chemical industry.

Significant valuation premium except nuclear and wind

Except for the nuclear and wind turbine industry all of the other industries trade at a valuation premium to the global equity market. This premium obviously reflects investors’ optimism about future cash flows in those industries, though with high expectations come higher risk in general if these expectations are not met. While we understand the valuation discount on nuclear due to low growth we find it more difficult to reconcile the valuation discount for wind turbine makers given the positive outlook for the industry and vastly improved industry conditions over the past 10 years.

Another important point about these industries is that they are operating in the physical world compared to the software industry, where return on capital is insanely high and easily scales. These greener industries all require vast amount of capital to operate and thus the low interest rate environment has helped fund growth in these industries and making projects more profitable. If interest rates rise again this should have a negative effect on their operating conditions and especially on equity valuations as high growth stocks fall more than value stocks in a rising interest rate environment.

Government support is key in green transition

Many of the industries mentioned are dependent on government support either through subsidies (wind, solar and fuel cells etc.) or liability caps (nuclear power) which means that shareholder returns in the future will be dependent not only on technological advancement but also the continuing support of governments. With the green policy agenda adding speed in many countries the risk of losing government support is most likely small but it’s still a risk. The risk would rise in the event of a recession where a government could be forced to reduce subsidies on green policies as resources are diverted to unemployment benefits and other social welfare costs.

One final way to get exposure to the transitioning to a less carbon intensive economy is through carbon emissions which could rise in the future if the European Union (the only place in the world where a market-based carbon emission market exists) limits the supply of carbon emissions. This could happen if the EU decides that current carbon emission prices are not curbing carbon emissions enough. Carbon emissions are traded through futures expiring each year in December.

High growth renewable energy sources

Solar energy has been a known technology for over 180 years as the photovoltaic (PV) effect was discovered in 1839 by a French physicist. However, the energy efficiency has been too low until recently with new industrial-scale solar farms now producing electricity at cost levels making it competitive, in some areas of the world even without subsidies. As with the computer hardware industry, the ongoing technological advancement is constantly pushing down prices making it very difficult for PV solar panel makers to make consistent return on the invested capital. The economic benefits have so far mostly flowed to consumers and utilities. Solar energy will most likely play an important role in the energy mix and especially in the world’s most sunny regions.

The wind turbine industry operates with far greater technology moats, or entry barriers, which has boosted operating margins over time and the return on invested capital. The industry is dominated by a few companies and few new companies are entering the industry. This is good from a shareholder perspective but as with solar industry the majority of the economic benefits from wind energy has flowed to utilities and consumers, and to a lesser degree the wind turbine makers. The latest battlefield for wind turbine makers is offshore wind turbines that a decade ago looked too expensive to ever work, while today it looks like offshore is the future for the industry. Industry leader MHI Vestas Offshore Wind announcing the first 10MW offshore wind turbine in September 2019, a major technical breakthrough for the industry. In Europe, 63% of renewable energy investments was in wind energy in 2018, and the continent also leads on expected installed offshore wind capacity by 2040.

The trouble kid and the underdog rises

Fuel cell technology has been around for decades, with too many high hopes and too little actual achievement. The global market value of fuel cells is still very low and the current fuel cell applications are not producing energy at low enough costs to survive without government subsidies. The industry has seen many failures and in 2016 Samsung decided to drop fuel cell business projects due to the poor outlook. Fuel cells biggest hope in terms of main applications is base load applications – helping to offset the constant variation in electricity production from renewable energy sources.

