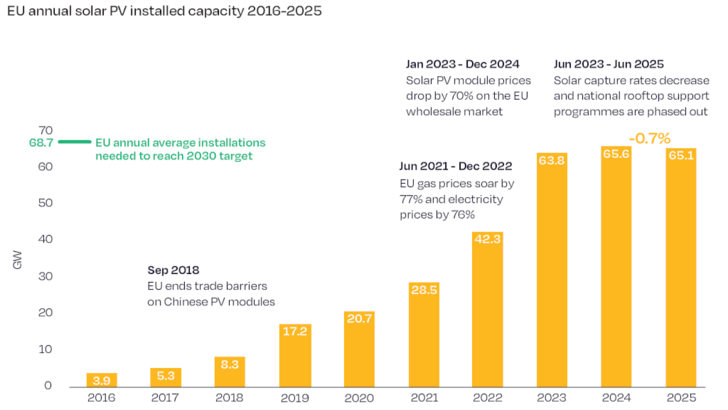

The boom years of EU solar in the 2020s have ended. In 2025, the sector contracted by 0.7%, falling from 65.6 GW installed in 2024 to 65.1 GW. According to the EU Solar Market Outlook 2025–2030, this marks the first time since 2016 that the EU has installed less solar than the year before.

Stay informed – subscribe to our newsletters

Yet the news is tempered by a significant milestone. In its 2022 EU Solar Strategy, the EU set a goal of 400 GW installed solar capacity by 2025. Europe has now surpassed that target, reaching an estimated 406 GW by year-end.

Ambitious target slipping out of reach

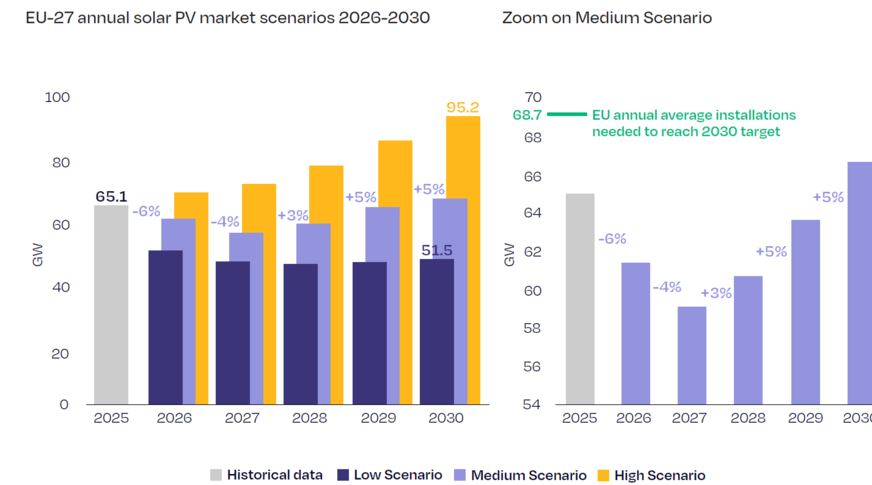

The slowdown is expected to continue into 2026 and 2027, with growth returning in 2028 and 2029. By 2030, annual installations are projected to recover to around 67 GW – roughly 2025 levels. However, the EU's target of 750 GW installed by 2030 is slipping out of reach. In its most likely scenario, SolarPower Europe forecasts total EU solar capacity will reach only 718 GW.

SolarPower Europe

“The number may seem small, but the symbolism is big. We hit our 2025 solar target, but now for the first time, our 2030 target is falling out of reach. This interruption in solar market growth comes at a pivotal moment when acceleration is essential. Solar is now delivering for Europe – 13 percent of Europe’s electricity was solar powered in 2025. In June, we provided the most power out of all other sources in the EU. It's critical that policymakers now implement robust frameworks for electrification, system flexibility and energy storage to ensure solar leads Europe’s energy transition for the rest of this decade,” said Walburga Hemetsberger, CEO of SolarPower Europe.

