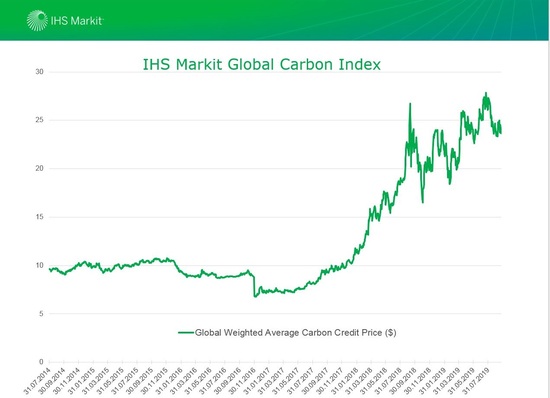

Prices have dropped up to €9 per metric ton—40% since early March when prices were trading at about €24 per metric ton. The current trading levels are roughly two thirds of the level of the high of 2019 of €29 per metric ton, IHS Markit says.

Main drivers of the price collapse

The three drivers of the price collapse are:

- Severely weakening fundamentals: Reduced economic activity, power demand, and aviation demand will lead to lower 2020 emissions across Europe

- Weakening oil prices brought on by an unprecedented fall in global oil demand at a time when current production is outpacing global storage capacity.

- Bearish financial markets with increased margin calls are reducing noncompliance capital invested in the ETS.

The Market Stability Reserve (MSR) could bring the market back into balance in 2021. The MSR removes 24% of excess annually, which amounts to 400 million metric tons this year. Of the newly accumulated excess created by COVID-19 in 2021, the MSR will also remove 24%.

Did you miss that? Solar can play a key role in the EU COVID-19 stimulus package

Further drop expected

Depending on the severity and extent of power demand impacts going forward, the IHS Markit outlook for EU ETS prices ranges from an average of €12.6 per metric durinsecond quarter-fourth quarter 2020 (in the reference case) to as low as a €5 per metric ton average over the same period (stress case). (HCN)