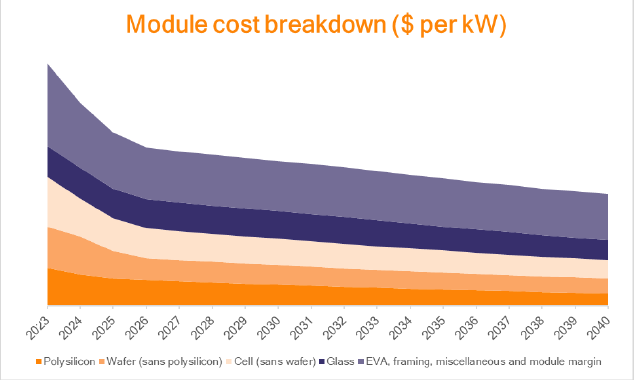

The current module price of $150 per kW is already a historic low, down 42% from January 2020 just before the pandemic hit. The report of Rethink Energy predicts there is much further to fall as the solar industry hits an extended period of overcapacity and consolidation – not from any weakness of demand, which has already grown to 600 GW, but from the over $100 billion invested in new solar manufacturing production capacity since 2020.

Demand Forecast and Module Cost Per Year

According to the report global demand for solar modules will peak at 1,308 GW in 2037, with the total global solar fleet reaching 19 TW in 2040, which is over twelve times the current fleet of 1.5 TW.

Rethink has forecasted already before a couple of solar module elements in accordance with a learning curve based on past performance and projected according to this future industry scale.

Other elements of the supply chain, such as industrial silicon or glass, will not benefit from a learning curve as their production processes are already extremely well-understood and scaled. „Still others, such as high-purity quartz and silver paste, must be forecasted more in terms of shortage and technological adjustments which are more categorical in nature than a learning curve can describe“, the authors of the report say.

Rethink Energy

Currently the cost of a silicon solar module fresh from the production line in China is $154 per kW, a historic low. Rethink expects that this will fall to $92.2 per kW by 2030, and then to $71.1 per kW in 2040.

The improvement to silicon module prices through 2030 will be driven by a broad swathe of incre-mental technological upgrades, which will continue at a slower pace through 2040.

By 2040, silicon-perovskite tandems – perhaps some will even be silicon-perovskite-perovskite – will have 61% market share. Thin-film perovskite – a category that starts off as single-junction but will also likely end up as perovskite-perovskite double or triple junction – will have 22% market share.

Price advantage for thin-film perovskite modules expected

The report doesn’t attempt to forecast the price of perovskite modules in detail, given the lack of empirical evidence to draw from. But the authors estimate that thin-film perovskites will cost half as much per kW silicon module . The low proportion of module cost in total project cost, and the inferior wattage per square meter, will restrict single-junction perovskites to the BIPV and EV roof sectors until their efficiency rivals that of silicon PV in the mid-2030s.

As for tandem solar cells and modules, in the year 2030, Rethink estimates that adding the perovskite layer to a (then typical) 25.5%-efficient heterojunction module will bring it up to 30.4% efficiency, for an 18% cost increase per square meter.

That would make tandem 1% cheaper per kW in 2030, a clear advantage given that even if it were more expensive per kW, tandem would be able to carve out a market niche in the rooftop segment where power per square meter is very relevant. By 2040, Rethink expects tandem Si-perovskite to be 10.4% cheaper per kW. (hcn)