With the Luna2000, Huawei has a commercial and large-scale storage system in its portfolio. How important is this segment in your overall portfolio?

Max Münnicke: We are currently seeing a strong increase in interest in battery storage solutions in Germany, particularly in innovative products with high availability. The commercial storage segment in the German market is currently the smallest alongside Residential and Utility Scale, but it is growing.

How do you expect demand to develop?

We expect a significant increase in commercial storage projects in 2024, albeit starting from a relatively low level. In the utility scale sector, we expect the installation rate to double or even triple in 2024 compared to 2023, depending on whether developers receive their building permits and financing on time.

See also: Energy storage integrator market expected to consolidate

Huawei offers the new battery string inverters for the integration of storage units in solar power plants. How do you expect demand to develop in this segment?

Co-located battery storage solutions in combination with photovoltaic systems are particularly attractive as they can utilise the installed electrical systems such as substations and grid connections particularly efficiently. We therefore anticipate a level of project realisation that will accelerate over the next few years.

To what do you attribute this development in demand in the commercial storage market as a whole?

In the commercial storage market, demand is mainly due to the combination with photovoltaic systems and thus the optimisation of self-consumption. In many cases, photovoltaics and battery storage systems are now a more financially attractive supply solution than expensive grid electricity. In some cases, these storage units will also take over peak load management, buffer fast-charging stations for electric vehicles and participate in the electricity market.

And what about large-scale storage systems?

In the large-scale storage market, the innovation tender offers an attractive investment basis. In addition, as the number of producers and consumers increases, there are more and more discrepancies between the energy required and the energy available in the grid, which leads to price differences on the intraday and day-ahead market that can be served by battery storage systems.

With the new battery inverters, large storage projects can also be realised with string devices. What is the advantage of this?

A comparison can be drawn with the photovoltaic market. Today, around 80 per cent of all utility-scale PV projects worldwide are already being implemented with string inverters, as they are more cost-effective, easy to install and replace, reliable and freely scalable and ultimately do not incur any expensive follow-up costs due to the elimination of service contracts. We therefore see no reason why battery storage systems should be realised with central inverters, as the advantages of the string inverter architecture are obvious and this success has already been proven in the photovoltaic industry. With the string inverter for battery storage, storage projects with 200-kilowatt devices can be freely scaled in terms of output.

The new battery string inverters from Huawei have a smart string architecture. What is it and how does it work?

The Smart String inverters form a 1200-volt DC bus, while the battery rack voltage is freely regulated by a DC/DC converter. This means that not only can each rack be charged and discharged individually, but each individual module can actually be charged and discharged using battery modules with optimisers. This means that the entire storage capacity can be fully utilised at all times. If a device is defective, it is automatically switched off and system performance and capacity are only minimally affected. The Smart String architecture thus ensures maximum system availability. The system output can be adjusted at a later date at any time by installing additional inverters.

Which business models are relevant for commercial storage systems?

In the commercial storage sector, the predominant application purpose is to increase self-consumption of self-produced solar power, as the storage unit makes it plannable and predictable, followed by peak shaving. Charging parks for electric vehicles in particular drastically change the load behaviour for industrial and commercial companies, which can result in expensive follow-up costs for increasing the capacity of the grid connection infrastructure or an increased peak load price for the distribution grid operator due to the higher peak load. Here, commercial storage systems can distribute loads more homogeneously and thus reduce peak loads. In most cases, these applications are combined in order to maximise the system's yield. Backup power still plays a subordinate role in Germany due to the high availability of the German grid. Customers attach particular importance to delivery times and investment security in a system with long-term availability and consistently available service personnel. If a problem arises, it must be able to be rectified at short notice.

What business models are used to build the large storage containers - is it exclusively for grid operators who want to use them to stabilise grids or is there now also demand from solar park developers who combine the systems with storage units?

The market currently consists mainly of projects from the Federal Network Agency's innovation tender and this business model offers a solid, predictable system yield and is therefore relatively easy to finance. We anticipate a stable market in the innovation tender, as the number of awarded projects is currently capped, but is also fully utilised. We are seeing growing interest in combined systems that are active on the intraday market, although developers are also facing more complex financing challenges. Co-location with photovoltaic systems is currently developing quite rapidly, as grid connection capacities are sometimes a limiting factor and business models can be combined if electricity can be produced more cost-effectively in the solar park and marketed at peak times.

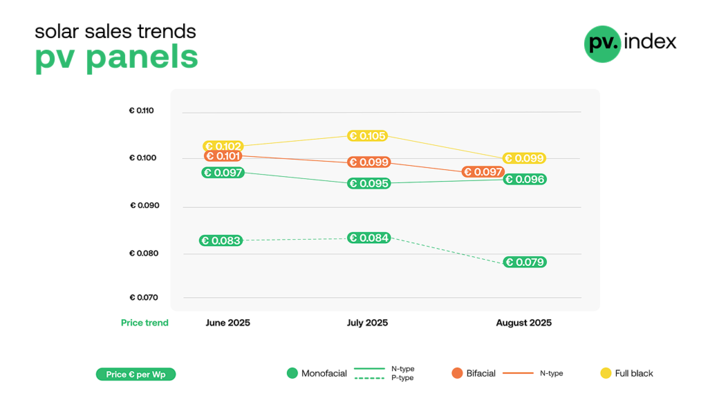

How are prices for storage units developing in the various segments?

A sharp fall in raw material prices and a generally more stabilised global supply chain have already led to noticeable price declines in the past year. We expect further slight price declines in the medium term. In the long term, it can be assumed that system technology will be able to further reduce costs as a result of technological and production-related progress. However, due to short-term material shortages or geopolitical changes, it must always be expected that prices may rise in the meantime, as happened in 2022.

Also interesting: Huawei FusionSolar: Systems for Agri PV and floating PV (video)

What further technical developments can be expected in the near future - also with regard to battery technology?

Lithium technology is likely to remain the mass market in the near future, as the production capacities for this have already been built. Many follow-on technologies are being researched, but they all have to be able to reconcile the factors of safety, availability of raw materials, energy and power density and price in order to be suitable for the mass market. In the lithium segment, lithium iron phosphate - LFP - will clearly be the winner in the mass market, as the technology is more cost-effective and safer than previous technologies and high-power applications for stationary batteries are hardly an issue anymore, but capacity is the driver of battery project developments.

The questions were asked by Sven Ullrich.