How dependent is the photovoltaic industry in Germany and Europe on China at present?

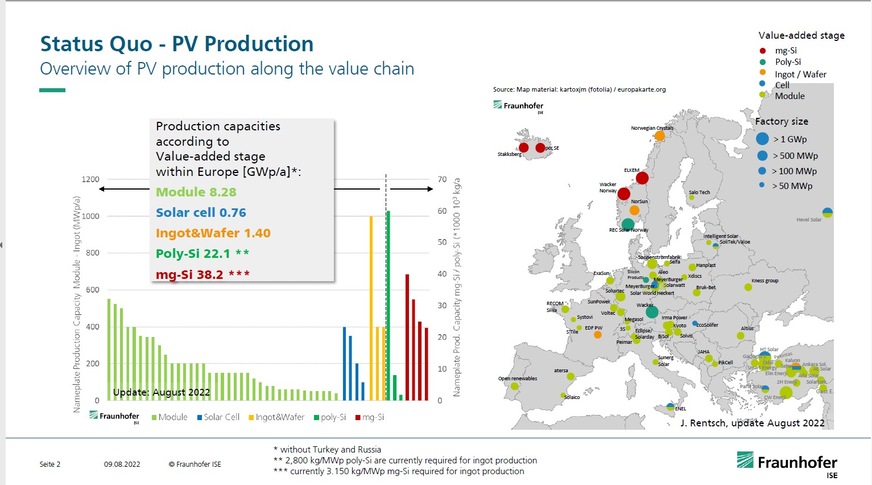

The PV industry is almost completely dependent on mainland China because we have an import quota of 97 to 99 percent for the main components of solar modules, especially wafers and solar cells. For solar modules, our dependence on China is somewhat lower. Here, we also purchase significant quantities from manufacturers in Southeast Asian countries such as Vietnam or Malaysia, although these are often subsidiaries of Chinese companies that have established sites there due to existing trade restrictions imposed by the USA.

Do the necessary production lines for this often come from German PV machine manufacturers? How important is China as an export market in this area?

Until a few years ago, China was the most important sales market for local PV machine and plant manufacturers. However, they have been increasingly pushed back as suppliers in recent years because China is focusing strongly on expanding its own value creation and supplier industry, including in the PV production sector. In terms of price and quality, German PV machine manufacturers could certainly still keep up, but in many cases they no longer have a chance because they are not Chinese companies and China is building up its own production capacities.

Local companies in the field of precision measurement technology are most likely to have sales opportunities in China. Recently, German and European PV machine builders have been focusing heavily on exports to India. However, this is also a difficult market because it is very price-sensitive, and India is increasingly buying Chinese PV manufacturing equipment.

What about other components and materials such as PV inverters or PV glass?

In the inverter sector, there is still one manufacturer in Hesse with larger market shares, SMA. PV glass is practically no longer available in Europe and has to be almost completely imported, to a large extent also from China. In addition, the export of Chinese solar glass to Europe is still subject to customs duties, which costs European module manufacturers twice. In contrast, Chinese competitors can import their complete PV modules duty-free into Europe. There is still one manufacturer in Germany, in Brandenburg, which produces in small quantities and has been bought up by Indian companies.

Where we are even better positioned is in polysilicon production. Here we still have a significant player in the form of the Wacker company in Burghausen (Bavaria), also on the world market. However, the announced expansion plans of Chinese manufacturers in this segment are also increasing the pressure here, but Wacker is able to hold its own at the moment, in particular due to its high quality.

Fraunhofer ISE

Fueled by the Russian war of aggression on Ukraine, the China-Taiwan conflict situation and the global supply problems resulting from Corona, the strengthening of Europe as a production location, also in the photovoltaic sector, is increasingly coming into political focus. How realistic do you think a renaissance of PV production in Europe or Germany is?

The main question is whether it will be possible to produce in Europe at costs similar to those in Asia. And in view of highly automated manufacturing, higher labor costs no longer play a major role. In addition, transportation costs now account for more than 10 percent of manufacturing costs, which argues for more regional production. But a prerequisite for this is scaling. In China, these are all gigawatt factories.

Module production in Europe is currently mostly in the megawatt range, which is still too small. We need economies of scale to achieve manufacturing costs similar to those in China. And we also need the scaling to bring the supply chains around it, with the other materials such as glass or silver pastes, back to Europe to a greater extent and to no longer be so dependent on China.

There have been various initiatives for PV gigafabs in Europe for some time. How far have the gigafactories progressed and what is still the problem?

A few years ago, this was still somewhat exotic, but now there are concrete plans and locations for PV production facilities all over Europe that are being developed and tapped for the supply chains. But a major hurdle is still money. After all, we are talking about an investment of around 1 billion euros for an integrated PV manufacturing facility for ingots, wafers, cells and modules with 5 gigawatts.

In any case, almost all initiatives are currently still looking for the final financing concept. In addition, there are usually lengthy approval procedures, especially in Germany. An interesting development is that a number of major European utilities approached the EU Commission in Brussels earlier this year with a request to support their own local PV production as an important pillar of a future renewable energy supply. Companies such as ENEL in Italy are pioneers in this regard, already investing significantly in their own PV manufacturing capacity.

Is the EU Innovation Fund an important instrument to effectively promote European PV production?

The EU Innovation Fund is now in its third edition. However, the projects are quite broadly spread, companies can participate in calls for proposals here, and in each of the first two calls a project with a focus on Pv production was selected. A more effective lever for a broader promotion of European PV production is offered by the IPCEI initiative, coordinated by the European Solar Manufacturing Council (ESMC). This aims to make photovoltaics an "Important project of common European interest" within the framework of EU industrial policy.

In this case, the current competition law in Europe is suspended and the individual member states can also put funds allocated by the EU into projects without this per se always being in overall competition. However, a significant number of member states must agree to such an IPCEI, and this is currently not (yet) the case.

What is the position of the German government?

So far, only 5 of 27 EU member states have officially backed an IPCEI for PV production, including Spain and Austria. But especially large countries like Germany, France and Italy have not yet signaled official support. Battery production, which is already classified as an IPCEI, can serve as an example here. There, companies such as Northvolt can benefit greatly from such EU funding.

The interview was conducted by Hans-Christoph Neidlein

Did you miss that? EU: New landmark solar target