PV Europe: What is your current assessment of the Spanish market?

Attilio Bragheri: Historically, Spain has been one of the strongest solar markets. The country is also a prime example of how electricity grids must adapt as renewables make up an ever-greater share of power generation. Spain is currently undergoing this transition in a somewhat painful way, as the blackout in April 2025 demonstrated. But there is no turning back. The good news is that solar installations are already the cheapest form of energy generation almost everywhere, or will be soon. The levelised cost of electricity (LCOE) for solar is among the lowest globally, especially in southern Europe where solar irradiation is very high. Regardless of government support, building a new solar plant remains the best option in terms of return on investment.

As the share of solar increases, it’s clear that the grid-supporting functions previously provided by fossil sources like coal and gas now have to come from solar parks.

Exactly, it is time not only to generate very low-cost solar power, but also to use the same technology to stabilise the grid. The so-called hybridisation of existing plants and the addition of storage to the grid is – and will be – the next step for Spain. It is the only way the country can maintain these very low energy prices, which are crucial for industry as a whole. Spain’s competitiveness as a country is rooted in its very low energy costs. If you operate a factory, you pay around 40 to 50 euros per megawatt hour for electricity in Spain. For comparison, in Italy it is more than 110 euros.

Grid-forming inverters are becoming increasingly important. What does this mean for SMA?

We have already invested heavily in grid-stability technologies. We have the best examples worldwide, including in Europe. One of these is Blackhillock in Scotland, the most complex and largest battery storage site with grid-forming technology in Europe. It serves as a blueprint for the future of grid stabilisation. The United Kingdom is, by definition, an island, so the grid is naturally less stable. Thanks to projects like this, SMA has developed the most advanced grid-forming technology.

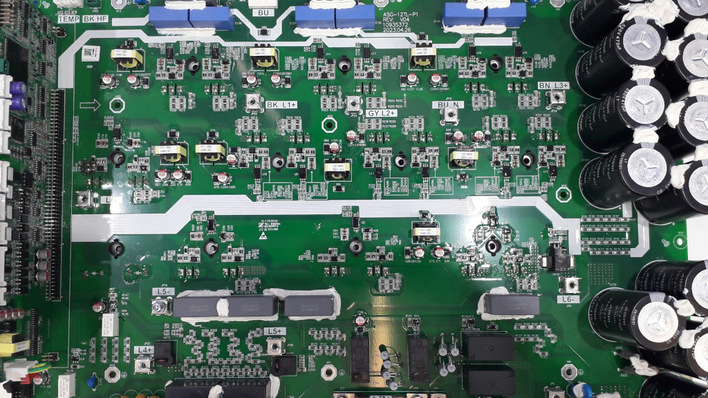

That covers the control side of the grid, but there have also been advances in power electronics. What are the current trends?

The market typically uses silicon-based IGBT semiconductors as the core of inverters. SMA is now introducing the next generation based on silicon carbide. SiC is more expensive, but it delivers very good performance in two key areas: firstly, reliability – SiC is used in many applications, from electronics to the brakes of high-performance sports cars, because its thermal management is excellent. When large energy flows are involved, for example in grid-forming or inertia services where significant power must be delivered in milliseconds, thermal stress is extremely high. The second aspect is speed. The silicon carbide design, based on MOSFET transistors, simplifies the switching structure. There is an old engineering rule: less is more. A simpler switch can operate much faster. With faster switching, you can deliver grid responses in milliseconds and once again provide virtual inertia similar to conventional generation.

Niels H. Petersen

How does SMA position itself regarding European initiatives such as the Net-Zero Industry Act?

We are focused on supporting local implementation of the European Net-Zero Industry Act to strengthen European industry. What SMA has been doing for years is to manufacture the entire Sunny Central platform – our large-scale solution – entirely in Europe, at our headquarter in Kassel. This gives us access to the benefits of the Net-Zero Industry Act. We made this decision because, for us, a local supply chain is critical for quality, supply chain stability and cybersecurity. Now, we are pleased to see Europe moving in the same direction with the Net-Zero Industry Act. We are ready and do not need to relocate anything back to Europe.

Which market segments are particularly interesting for SMA in Spain?

Both the utility-scale and C&I segments are developing well. However, our added value is currently much stronger in the utility-scale sector, as storage, silicon carbide, grid stability and cybersecurity are central priorities for investors and independent power producers (IPPs). In the C&I and residential segments, these values are important but not the main drivers. In Spain, installers are still looking for low-cost solutions, so it is difficult for SMA to compete where price is the main driver. However, when performance, long-term stability and fast return on investment become more important – as in large-scale projects – we attract significant attention from customers. At the moment, we still see purely solar installations in Spain. We expect the storage market to pick up next year and continue to grow steadily in the years to come.

What do low electricity prices mean for the installation of storage?

Low electricity prices in Spain are clearly the next challenge, but also a driver for expanding storage. The low prices are mainly due to more electricity being generated during the day than is needed. If you hybridise a plant, you can shift energy and sell it when the market needs it – at night or during morning and evening peaks. This hybridisation is another reason why storage will grow. Storage is not only needed to stabilise a grid that requires it, but also to respond more sustainably to negative prices. If the alternative is curtailing a plant, that is not very attractive for investors. Battery costs will soon reach a level where storing energy makes sense, allowing for a more robust business model.

After the blackout in April 2025, have you already seen any changes in the market or in investor demand?

Yes, the number of enquiries for storage applications is increasing. The local government here in Spain cannot simply change the rules for existing plants, but we are seeing clear acceleration in the storage sector. To be honest, there is not yet a final report on the causes of the blackout. We do not believe that solar was the main cause, but rather the difficulty and imbalance in generation in Spain. The country has come close to another blackout at least twice in recent months. So there is definite pressure to stabilise the grid.

Interview by Niels H. Petersen.