In the period that COVID-19 caused lockdowns worldwide, there was also major port congestion. Many containers with products were sent from China to Europe, but hardly anything was returned to China.

As a result, container prices went up sky-high. For example, there was a cost increase of 534 percent on the route from Shanghai to Rotterdam between July 2020 and July 2021. Conversely, there was only a 43 percent increase.

"The global distribution of containers is now back in balance. Moreover, the lockdowns in China are as good as finished. As a result, the prices of containers have gone from $15,000 to $5,000," Scheper notes.

"If you set the price for a longer period of time, you can even end up below 3,500 dollars, which also shows that despite the recovery, transport between China and the rest of the world is not yet optimal. Incidentally, most Chinese parties actually think this is fine, they charge the transport rates anyway."

In addition, he sees that an unexpected alternative to the ship transport of Chinese PV to Europe has also emerged: the truck. "In about 25 days they drive here en masse with trucks, which is fairly competitive in terms of costs due to the greater truck competition between them, and it is faster."

In November and December there is a gap in Chinese orders

In China there is another interesting development coming, according to Scheper. Material prices have been very high for quite some time and Chinese project developers are inclined to postpone their November and December orders to the beginning of next year. Although energy prices in China are also higher, in many cases they are not high enough to compensate for the higher production costs.

"This has to do with the fact that the Chinese renewable energy subsidy is very low and therefore does not offer enough profit margin at current material prices. In particular, the prices of polysilicon have gone through the roof. Depending on when a project was supposed to be connected to the electricity grid, they will postpone it, because in many cases it simply can not be made profitable" says Scheper.

Did you miss that? China freezes polysilicon prices, resulting in falling transport costs

"There are a number of substantial projects in between, so that 15 to 20 gigawatts of production orders are halted. Those slots will then become available for European orders. Most people in PV are happy with that possibility, but they won't just say that out loud, because then their negotiating position is gone."

At the same time, it is not so easy that just raising a finger is enough. "You will have to have a good relationship with a factory and you will have to be able to buy large, so this is especially an opportunity for wholesalers and project developers. It's a only small window, because from January onwards you are back in line behind the Chinese orders and you can wait five months for your products."

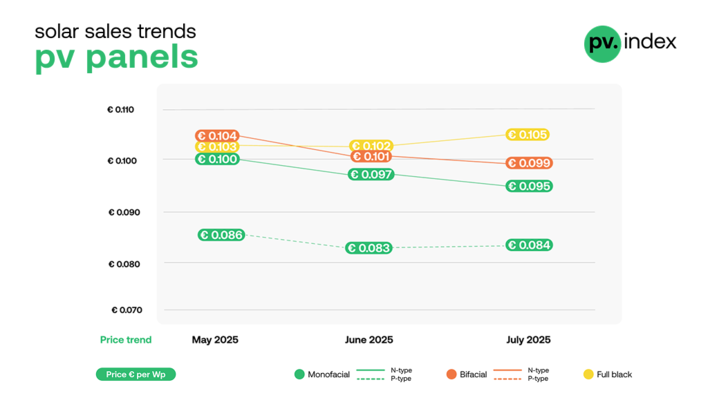

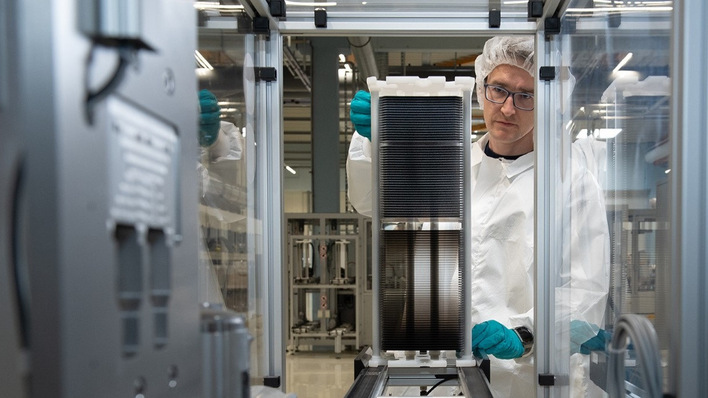

Enterprises should consider N-type

An alternative that enterprises should consider, according to Schepers, is the N-type solar panel with higher efficiency. That has everything to do with the fact that the business case for PV projects is currently more than tight.

"Of course, that sounds very strange in times when for example the whole of the Netherlands would rather have solar panels today than tomorrow, but you really have to distinguish between the private and the commercial market," he explains.

The current energy crisis has unleashed a boom in solar panels on the private market. As a result, especially the inverters are hard to find and PV companies experience golden times. But that does not apply to the commercial market.

"That's because banks only include higher energy prices for the first three years of your business case. After that, your project must be profitable with yield subsidy," says Scheper.

Higher investment – but higher efficiency

"This means that every business case can be flushed down the toilet, especially with current interest rates. You can get rid of those higher production costs in the longer term thanks to the high energy prices, but if the bank only takes that into account for the first three years, then it stops."

It would therefore not surprise him if the commercial market starts to look more at N-type solar panels. Although these require a higher initial investment, they also guarantee higher efficiency per watt peak and therefore a more solid business case in the long term.

"If the current status quo continues, I think we can start to see this development. When the market switched from polycrystalline to monocrystalline at the time, you saw the same development based on similar arguments. The higher efficiency outweighs the higher investment costs in the longer term."

Scheper thinks that Chinese manufacturers should in principle have enough production capacity to also serve the Dutch and other European markets with N-type. "China had promised that they would be able to offer the N-type en masse in the second half of this year. That didn't work out, but they are available."

That is why project developers should simply calculate it, he thinks. "It doesn't hurt to at least consider. Removing a eurocent per watt peak via the current supplier is, I think, more complicated than switching to N-type. I think it's a great option: the technology has been around for about seven years and it has been offered on the market for three years." (hcn)

The full report if for download here for free