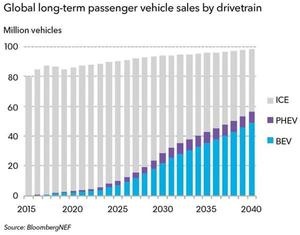

Few believed in the future of electric vehicles (EV) a decade ago and many executives in the car industry shrugged off Tesla as a hobby project for the rich and environmentally conscious Hollywood stars. But since then Tesla has transformed and pushed the entire car industry towards EVs. The current projections are that the 2020s will be the breakthrough decade for EV’s. However, one factor that could accelerate the penetration is consumer behaviour. We currently observe that consumers are hesitant to buy a car with internal combustion engine (ICE) in a clear sign of a present regret bias – the concern that they will regret any decision made on what kind of car to buy. If this behavioural bias grows then carmakers will be forced to accelerate capex on EVs and the number of available models faster than initially thought. This could accelerate growth in EV’s much faster than current projections.

ICE = internal combustion engine, PHEV = plug-in hybrid electric vehicle, BEV = battery electric vehicle.

Stable hydropower

Hydropower is a clean stable energy source with strong profitability and return on capital. It’s not a high growth industry, with hydropower generation only growing around 2.5% per year. But the stability in both operating metrics and cash flow generation is what is attractive for investors. China is one of the countries that is rapidly expanding its hydro power capacity and Chinese hydro power companies are looking to expand globally.

The nuclear power industry had its growth phase from 1960 to 1986 where its share of electricity production went from 1% to 16%. It has been steady ever since with the industry increasing capacity at the same rate as the electricity demand increase. Around 30 countries have nuclear power with Germany exiting the energy source while China is doing the most investments into nuclear power, but despite many new constructions in China nuclear power will still only amount to 4% of total electricity demand.

Plastic fantastic or not and the recycling industry

Bioplastics are a fast growing phenomenon, with expected annual growth rate of 25% according to data from the European bioplastics industry, with the biggest application for bioplastic (65%) in packaging. Bioplastic has varying degrees of degradability. The official definition is that at least 25% of the material has to come from plant-based content. This means that a lot of the current bioplastic products still have a high degree of non-biodegradable material and longer biodegradation time. Everyone has seen the devastating pictures of plastic in the oceans so the outlook for bioplastics is assumed to be very positive for coming decades.

The recycling industry is not new and actually quite mature in the developed world. In the developing world recycling has seen renewed focus the last couple of years, with China introducing mandatory recycling in several major cities in 2019. Proper recycling is a key catalyst for better use of resources and also less impact on the environment. The global market for recycling is growing slowly at around 2-3% but demand is stable and that’s an attractive feature from a shareholder perspective.

The blue dot’s water crisis and the green house

The world has a water crisis as water consumption has grown rapidly over the past 40 years with the rising wealth in emerging market countries and over 800 million people still lack basic access to drinking water. Ironically on a planet swept in water has only 3% of its water is fresh water and as result people are struggling to get access to water both in terms of quantity and quality. This means that seawater reverse osmosis desalination is a key solution and this industry is expected to be the fastest growth segment in the water industry. Wastewater treatment and desalination are both mission critical applications for water quality in urban areas and related operations often come with long-term public contracts that ensure the stability in their operation and profitability. This ensures access to funding and huge interest from investors. Point-of-use water filtration is also a fast-growing industry with a shorter payback period on investment.

New construction and existing buildings are responsible for 39% of all carbon emissions with the operational emissions accounting for 28%. This means that there is a large potential for “green building materials” that reduce the energy required for heating, cooling and lighting buildings. Many governments around the world provide incentives for households to upgrade the energy efficiency of their houses and we expect this to be a driver of the industry for decades

Green stocks could become long-term winners

If we have learned anything since the financial crisis in 2008 it is not to fight the government and the political willingness to shape markets. The political capital behind reducing carbon emissions as the climate crisis rages will provide extraordinary opportunities for investors over the next three decades. In the last decade technology companies have risen to dominant the ranking of the world’s most valuable companies and their monopolistic positions will solidify this position for the years to come. But with increasing technology regulation to curb the negative side effects of targeted ads, social media, user data etc. and the fight to improve the environment the green stocks will become the largest companies in the world lifted by an enormous tailwind from governments, technological advancement and the choice of consumers. If investors do not make their portfolios greener they could miss out on the next important mega trend in financial market and society.“ (HCN)