We’ve already looked at how solar PV is poised to enable many more homes and businesses to generate their own clean, green electricity from the sun. Now we ask, what’s in store for ground-mounted solar in the UK?

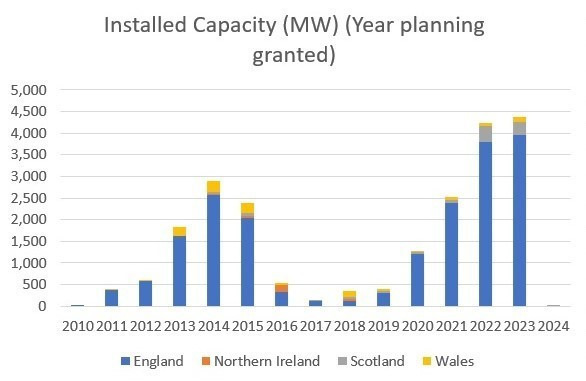

A study by Corrie Energy Partners reviewed a sample of 1,809 consented ground-mounted projects in the UK, showing a strong recovery in the market from a low in 2017. According to Jo Fleming of the consultancy, which advises clients on implementing low-carbon, sustainable energy projects, this has coincided with a clear increase in the average project size over the same period.

Shift to big solar

“The technology – and the development process – are relatively mature, so participants are more comfortable with the risks involved and undertaking larger projects,” said Mr Fleming.

“Further, given the high fixed costs such as grid connection, security and fencing, ground preparation and remedial works, and seeking planning consent, companies will gravitate to projects likely to yield richer returns – that translates into bigger acreages.”

See also: We’ve already looked at how solar PV is poised to enable many more homes and businesses to generate their own clean, green electricity from the sun. Now we ask, what’s in store for ground-mounted solar in the UK?

A study by Corrie Energy Partners reviewed a sample of 1,809 consented ground-mounted projects in the UK, showing a strong recovery in the market from a low in 2017. According to Jo Fleming of the consultancy, which advises clients on implementing low-carbon, sustainable energy projects, this has coincided with a clear increase in the average project size over the same period.

Shift to big solar

“The technology – and the development process – are relatively mature, so participants are more comfortable with the risks involved and undertaking larger projects,” said Mr Fleming.

“Further, given the high fixed costs such as grid connection, security and fencing, ground preparation and remedial works, and seeking planning consent, companies will gravitate to projects likely to yield richer returns – that translates into bigger acreages.”

See also: Back in UK with a large-scale PV project

There is a clear difference in the average size of projects covered by the contracts for difference (CfD) support mechanism. CfDs provide greater certainty on pricing and are aimed at promoting renewable resources, with solar becoming eligible in rounds 4 and 5 of the scheme. CfD projects are roughly twice the size although both CfD and non-CfD projects show a similar trend towards increasing project size. However, almost all projects (99.4%) stay below a generating capacity of below 50 MW and so remain permitted by local planning authorities.

Corrie Energy Partners

One drawback is, the trend will limit the options of farmers who might otherwise consider allocating a proportion of their land to clean energy production. National planning guidance directs renewable energy projects, away from the “best and most versatile” (BMV) agricultural land (grades 1, 2, and 3a), which is harder to achieve for larger projects.

Decarbonisation commitment

Mr Fleming added that he and his colleagues are seeing plans for projects typically in the range of 30-50MW, much larger than a decade ago.

The Government is committed to decarbonising the economy but its advisory body the Climate Change Committee has claimed ministers are significantly off track in achieving their target of 70GW of solar energy generation by 2035. Total solar capacity was 15.2GW in July, comprising both utility-scale and domestic solar electricity generation, an increase of 6.7% since June 2022.

A Solar Taskforce was established in May 2023 to produce a draft Solar Roadmap, setting out a deployment trajectory by February, though it now looks like the report will arrive in the spring.

Yet the 70GW target looks increasingly out of reach as developers face some big challenges getting the go-ahead for their plans.

First, despite the UK Government’s energy security strategy favouring solar, not all local planners or local residents are enthusiastic about solar farms and application rejections are high in England and Wales and also in Scotland.

Grid logjam

Second, obtaining a connection to the grid, enabling the export of energy to the national electricity supply system, can be very difficult. The current network was designed in the last century to carry energy generated at central points, typically coal-fired plants, to customers across Britain.

The low-carbon transition has necessitated the system’s wholesale transformation into a complex, diversified web, in which clean energy is produced by on- and offshore wind farms, often in Scotland and the north of England and, increasingly, on solar farms in rural locations – and transported to areas of high demand, typically in cities and built-up areas.

The cost and availability of a grid connection varies greatly depending on factors such as the state of existing local infrastructure and cables and distance and ease of access to a connection point into the grid, and also the capacity of National Grid to facilitate the connection.

Cutting the queue among possible reforms

In November the UK energy regulator Ofgem unveiled new rules aimed at reducing the average delay time for projects to connect to the grid from five years to six months, to clear so-called zombie projects and speed completion of the most feasible, higher-priority connections.

Two emerging trends may also speed the transition. Technical advances are bringing closer the time when battery systems cross a reliability threshold, storing electricity generated by weather-dependent solar and wind farms long enough and in sufficient volumes to compete with fossil fuel sources.

See also: Trina Storage and Low Carbon build four large-scale storage facilities

For consumers and the British economy, the potential payback in clean, economical energy and sustainability is immense.

For those concerned about a countryside dotted with solar panels, Government plans to scale solar power for net zero are expected to increase to just 0.3% of the UK – around 0.5% of land currently used for farming, and roughly half of the space taken by golf courses.

Utilities and distributors are trialling a number of ways to reform transmission and distribution to hasten decarbonisation and increase energy security while ensuring continuity of supply. Some believe a switch to ‘locational pricing’ could herald a new solar revolution.

Effective reforms would encourage further investment in ground-mounted solar PV and other forms of clean energy. (PC/hcn)