Mr Grošelj, what developments do you expect for your Eastern Europe markets in the next 12 months?

We expect the markets to remain flat, with no significant growth anticipated in the medium term. Our industry experienced record-breaking demand and shipment volumes in 2022–2023, which led to sky-high expectations combined with panic buying and hyperinflation in the aftermath of COVID-19 and the outbreak of the war in Ukraine.

Matjaž Grošelj of K2 Slovenia: “We face strong competition”

You mean overcrowded warehouses, falling demand and prices?

Yes, exactly. The overordering during the period of exceptionally high demand led to a massive oversupply across the industry, affecting all types of equipment – from PV modules and inverters to mounting systems. The destocking process is still ongoing, with both manufacturers and European distributors holding large inventories from that period. As a result, current market activity and prices remain well below the levels seen in 2022–2023.

Do you expect the market to stabilise?

The decline is slowing and stabilising at a new, albeit lower, level. At K2 Systems, we focus on what we can influence. We continue to serve our customers with the utmost respect while developing new technical solutions, enhancing our service offering, and introducing innovative business models. We also place great importance on our so-called indirect customers – those who purchase our products through our sales partners rather than directly from us. It is important to us to ensure good service for all customer groups, as this is the only way to achieve sustainable customer loyalty.

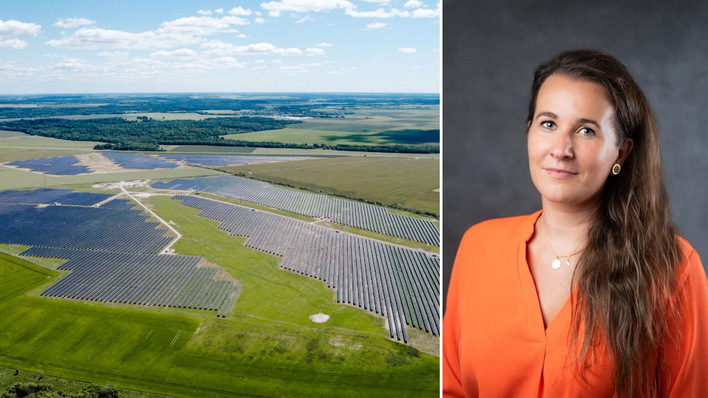

Steffen Emmerich of GOLDBECK SOLAR Polska: "You have to be perceived as a Polish company"

What are your long-term expectations for the markets you oversee up to 2030?

The enormous growth of the past five years has also brought challenges, prompting regulators to impose certain restrictions on the industry. In many countries in our region, electricity grids are overloaded. As a result, regulators have removed incentives for photovoltaic power plants in the residential segment, where the number of small, decentralised energy producers is highest.

Can you give us an example?

One such measure was the elimination of net metering schemes in several countries. Net metering allowed households to feed surplus energy into the grid during the day and draw energy from it during periods of low production. Since upgrading public power grids is both time-consuming and capital-intensive, and government budgets are already constrained, storage systems are becoming the new key element in residential markets. While households are expected to gradually adopt storage solutions, we anticipate only modest growth.

Nina Hojnik of ZSFV: “The focus has been on shaping the legal framework”

Is power storage the solution to grid problems in your markets?

However, investments in storage alone are not enough. A more comprehensive transformation of household energy consumption is necessary to increase self-consumption and reduce grid feed-in. This includes the introduction of new heating systems such as heat pumps and electric vehicles. However, this is an extremely capital-intensive process that rarely happens quickly, even though storage systems are already being promoted in many countries. The use of storage systems in private households is still far from reaching the level of net metering times. Therefore, commercial real estate and large solar parks – especially those with storage systems – will remain the most active segments for some time to come.

What are your expectations specifically for your market segment mounting systems?

Regarding overall demand in our region, we do not expect a major boom before 2030. Instead, we expect stagnant demand and annual installation volumes below the peaks of 2022–2023. This outlook does not take into account other influencing factors such as energy market prices or potential geopolitical events that could significantly impact the attractiveness of PV investments. Our goal is to at least maintain or even expand our market share in the rooftop segment, even in a challenging market environment.

Thank you

Interview by Manfred Gorgus