The upward trend in the European solar market continues: A 20.4-gigawatt increase in photovoltaics (PV) in Europe is expected for this year, as recently outlined by SolarPower Europe in the intermediate scenario of its Global Market Outlook. This would represent an over 80-percent increase in comparison to the previous year. The trade association estimates further growth of 18 percent in 2020. The rapid growth of the European PV market is reflected in the number of tickets already booked for Intersolar Europe, the world’s leading exhibition for the solar industry. Seven months before the start of the exhibition, more than 90 percent of exhibition space has already been booked. This includes a number of new exhibitors who will be there for the first time next year. Intersolar Europe will be held in conjunction with three other energy exhibitions from June 17 to 19, 2020 in Munich as part of The smarter E Europe, the continent’s largest platform for the energy industry.

255 GW PV by 2023 in Europe

The outlook is sunny for the European solar market in 2020 and beyond. SolarPower Europe’s five-year outlook shows two-digit annual growth rates through 2023 as well as a rise in the total installed PV capacity to 255 GW. Germany has been ranked in first place with an expected increase in photovoltaics of 26.69 GW by 2023 and an annual growth of 10 percent, followed by Spain, the Netherlands and France.

The PV market in Europe is currently in the midst of its renaissance, which has produced a significant effect on the number of visitors at Intersolar Europe. The 2020 exhibition is already 90 percent booked up despite the exhibition space having been increased once again. The number of new exhibitors has also increased dramatically. In 2020, The smarter E Europe expects to see a total of 1,450 exhibitors and over 50,000 visitors in an exhibition space of 110,000 square meters. As part of the innovation hub for new energy solutions, Intersolar Europe is held in parallel to three other exhibitions – ees Europe, Power2Drive Europe and EM-Power.

Sources of growth on the PV market

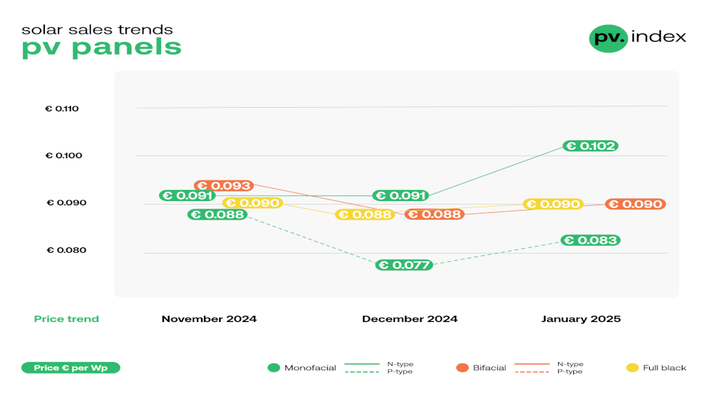

A decade ago, the main drivers of the European PV market were the feed-in tariffs offered in a few countries. Today, the market has a solid footing. The steadily declining costs and the increasing competitiveness of photovoltaics have become the key drivers of the market. In 2018 alone, the costs of generating solar power dropped by 14 percent compared to the previous year. Photovoltaic solar electricity can now be produced in the megawatt range by free-standing installations in countries such as Germany for four or five euro cents per kilowatt hour. In sunnier regions of Europe such as in Spain, even larger installations can generate tens and hundreds of megawatts of power starting at only two euro cents per kilowatt hour.

Accordingly, subsidy-free business models are becoming more important for financing PV installations. Solar power is becoming more profitable, even without subsidies. Reports from SolarPower Europe show that this has led companies to enter into power purchase agreements (PPAs) with renewable power plant operators with a volume of 7.5 GW in Europe in order to buy renewable power — 1.6 GW of which was purchased in 2019 alone. PPAs for renewable power have already been concluded in 13 European countries, led by the Scandinavian countries, Spain, Portugal and the UK. PPA projects are also currently being developed in countries like Germany. EnBW caused a stir at the beginning of October 2019 when it announced its intent to build the largest 180-MW solar park in Germany without the aid of subsidies from the Renewable Energy Sources Act (EEG). The system is set to be put into operation in Brandenburg in 2020.

Trending: self-consumption and cross-sector applications

In addition to PPAs and the direct marketing of electricity, state invitations to tender represent an important market driver for affordable solar power, usually stemming from ground-mounted and large rooftop installations. This has allowed PV projects to prevail in technology-neutral public tenders in multiple European countries. Self-consumption of solar power has become popular in many European countries, whether it is consumed in private households or by commercial businesses. After all, solar power generated on one’s own roof is often more affordable than conventional power purchased from utilities. Even batteries are becoming increasingly economical. What’s more, feed-in tariffs are expiring in countries such as Germany and new areas of application are opening up as part of sector coupling, be they for operating heating pumps or charging electric vehicles.

Thus, 28 percent of private households in Germany which are planning to install their own PV system seek to exclusively self-consume the solar power generated, according to a survey conducted in July 2019 by the market research company EuPD Research. Private use of solar power has also been fueled by the EU’s “Clean Energy Package,” which includes a stipulation barring taxes on the on-site consumption of solar energy.

Other important driving factors for PV in Europe include the EU’s and its member states’ climate protection targets and expansion goals for renewable sources of energy. These state that by 2030, greenhouse gas emissions in the EU must be cut by 40 percent from 1990 levels. The share of renewable energies in Europe’s end energy consumption must rise to at least 32 percent. President-elect of the European Commission Ursula von der Leyen seeks to achieve climate neutrality in the EU by 2050 by employing a Green New Deal. The outlook for PV will continue to spur on Intersolar Europe in the future.

Intersolar Europe and the parallel exhibitions will all take place from June 17 to 19, 2020 as part of the innovation hub The smarter E Europe at Messe München. (HCN)

Innovations at The smarter E Europe 2019 can be found on our website and YouTube.