High preference for sustainable green energy and enhanced power harvesting systems will push solar microinverter and power optimizer market. Elevated demand for PV systems across commercial and residential ventures for reliable and improved power supply is likely to contribute toward the surging growth of this industry. Beneficial legislations such as tax concessions, subsidies, and monetary support will open new vistas for the business.

Did you know?

Green stocks are the next megatrend in equities

Standalone products and on-grid systems help in connecting solar microinverter and power optimizers. On-grid solar microinverter and power optimizer industry share, worth USD 120 million in 2015, will grow at an annual rate of 15 per cent over 2016-2024. Favorable government regulations such as tax discounts, feed-in- tariff, and financial aids will push the business landscape.

Rise in installation of PV systems

Solar microinverter and power optimizers find extensive application across utility, residential, and commercial sectors. Solar microinverter and power optimizer market revenue across commercial sector is expected to cross the revenue margin of USD 300 million by 2024. High energy throughput and enhanced security measures will contribute significantly toward the market demand. Residential applications, which collected a revenue of USD 400 million in 2015, are forecast to observe a robust expansion. Rise in installation of PV systems on the rooftops of residential constructions will propel the revenue.

Three phase solar microinverters and power optimizers help enhance the system downtime, in addition to possessing features such as upgraded conversion efficiency coupled with high circuit density in comparison with their counterparts. High demand for uninterrupted power supply will fuel solar microinverter and power optimizer market in the utility sector in the years to come.

Government initiatives will drive market

Features such as upgraded safety and high energy yield will boost solar microinverter and power optimizer industry in commercial applications, which contributed to more than 15 per cent of the overall share in 2015. Government initiatives such as tax rebate, investment tax credit, net metering and FIT to increase the number of PV system installations across commercial buildings, will also subsequently propel U.S. solar microinverter and power optimizer market, which is anticipated to grow at a CAGR of 15 per cent over 2016-2024.

Are you having trouble with DC optimizers?

We want to hear from you!

Solar microinverter and power optimizer industry size in the U.S. is slated to grow at a CAGR of 15 per cent over the coming timeframe. Government schemes encouraging large-scale deployment of solar power systems across commercial and residential constructions will drive the development.

Solar microinverter and power optimizer market size in China, worth USD 50 million in 2015, is anticipated to observe a striking growth over 2016-2024. High government emphasis on the use of renewable energy to fulfill the rising power supply needs will further propel the industry growth.

Policies promoting to use green energy

UK solar microinverter and power optimizer industry, which contributed nearly 10 per cent of Europe market revenue in 2015, will expand notably due to government policies promoting to use green energy.

Chile solar microinverter and power optimizer industry, which contributed more than 20 per cent of Latin America solar microinverter and power optimizer market share in 2015, is projected to witness a high surge, owing to its project in harnessing 70 per cent of overall energy through sustainable resources by 2050.

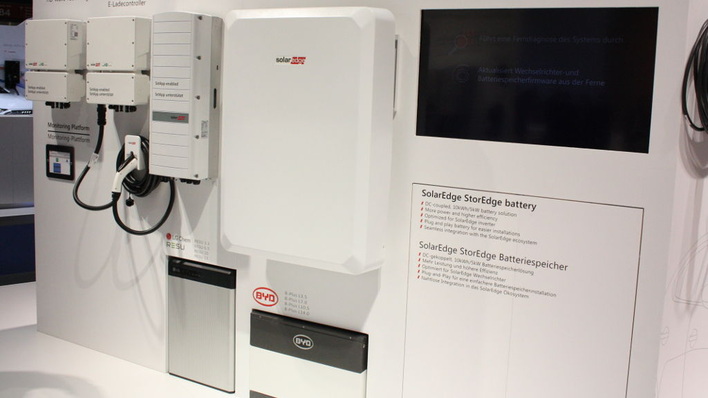

Large availability of solar power, low rate of interests, and political stability are few of the factors predicted to boost the industry revenue. Key industry participants include Tigo Energy, SolarEdge Technologies Incorporation, Petra Systems Incorporation, Altenergy Power System Incorporation, KACO New Energy, SolarBridge Technologies, and Sparq Systems. (mfo)