“Forever chemicals”, the common term for PFAS (per- and polyfluoroalkyl substances), face growing regulatory pressure worldwide amid rising concern over their health and environmental impacts. The battery industry, which was long exempt from early rules, is now under closer scrutiny for its continued use of PFAS.

In its new report, Additives for Li-ion Batteries and PFAS-Free Batteries 2026–2036: Technologies, Players, Forecasts, IDTechEx examines PFAS use in current batteries and highlights non-PFAS alternatives poised to disrupt materials markets and enable the first PFAS-free cells. It forecasts the market for these additives will exceed US$2 billion by 2036.

How and why is PFAS used in batteries?

PFAS are a class of highly fluorinated synthetic materials encompassing nearly 5,000 chemicals with broad applications. They pose significant risks to health and the environment, including cancer, water contamination and developmental delays. Yet their unique properties sustain widespread use across industries, and IDTechEx finds the same holds true in batteries.

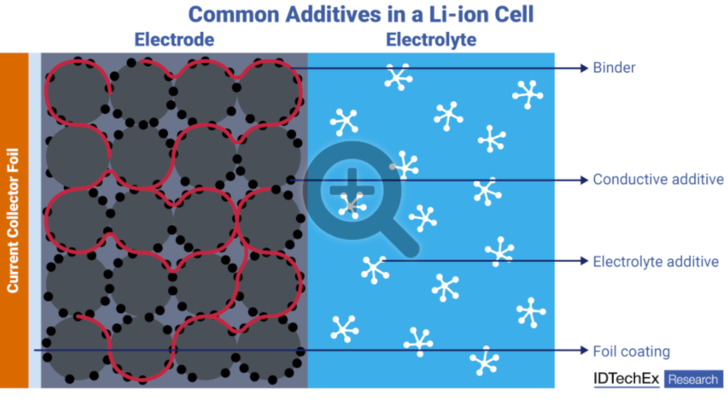

PFAS offer stability, conductivity and adhesion, making them well suited as binders in Li-ion electrodes. While anode systems have shifted away from PFAS, cathodes still rely on PVDF as the dominant binder. With electrode manufacturing evolving and dry processes emerging, PVDF is increasingly replaced by PTFE, another PFAS material.

Sodium-ion batteries – “built for trade resilience”

PFAS are also well suited as electrolyte additives, enhancing conductivity and stability or acting as flame retardants. Options include PFAS-based lithium salts, organic carbonates and hydrofluoroethers, each tailored to specific roles in electrolyte formulations. More recently, growing awareness of PFAS harms is driving regulation, coinciding with the rising importance of Li-ion batteries in electric mobility and energy storage.

Solid-state battery sector eyes $9 billion market by 2035

In response, IDTechEx’s “Additives for Li-ion Batteries and PFAS-Free Batteries 2026-2036: Technologies, Players, Forecasts” report has identified alternative non-PFAS materials and systems that can be used in their place in future PFAS-free Li-ion cells. The report also highlights key players developing this technology and the future direction of non-PFAS material research.

What are the alternatives to PFAS?

For a non-PFAS material to replace a cell component, it must share most or all of the properties of the PFAS incumbent. Ideally, it should also be cheap, sustainable and compatible with current production processes. Few materials meet all these requirements and are commercially ready today, but incremental progress is being made toward PFAS-free batteries.

On the binder front, Leclanché has announced the removal of PFAS from its systems, and a wide array of polymers is being explored as replacements for PVDF. These range from synthetic to bio-based, and from novel bespoke polymers to those already used in other commercial applications.

Belgium: Solarge builds solar plant with fully recyclable modules

IDTechEx reports that polymers such as polyacrylic acid (PAA) and polyethylene oxide (PEO) are among the leading non-PFAS alternatives, though each is at a different stage of commercialisation. Meanwhile, companies including Nanoramic and 24M are developing binder systems that avoid polymers entirely, highlighting the variety of solutions for removing PFAS from binders.

Similar progress is being made with electrolyte additives, with E-Lyte recently announcing a PFAS-free formulation. The field already includes several non-PFAS materials that are commercially viable and suitable for PFAS-free cells. Additives such as lithium bisoxalatoborate (LiBOB) and vinylene carbonate (VC) are widely used and are set to gain further prominence in a post-PFAS market.

Second-life batteries and AI open new paths for energy storage

However, PFAS remediation is not as simple as direct substitution, given the specificity of electrolyte formulations in each cell design. Major material suppliers are instead developing specialised additives for PFAS-free electrolytes, with further insights detailed in the new IDTechEx report.

Outlook

The battery industry is developing methods for PFAS remediation as the threat of regulation approaches. While rarely as simple as direct substitution, novel materials are emerging that can replicate PFAS roles in cells, with a number of players already adopting the technology.

The report highlights how the battery industry is expected to evolve in response to rising concerns over PFAS. It outlines current PFAS use in cells and identifies non-PFAS alternatives that will support compliance with future regulations. (hcn)