Drawing on real transactional data, the sun.store Battery Index will offer visibility into how prices evolve and how different brands are performing across all key segments of the market.

One of the most notable differences between the solar panel and energy storage sectors is the persistence of wide price gaps between leading brands and the broader market in the storage space. While module prices have largely converged — with market leaders and value brands now competing within a relatively narrow range — the battery market tells a very different story. Here, price disparities remain stark and, in some segments, are widening.

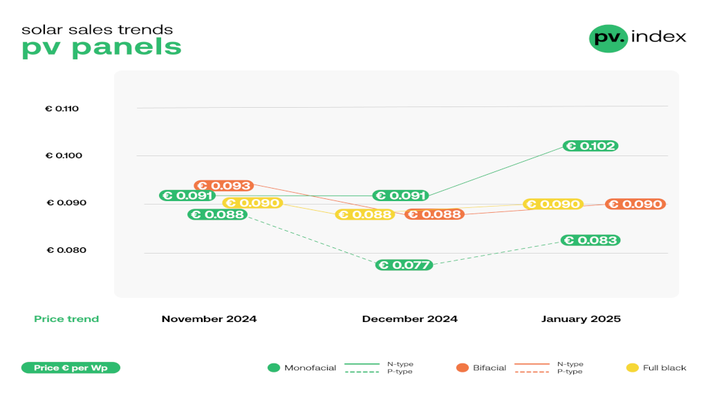

PV Index July – prices ease as demand stays soft

The Battery Index will track these trends in detail, providing professionals across the solar and storage value chain with data, analysis, and early signals of market shifts. The Battery Index will gradually expand to e.g. separately cover Low Voltage and High Voltage systems in the following months.

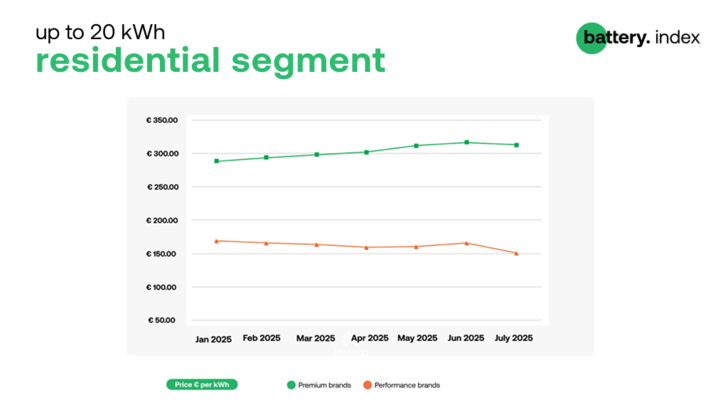

Residential segment (up to 20 kWh)

Price disparities are especially evident in the residential segment (up to 20 kWh). Since the beginning of 2025, average prices per kilowatt-hour for premium brands have increased, crossing 300 EUR/kWh, while prices for performance-oriented (value) brands have continued to decline, touching 150 EUR/kWh threshold for the first time in July.

As a result, the price spread between premium and performance brands — which stood at approximately 70% earlier this year — has now exceeded 100%

“The growing divide is fueling tension across the market, particularly among installers. While many recognize the advantages of premium brands — including stronger warranties, better technical support, and higher-quality components — they are increasingly questioning whether these benefits justify the steep price difference. The widening gap is triggering reconsideration of brand loyalties across the installer landscape,” comments Bartosz Majewski, Co-founder of sun.stor

This pricing dynamic is likely to remain a source of market friction, especially as performance brands continue to cut costs and gain traction in both mature and emerging markets.

Second-life batteries and AI open new paths for energy storage

Meanwhile, the popularity of individual brands, measured by the volume of transactions on sun.store, has been closely tied to supply availability from manufacturers. Brands such as Huawei and Deye, which experienced shortages in the first few months of the year, are now gaining market share as their availability improves.

Conversely, Dyness and Sungrow, which were previously among the leaders in terms of transaction volumes, have seen a decline in June and July due to delivery slowdowns and supply constraints. However, early indicators suggest that both Dyness and Sungrow are now regaining supply chain stability. As availability normalizes, there is a strong likelihood these brands will recover lost ground in trading volumes over the coming months.

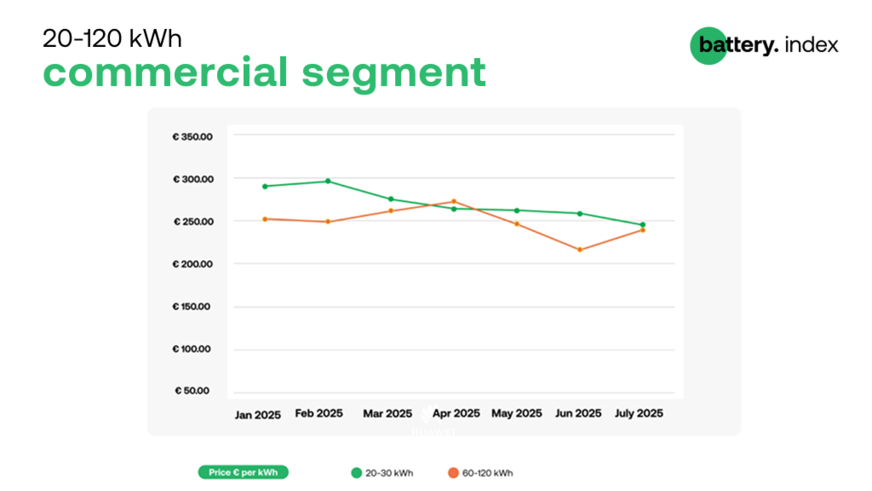

Commercial segment (20-120 kWh)

In the commercial battery storage segment (20–120 kWh), two sub-segments have emerged as particularly active: 20–30 kWh systems and 60–120 kWh systems. Both sub-segments have seen somewhat subdued price declines compared to residential systems, dropping by 5-15% since the beginning of the year.

How dynamic tariffs could wake the sleeping giant of C&I storage

Average price for 20-30 kWh sets declined steadily from 289 EUR/kWh to 245 EUR/kWh. 60-120 kWh systems recorded a more bumpy price trajectory, rising from 251 EUR/kWh to 272 EUR/kWh between January and April, before declining to 239 EUR/kWh by July.

sun.store

As for product popularity, the 20–30 kWh segment stands out for the breadth of choice available to installers and distributors, with leading names such as BYD, SolarEdge, PylonTech, Felicity and Dyness consistently appearing in merchant listings and transactions.

Stay informed – subscribe to our free newsletters

In contrast, the 60–120 kWh range is currently dominated by a smaller number of key players, with KStar, Deye, and Solax accounting for the bulk of systems on offer. This reflects a higher level of consolidation in the upper tier of the commercial segment, where project-specific requirements and integration complexity play a stronger role in brand selection. (hcn)