A new study has highlighted one of the major challenges that some of Europe’s biggest economies face in achieving their 2030 renewable energy targets, and it is all to do with what could be termed ‘the flexibility gap’. Governments must respond with policies that will deliver the fair, transparent, and easily accessible markets needed to attract private investments in demand-side flexibility.

As coal and gas generation are phased out, national grids must balance the intermittency of variable renewable generation from assets such as commercial windfarms with their country's minute-by-minute demands for energy. Flexibility is essential to stabilize a high-renewable grid and the only way that countries can achieve high levels of flexibility is by encouraging investment in demand-side response capabilities such as energy storage. Open markets for flexibility are a critical requirement for encouraging such investment.

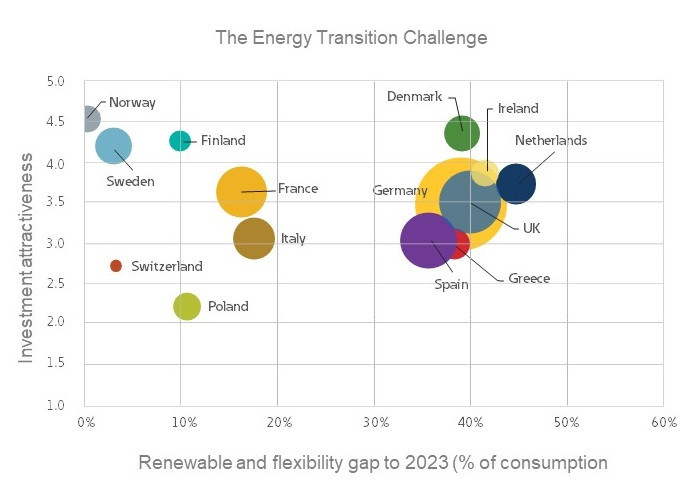

Flexibility readiness of 14 national electricity markets compared

The flexibility gap is highlighted in the 2023 Energy Transition Readiness Index (ETRI) produced by the Association for Renewable Energy and Clean Technology (REA) which this year is co-sponsored by Eaton and Foresight Group.

The study on which the index is based compares the readiness of 14 national electricity markets to make the transition away from fossil fuels and, amongst other thing, it explores the flexibility gap between each country’s target for variable renewable energy production by 2030, and the amount of associated flexibility the country would need by then.

REA/Eaton

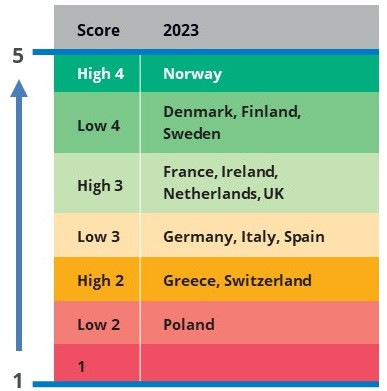

On this basis, Germany and the UK face the biggest flexibility gap by 2030, with Denmark, Greece, Ireland, the Netherlands, and Spain also challenged. Only Norway, Finland, and Sweden look set to bridge the gap with ease - their gap is smaller, partly because they have access to lots of hydropower but also because they have well-established flexibility markets.

France and Italy face a smaller gap than some neighboring countries but nevertheless must do more to attract the investments in flexibility they will need by 2030. Switzerland faces a relatively small gap thanks to high levels of flexible hydropower, but its regional governance structure means poor coordination of policies to deliver all the flexibility needed. Poland is in the early stages of energy transition, with strong ambitions but facing challenges in funding the necessary investments to improve grid access for flexibility providers.

Greatest mprovements in investor attractiveness in Germany and UK since 2019

There is much good news for Europe in this detailed and fascinating survey, with the index also encompassing sub-rankings for the socio-economic and technological factors that support or impede investments in the energy transition. Increasing the level of support for enabling technologies, such as EV charging infrastructure and smart meter rollout is one of the ways that countries can boost flexibility, and therefore help to close the flexibility gap, and there is evidence that some countries are seizing this opportunity.

Also interesting: Urgent call for more distribution grid capacity

Both Germany and the UK demonstrate the greatest improvements in ‘investor attractiveness’ since the annual survey started in 2019, showing that with the right policy environments both countries have the potential to attract investment in the energy transition, bridge the flexibility gap, and deliver high-renewable grids.

Cyrille Brisson, vice president sales and marketing, EMEA, Eaton, said: “Business enthusiasm for the energy transition is growing, spurred on by concerns about carbon emissions, energy security and price volatility. Governments must respond to this with policies that will deliver the fair, transparent, and easily accessible markets needed to attract private investments in demand-side flexibility and make the energy transition accessible and affordable to all. Stability and predictability will boost investor confidence in projects that can often have quite lengthy payback periods.”

Adressing current investment barriers

Chris Tanner, partner at Foresight Group and chair of the REA Finance Forum, said: "It is encouraging to see the progress observed across various European countries in both the renewables build out and the associated flexibility requirements. These improvements underscore that, with the right policy environments, the UK, and Europe as a whole, have the potential to attract significant investment in the energy transition. This, in turn, positions them to bridge the flexibility gap and successfully deliver high-renewable grids by 2030, showcasing a promising trajectory for the future of sustainable energy."

Did you miss that? Demand Side Flexibility increases grid stability and lowers electricity prices

Frank Gordon, director of policy at the REA (Association for Renewable Energy and Clean Technology), said: “It is welcome to see all countries assessed in ETRI 2023 have ambitious decarbonization targets. We now need to see significant action to remove the barriers facing our industry across the UK and Europe: proper long-term planning; prioritizing and accelerating market reforms; and urgently addressing current investment barriers - all are desperately needed to help put us on the right path.” (hcn)