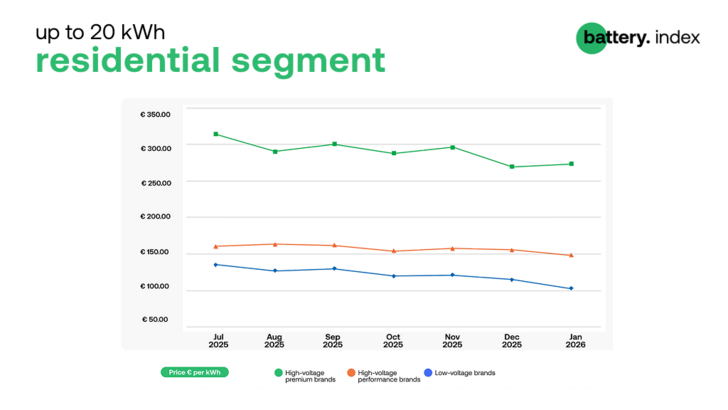

January 2026 data show clear differentiation between residential battery segments.

● High-voltage premium brands: €273.4/kWh (+1% vs December)

● High-voltage performance brands: €148.2/kWh (–5% vs December)

● Low-voltage brands: €102.89/kWh (–10.6% vs December)

Premium high-voltage systems recorded a modest month-on-month increase following December's correction. At the same time, performance high-voltage systems and low-voltage batteries continued to decline, with the largest percentage move observed in the low-voltage segment.

Top residential battery brands (up to 20 kWh)

- Huawei

- Dyness

- Deye

- Pylontech

- Sungrow

Brand rankings remain unchanged month-on-month. The top positions continue to be occupied by high-voltage system providers, reflecting consistent availability and transaction volumes across the residential segment.

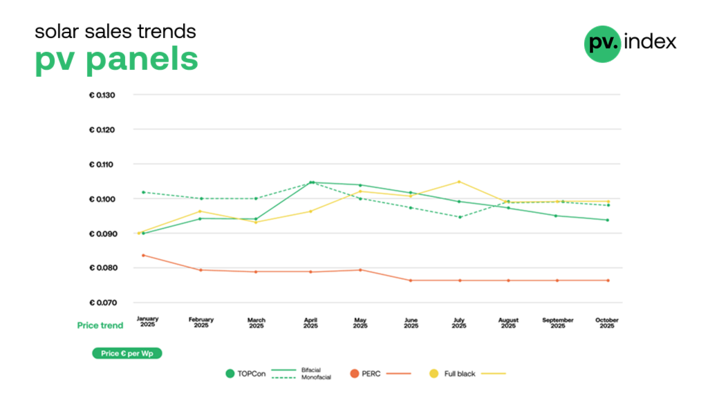

After the spike – why solar and battery prices will cool again

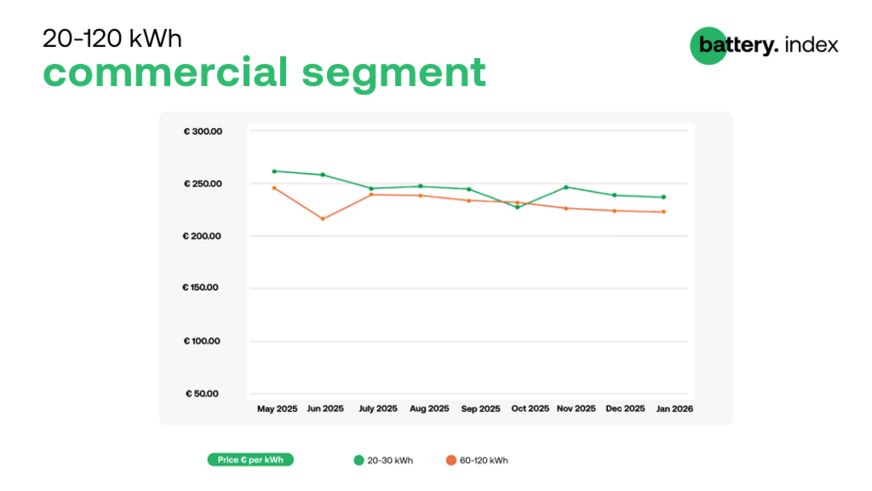

Commercial segment (20–120 kWh): limited month-on-month movement

Pricing in the commercial storage segment showed limited variation in January.

● 20–30 kWh systems: €236.62/kWh (–1% m/m)

● 60–120 kWh systems: €222.45/kWh (0% m/m)

Month-on-month changes in both capacity ranges remained within a narrow band, indicating stable pricing conditions at the start of the year.

sun.store

Most offered products – January 2026

20–30 kWh segment

- BYD Battery-Box Premium HVM 22.1

- PylonTech Force H3/409.6

- Dyness Tower T21

- BYD HVB 29.6

- BYD HVB 26.7

- BYD HVB 23.7

- BYD HVB 20.7

The product mix in this segment continues to be dominated by modular high-voltage systems, with multiple capacity variants available within the same product families.

60–120 kWh segment

- Deye GE-F60

- Deye BOS-G60 Pro

- Solax AELIO-P60B100

- Solax AELIO-P50B100

- KSTAR KAC50DP-BC100DE

- Huawei LUNA2000-107-1S11

- Deye BOS-G80 Pro

The upper commercial range remains concentrated around a limited set of recurring platforms, with consistent representation from the same suppliers month-on-month.

EU battery storage up 45 percent to 27.1 GWh in 2025

Summary

● Residential pricing diverged in January, with premium HV systems increasing slightly, while performance HV and low-voltage systems declined.

● Residential brand rankings remained unchanged.

● Commercial storage pricing showed minimal month-on-month movement across both capacity ranges.

● Product availability continued to be concentrated around established, repeat system architectures. (hcn)