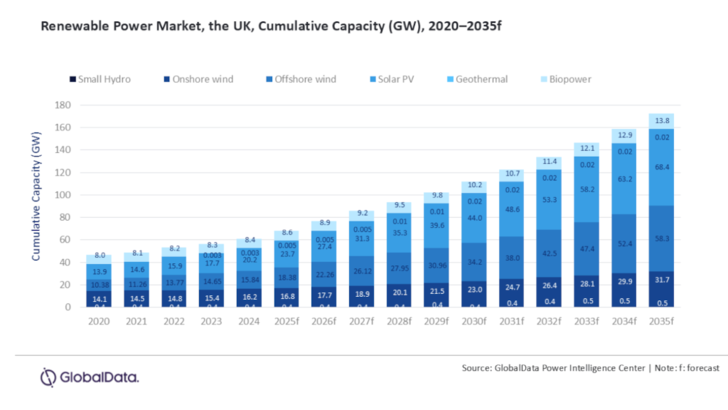

The country’s cumulative renewable power capacity is projected to reach 172.7GW by 2035 – up from 61GW in 2024 – reflecting a compound annual growth rate (CAGR) of 9.9 percent from 2024 to 2035, according to GlobalData.

GlobalData’s latest report, “United Kingdom (UK) Power Market Trends and Analysis by Capacity, Generation, Transmission, Distribution, Regulations, Key Players and Forecast to 2035,” finds that wind power will remain the main growth driver in the UK’s renewable energy mix. Offshore wind capacity is expected to rise to nearly 58.3 GW by 2035, up from 15.8 GW in 2024, supported by the Clean Power 2030 mission, successive Contracts for Difference auction rounds and major grid expansion projects across the North Sea. The UK’s offshore wind pipeline is among the largest in the world, bolstered by floating offshore wind projects, investment in port infrastructure and manufacturing localisation in regions such as Teesside, Humber and Scotland.

UK households increasingly see cost benefits of solar

Onshore wind is likewise set for strong growth, rising from 16.2 GW in 2024 to 31.7 GW in 2035, supported by the government’s decision to lift previous planning restrictions and accelerate approvals for repowering and hybridisation. Solar PV is forecast to expand from 20.2 GW in 2024 to 68.4 GW in 2035, driven by Contracts for Difference-backed utility-scale projects, commercial rooftop installations and community energy initiatives. Biopower will continue to provide system stability, increasing from 8.4 GW to 13.8 GW, underpinned by the UK’s circular economy initiatives and sustainable waste-to-energy policies.

Robust investment framework

Mohammed Ziauddin, Power Analyst at GlobalData: “The UK’s clean energy growth is being powered by a robust framework that includes the Contracts for Difference mechanism, the Clean Power 2030 mission and the Net Zero Strategy, all providing long-term policy stability and investment certainty. Infrastructure programmes such as National Grid’s £35 billion ($44.4 billion) transmission upgrade plan and the Eastern Green Links offshore superhighway are further enabling large-scale renewable integration and regional balancing.”

Heat pumps could cut UK household heating bills by half

The report notes that while nuclear capacity growth is expected to slow in the near term, declining from 5.9 GW in 2024 to around 4.1 GW by 2035, thermal gas will continue to play a crucial role in ensuring system reliability and balancing renewable generation. Gas-fired plants will remain essential for peak demand management and supply security as storage and hydrogen capacity gradually expand. (hcn)