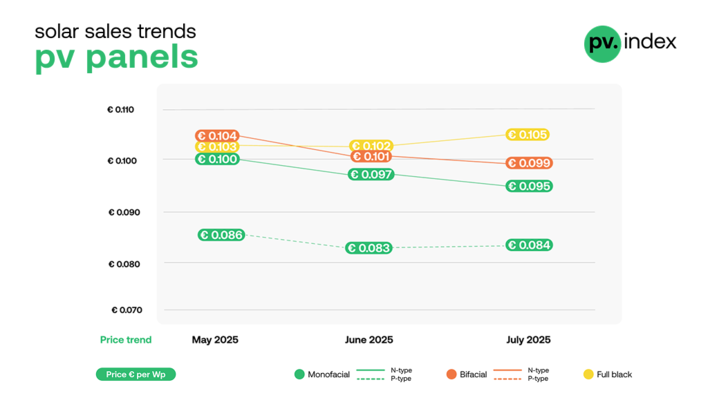

At the end of 2022, solar panel prices fell sharply in a short period of time. First, transport costs dropped sharply and then Chinese project developers pushed huge orders to the beginning of 2023, creating a significant demand shortage. This was problematic for wholesalers, because they still had batches at high prices in stock. "And now they are in the same situation again stuck with very expensive stock, while prices are plummeting," says Gerard Scheper, CEO of European Solar. "Those who only focus on residential projects are really going to run into problems this time."

It is a strange situation, both the prices of solar panels and the consumer demand for solar panels have been dropping for some time. Even though solar panels are still an excellent investment with a short payback period, consumer demand is declining.

It is speculating whether this is due to changes in the cost structure of energy suppliers for their customers with solar panels, lower energy prices, for instance, a recent report by Dutch institute Milieu Centraal states that the payback period of solar panels would rise to more than twenty years (which is not true, by the way), the winter weather or a combination of the latter. The fact is that consumers seem to be less interested in solar panels now than they were a few months ago.

Stock purchased at a too expensive price

"You can look at this in two ways," says Scheper. "On the one hand, the demand is similar to two years ago. But on the other hand, demand is half of last year, and the entire sector has invested in further growth. More staff, logistics, offices, storage, stock and so on.“

The stock that is now there has been purchased at a too expensive price. Adjusting the selling prices of solar panels to the current market prices would mean a huge loss on stock. "Some wholesalers are now willing to go so far as to sell at cost, but you might have to consider lowering your prices much further. Of course, that would be a huge loss, but what is the alternative," Scheper wonders aloud.

Knocking on the door of suppliers as an option?

"You can take a bet that there will be an increase in demand and/or price and stay put, but if that doesn't happen and you haven't drastically lowered your prices, you won't sell anything. That sounds extreme, but that's the situation now. If demand remains as it is now, we will get the same proposition as we had in 2019: are there too many wholesalers relative to the market size?

Now, entire year's profits are evaporating due to all the depreciation on stock because demand is disappointing for a while. You have to go through pain and take your loss now, but actually most of them are already too late.“

Also interesting: Prices drop, profit margins shrink: the new standard for PV?

There is another alternative: knocking on the door of the suppliers to come up with a temporary solution together. They may be able to take back part of the stock or postpone future deliveries for a while.

"If you have a good relationship with your supplier, this is an option. But there are also parties that went to bottom price when their suppliers were in trouble, they now have a huge problem.“

Business market is reviving

Although the consumer segment is now in dire straits, the commercial segment seems to be starting to recover. "The prices are now so incredibly low that all commercial projects are coming back to the market," says Scheper.

Many of those projects were halted after material costs rose, energy prices soared, releasing less subsidy, and banks becoming reluctant to provide co-financing. "All those project applications are ready to be built and because the prices of solar panels are now so low, the business case now is feasible again.“

Did you miss that? Stabilisation of solar module prices seems to be in sight

Only wholesalers who focus (at least partially) on the business segment will probably really benefit from this. "There will be many more wholesalers who will try to switch to deliveries to commercial projects. But in practice, that is just a completely different market, which means that many will not be able to switch," says Scheper.

Get the full new report of European Solar for free here

"Due to the rebound in the business segment, it could well be that the solar energy sector as a whole will meet targets again, but the number of wholesalers will shrink. They have set up their workforce and stock for a growth that is not going to happen for the time being, some still have inverters for more than a year. We're now going to see who has a really good business model.“ (hcn)