Sharply slowing residential rooftops

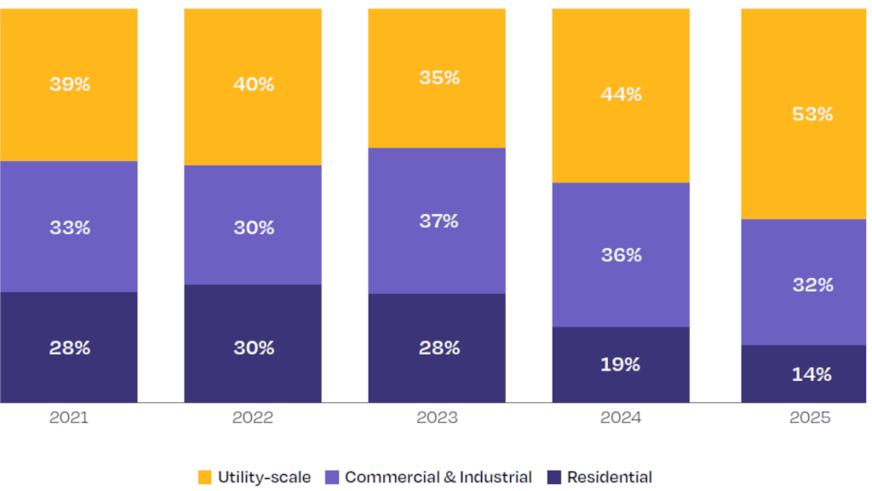

The faltering market is attributed to several factors. The post-energy crisis environment has brought cuts to rooftop support schemes and a perceived easing of price pressures on households, sharply slowing the home solar market. Home rooftop solar contributed 28% of EU installed capacity in 2023, but only 14% in 2025.

For the first time, solar farms accounted for more than half of installed capacity. However, standalone projects face increasing profitability challenges, with rising negative pricing hours eroding revenues.

SolarPower Europe

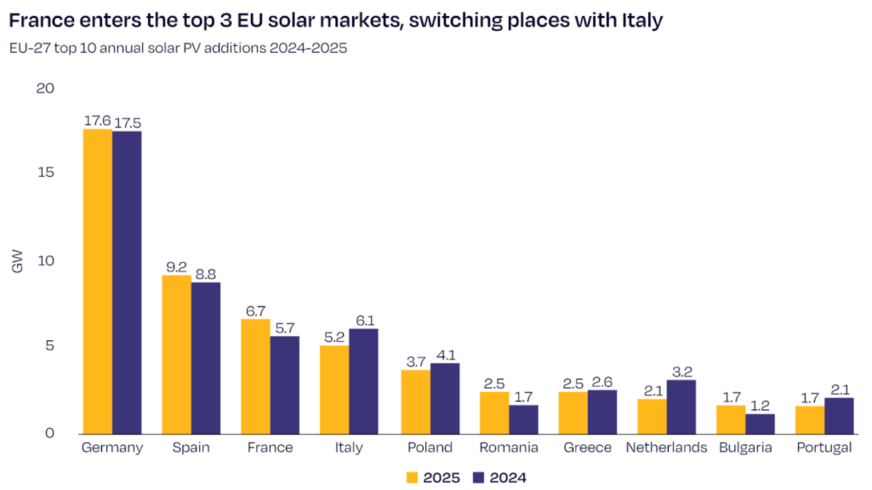

While the market composition is shifting, country rankings remain largely stable. Germany and Spain continue to lead as the EU's largest solar markets, propelled by utility-scale projects as rooftop incentives decline. France overtook Italy to claim third spot in 2025, driven by robust commercial and utility-scale expansion, while Italy's rooftop sector contracted sharply following the phase-out of support schemes.

Romania and Bulgaria entered the top ten for the first time, with Romania recording the fastest growth rate among its peers and Bulgaria's surge linked to national recovery funding deadlines. The Netherlands dropped to eighth place, reflecting a slowdown in rooftop installations. Across the top ten, half installed less solar in 2025 than in 2024: Italy, Poland, Greece, the Netherlands and Portugal.

SolarPower Europe

Market conditions differ across the EU, but common barriers remain. The report's policy recommendations call for redefining energy security around renewables, adopting a comprehensive strategy for system flexibility, streamlining permitting, revitalising the rooftop solar market and making supply chains more sustainable and resilient. (hcn)